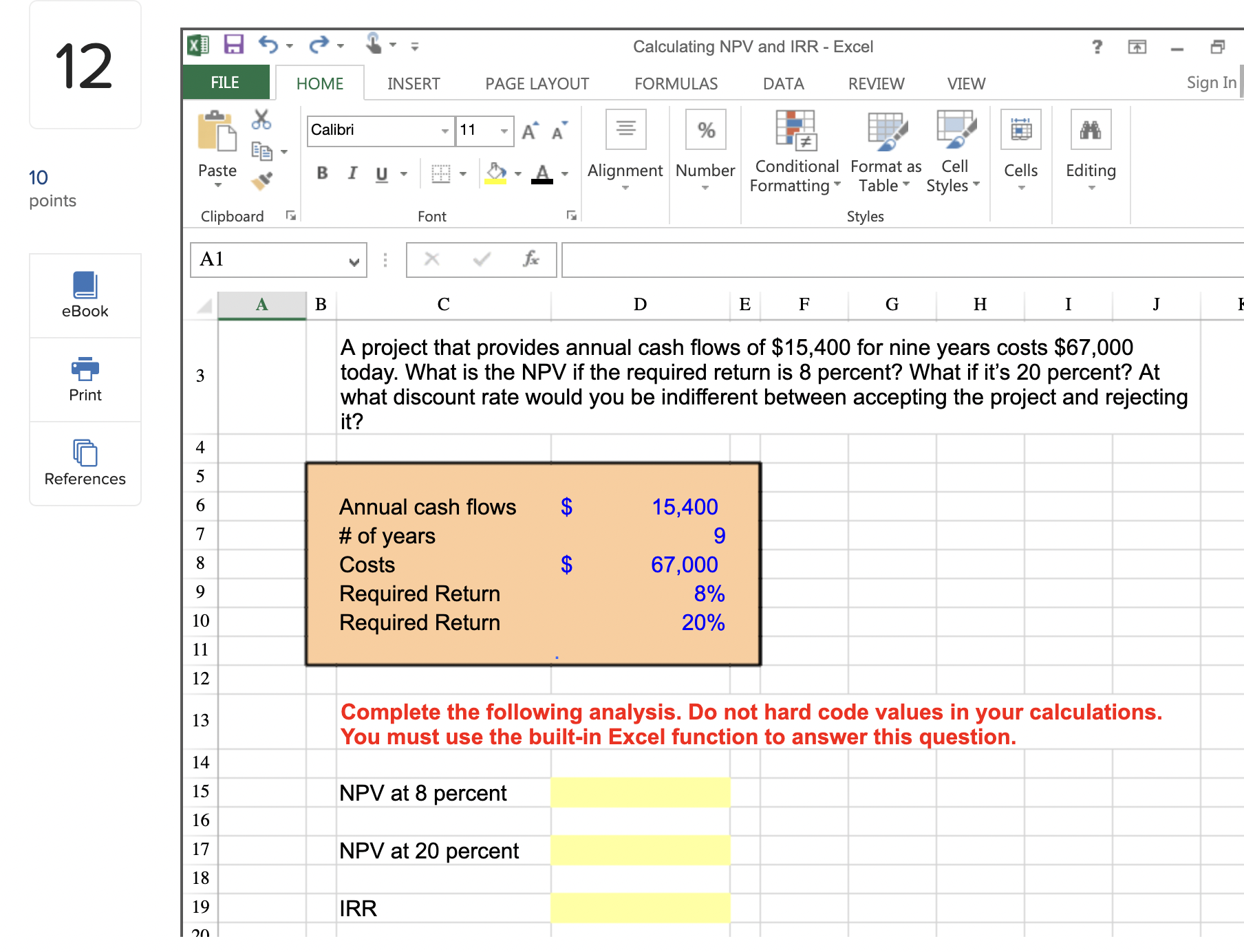

Question: Practice questions FOR QUESTION 12 PLEASE ALSO PROVIDE ANSWER IN EXCEL FORMAT (FORMULA EXAMPLE, =B6 +B7+B8) 12 x] H 6 - 2 - 1 .

Practice questions

FOR QUESTION 12 PLEASE ALSO PROVIDE ANSWER IN EXCEL FORMAT (FORMULA EXAMPLE, =B6 +B7+B8)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts