Question: Practice problems for Module 2 Currency speculation: you are given following information Lending rate for $ is 8 . 0 % and for peso is

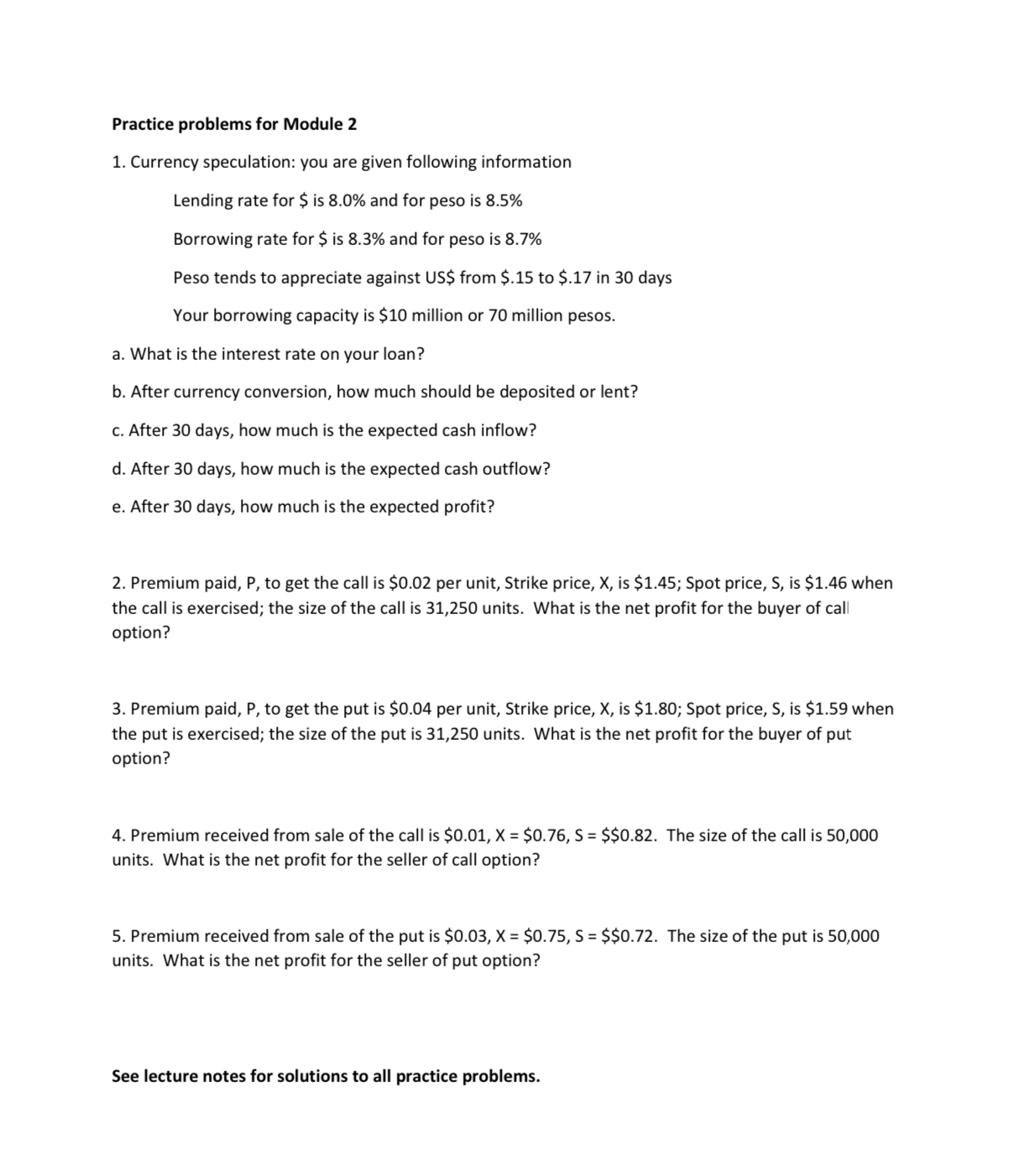

Practice problems for Module

Currency speculation: you are given following information

Lending rate for $ is and for peso is

Borrowing rate for $ is and for peso is

Peso tends to appreciate against US$ from $ to $ in days

Your borrowing capacity is $ million or million pesos.

a What is the interest rate on your loan?

b After currency conversion, how much should be deposited or lent?

c After days, how much is the expected cash inflow?

d After days, how much is the expected cash outflow?

e After days, how much is the expected profit?

Premium paid, P to get the call is $ per unit, Strike price, is $; Spot price, is $ when

the call is exercised; the size of the call is units. What is the net profit for the buyer of call

option?

Premium paid, to get the put is $ per unit, Strike price, is $; Spot price, is $ when

the put is exercised; the size of the put is units. What is the net profit for the buyer of put

option?

Premium received from sale of the call is $$$$ The size of the call is

units. What is the net profit for the seller of call option?

Premium received from sale of the put is $$$$ The size of the put is

units. What is the net profit for the seller of put option?

See lecture notes for solutions to all practice problems.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock