Question: practice problems need help A1 X 11 A B C D E F G H 2 3 Hare, Inc., had a cost of goods sold

practice problems need help

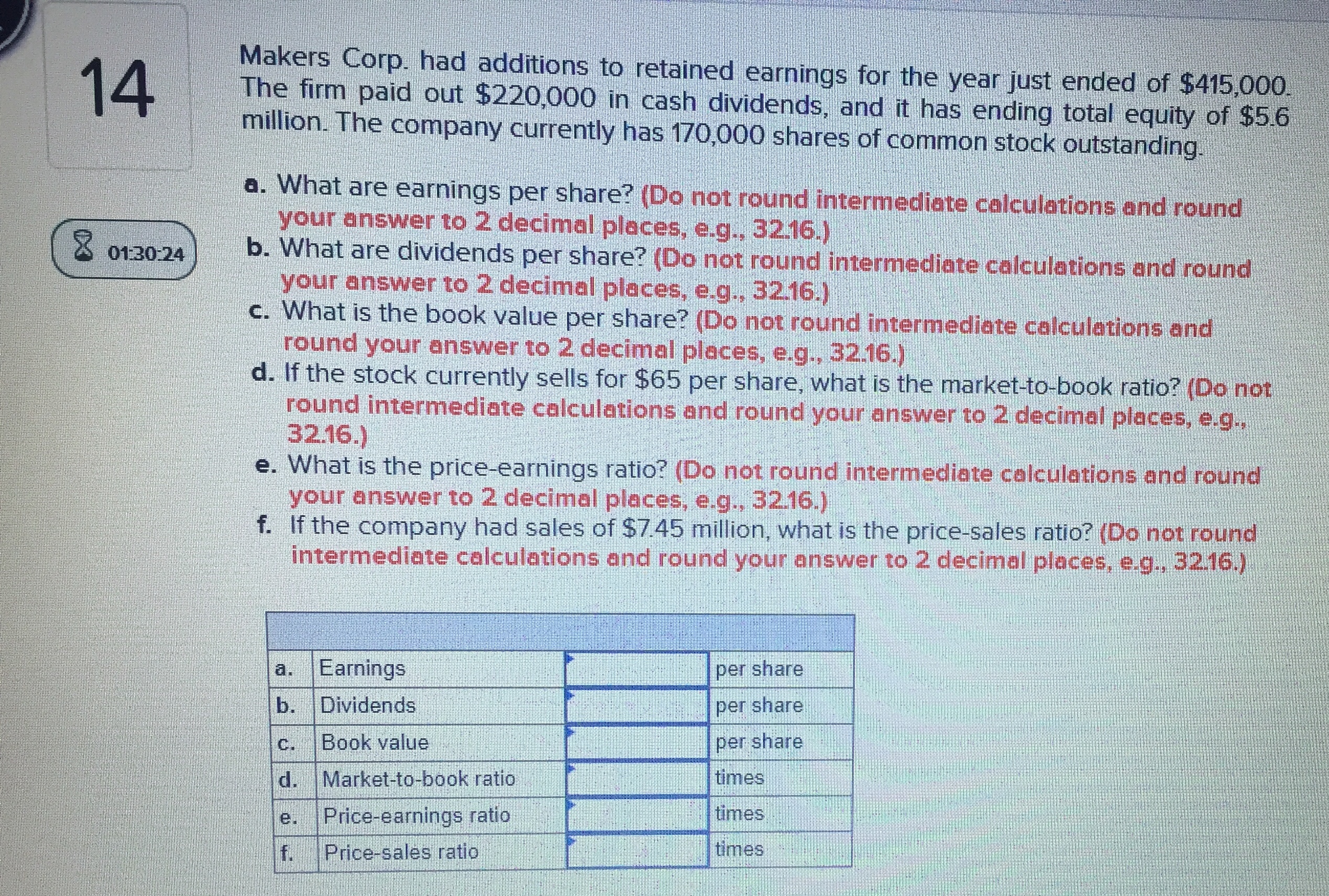

A1 X 11 A B C D E F G H 2 3 Hare, Inc., had a cost of goods sold of $57,382. At the end of the year, the accounts 01:31:20 payable balance was $10,432. How long on average did it take the company to pay off its suppliers during the year? 4 5 6 Cost of goods sold $ 57,382 Accounts payable balance $ 10,432 8 Days per year 365 9 10 11 Complete the following analysis. Do not hard code values in your calculations. 12 13 Payables turnover 14 15 Days' sales in payablesDTO, Inc., has sales of $37 million, total assets of $25 million, and total debt of $6 million. 12 a. If the profit margin is 8 percent, what is the net income? X 01:30:59 b. What is the ROA?\fThe most recent financial statements for Bello Co. are shown here: 13 Income Statement Balance Sheet Sales $20,300 Current $ 11,980 Debt $ 16,540 assets Costs 13,900 Fixed assets 32,400 Equity 27,840 01:30:37 Taxable $ 6,400 Total $ 44,380 Total $44,380 income Taxes (21%) 1,344 Net income $ 5,056 Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 45 percent dividend payout ratio. What is the sustainable growth rate? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Sustainable growth rate14 Makers Corp. had additions to retained earnings for the year just ended of $415,000 The firm paid out $220,000 in cash dividends, and it has ending total equity of $5.6 million. The company currently has 170,000 shares of common stock outstanding. a. What are earnings per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) 01:30:24 b. What are dividends per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the book value per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. If the stock currently sells for $65 per share, what is the market-to-book ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g.. 32.16.) e. What is the price-earnings ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) f. If the company had sales of $7.45 million, what is the price-sales ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a Earnings per share Dividends per share C. Book value per share d. Market-to-book ratio times Price-earnings ratio times F. Price-sales ratio times