Question: Practice Question: Transaction Exposure 1. Macy's recently imported 6500,000 worth of apparels from Europe, it is scheduled to pay the money to the European company

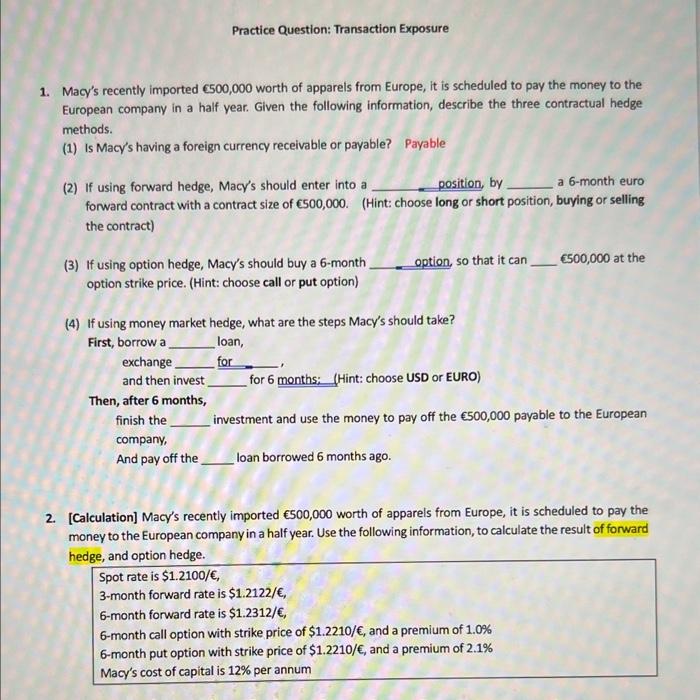

Practice Question: Transaction Exposure 1. Macy's recently imported 6500,000 worth of apparels from Europe, it is scheduled to pay the money to the European company in a half year. Given the following information, describe the three contractual hedge methods. (1) Is Macy's having a foreign currency receivable or payable? Payable (2) If using forward hedge, Macy's should enter into a position, by a 6-month euro forward contract with a contract size of 6500,000 . (Hint: choose long or short position, buying or selling the contract) (3) If using option hedge, Macy's should buy a 6-month option, so that it can 6500,000 at the option strike price. (Hint: choose call or put option) (4) If using money market hedge, what are the steps Macy's should take? First, borrow a loan, exchange for and then invest for 6 months: (Hint: choose USD or EURO) Then, after 6 months, finish the investment and use the money to pay off the 500,000 payable to the European company, And pay off the loan borrowed 6 months ago. 2. [Calculation] Macy's recently imported 500,000 worth of apparels from Europe, it is scheduled to pay the money to the European company in a half year. Use the following information, to calculate the result of forward hedge, and option hedge. Spot rate is $1.2100/, 3-month forward rate is $1.2122/, 6 -month forward rate is $1.2312/, 6-month call option with strike price of $1.2210/, and a premium of 1.0% 6-month put option with strike price of $1.2210/, and a premium of 2.1% Macy's cost of capital is 12% per annum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts