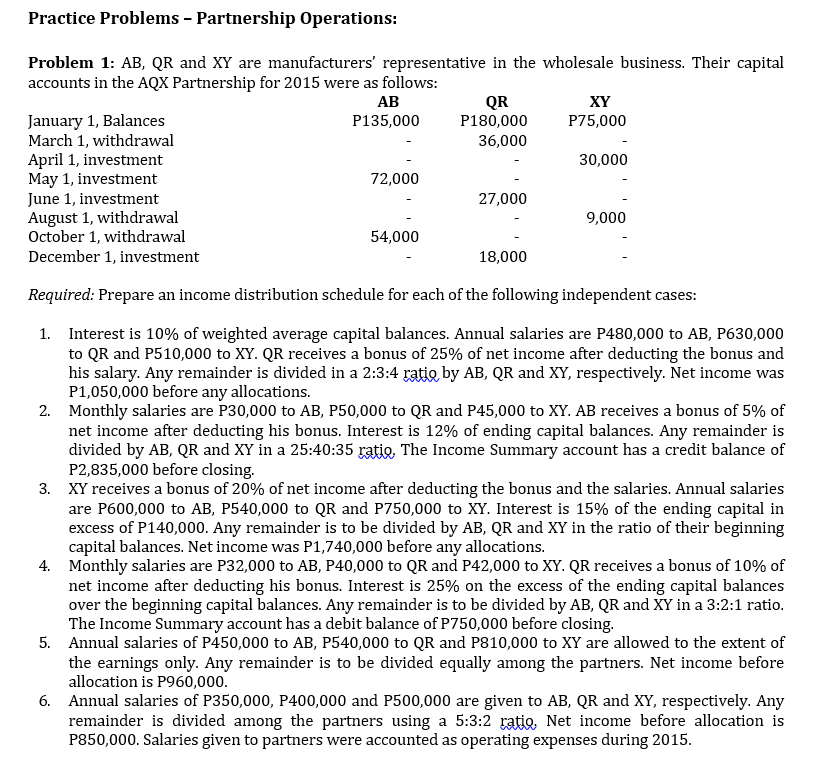

Question: Practice Problems Partnership Operations: Problem 1: AB, QR and KY are manufacturers' representative in the wholesale business. Their capital accounts in the AQX Partnership for

Practice Problems Partnership Operations: Problem 1: AB, QR and KY are manufacturers' representative in the wholesale business. Their capital accounts in the AQX Partnership for 2015 were as follows: AB QR KY january 1. Balances P135,000 P180,000 P275000 March 1. withdrawal 36.000 April 1, investment 30,000 May 1. investment 72.000 june 1. investment 227.000 August 1, withdrawal 9,000 October 1. withdrawal 54-.000 December 1, investment 18.000 Required: Prepare an income distribution schedule for each of the following independent cases: 1. Interest is 10% of weighted average capital balances. Annual salaries are P430000 to AB, P630,000 to QR and P510.000 to KY. QR receives a bonus of 25% of net income after deducting the bonus and his salary. Any remainder is divided in a 2:3:4- gamby AB. QR and KY. respectively. Net income was P1.050,000 before any allocations. Monthly salaries are P30,000 to AB. P50,000 to QR and P45.000 to KY. AB receives a bonus of 5% of net income after deducting his bonus. Interest is 12% of ending capital balances. Any remainder is divided by AB. QR and KY in a 25:40:35 MIR- The Income Summary account has a credit balance of P2.835,000 before closing. KY receives a bonus of 20% of net income after deducting the bonus and the salaries. Annual salaries are P600.000 to AB. P540,000 to QR and P?50.000 to KY. Interest is 15% of the ending capital in excess of P140000. Any remainder is to be divided by AB, QR and KY in the ratio of their beginning capth balances. Net income was P1.74-0.000 before any allocations. Monthly salaries are P32,000 to AB, P40.000 to QR and P42,000 to KY. QR receives a bonus of 10% of net income alter deducting his bonus. Interest is 25% on the excess of the ending capital balances over the beginning capital balances. Any remainder is to be divided by AB. QR and KY in a 3:2:1 ratio. The Income Summary account has a debit balance of P?50.000 before closing. Annual salaries of P450.000 to AB. P540000 to QR and P310.000 to KY are allowed to the extent of the earnings only. Any remainder is to be divided equally among the partners. Net income before allocation is P960.000. Annual salaries of P350.000. P400000 and P500,000 are given to AB, QR and KY. respectively. Any remainder is divided among the partners using a 5:3:2 gang, Net income before allocation is P350,000. Salaries given to partners were accounted as operating expenses during 2015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts