Question: Practice Question I need help with You are the Chief Financial Ofcer (CFO) for a US. company that has sold 10,000,000 in services to a

Practice Question I need help with

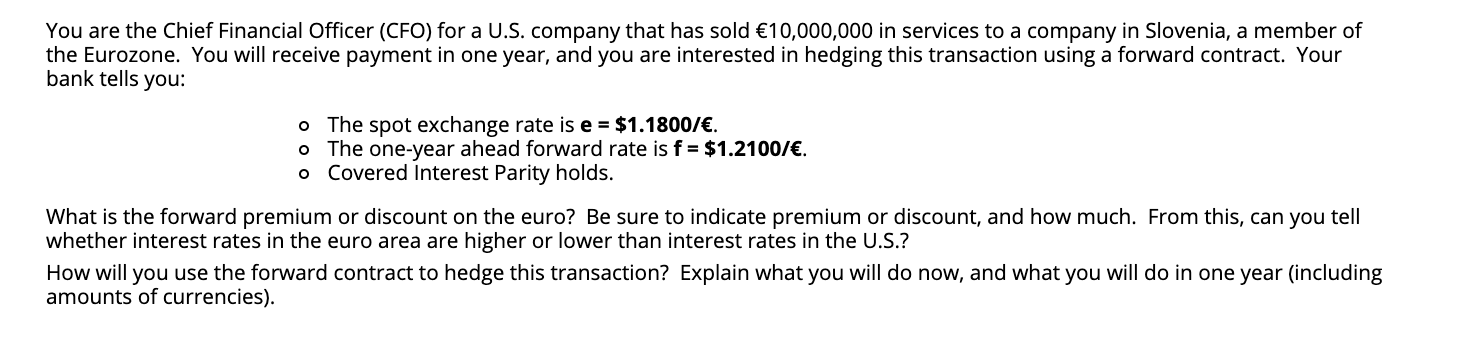

You are the Chief Financial Ofcer (CFO) for a US. company that has sold 10,000,000 in services to a company in Slovenia, a member of the Eurozone. You will receive payment in one year, and you are interested in hedging this transaction using a forward contract. Your bank tells you: 0 The spot exchange rate is e = $1.1SDOIE. o The one-year ahead forward rate is f = $1.21ODIE. 0 Covered Interest Parity holds. What is the forward premium or discount on the euro? Be sure to indicate premium or discount, and how much. From this. can you tell whether interest rates in the euro area are higher or lower than interest rates in the U.S.? How will you use the fonrvard contract to hedge this transaction? Explain what you will do now. and what you will do in one year (including amounts of currencies)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts