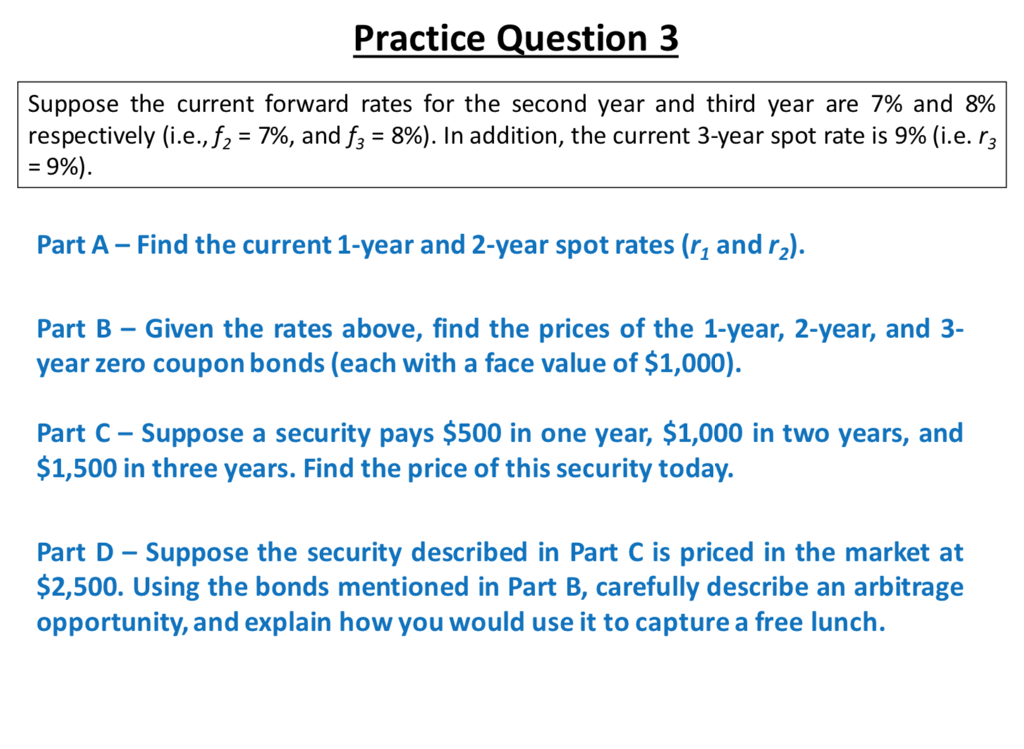

Question: Practice Question 3 suppose the current forward rates for the second year and third year are 7% and 8% respectively (i.e.,f2-7%, and f,-8%). In addition,

Practice Question 3 suppose the current forward rates for the second year and third year are 7% and 8% respectively (i.e.,f2-7%, and f,-8%). In addition, the current 3-year spot rate is 9% (ie. r3 -996). Part A- Find the current 1-year and 2-year spot rates (r, and r2) Part B - Given the rates above, find the prices of the 1-year, 2-year, and 3- year zero coupon bonds (each with a face value of $1,000) Part C Suppose a security pays $500 in one year, $1,000 in two years, and 1,500 in three years. Find the price of this security today. Part D Suppose the security described in Part C is priced in the market at 2,500. Using the bonds mentioned in Part B, carefully describe an arbitrage opportunity, and explain how you would use it to capture a free lunch. Practice Question 3 suppose the current forward rates for the second year and third year are 7% and 8% respectively (i.e.,f2-7%, and f,-8%). In addition, the current 3-year spot rate is 9% (ie. r3 -996). Part A- Find the current 1-year and 2-year spot rates (r, and r2) Part B - Given the rates above, find the prices of the 1-year, 2-year, and 3- year zero coupon bonds (each with a face value of $1,000) Part C Suppose a security pays $500 in one year, $1,000 in two years, and 1,500 in three years. Find the price of this security today. Part D Suppose the security described in Part C is priced in the market at 2,500. Using the bonds mentioned in Part B, carefully describe an arbitrage opportunity, and explain how you would use it to capture a free lunch

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts