Question: Practice questions I need assistance with. Please help. Question 3: Wascana Corporation is considering one of the following three options: 1. Paying a $0.50 cash

Practice questions I need assistance with. Please help.

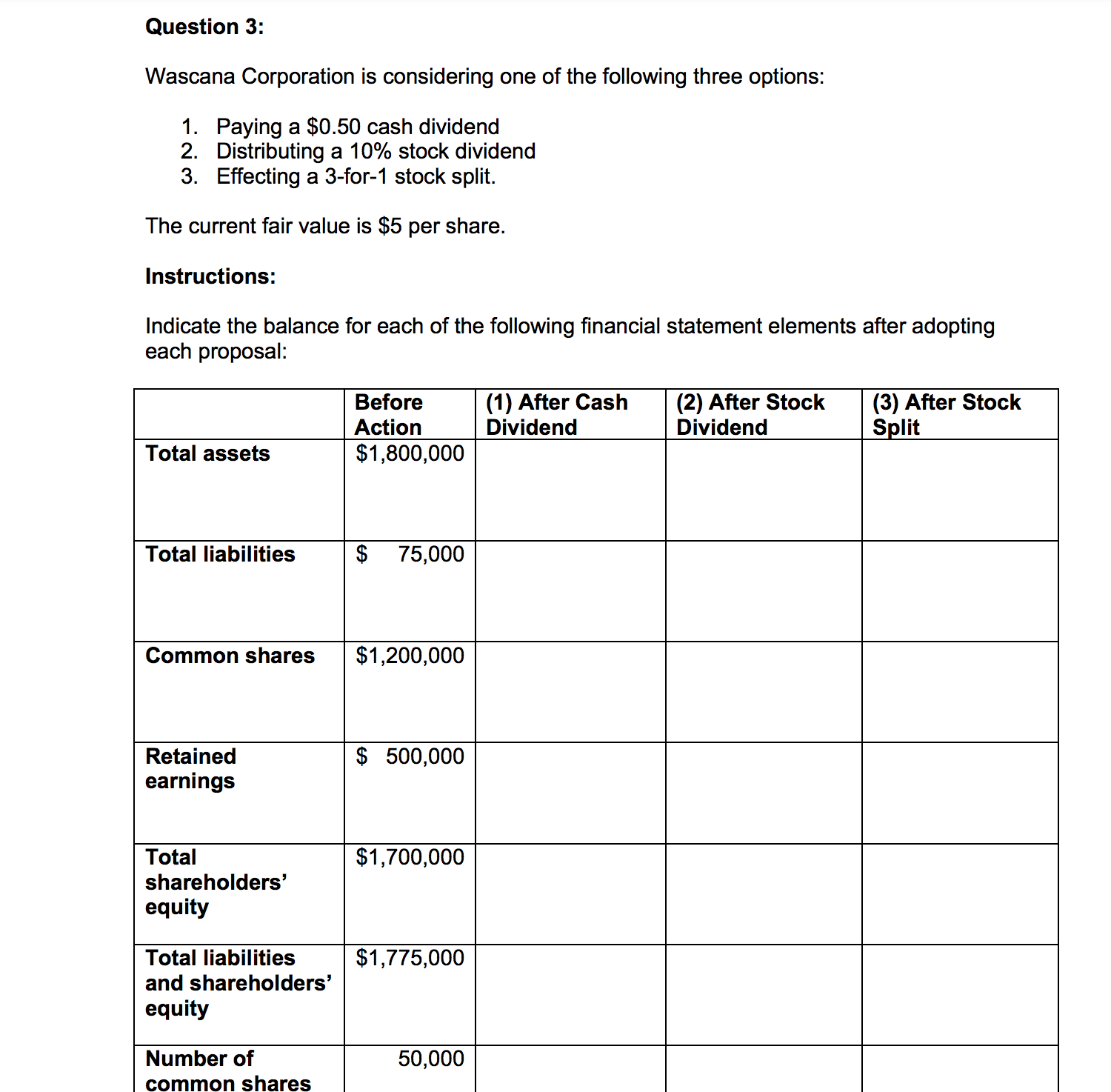

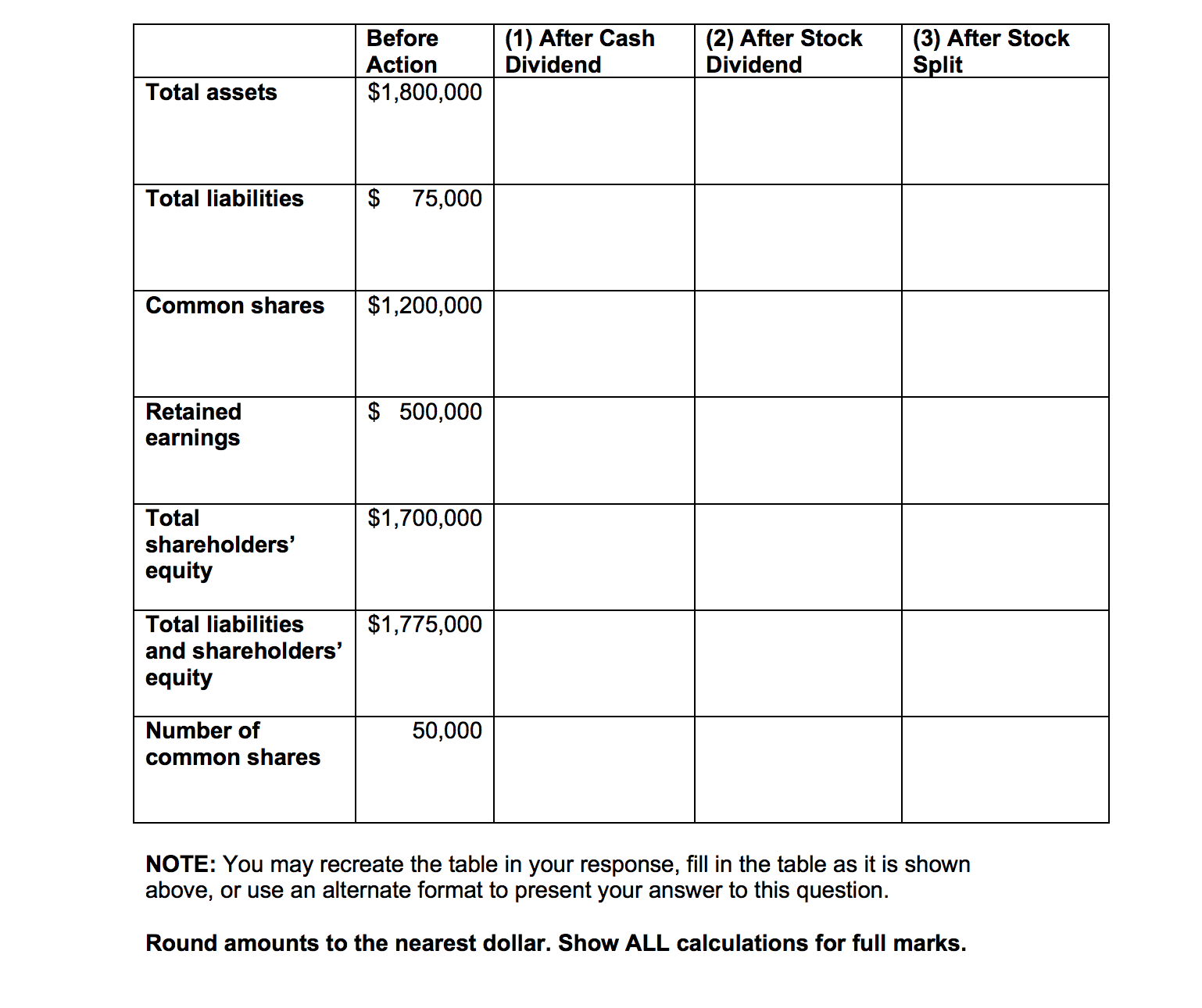

Question 3: Wascana Corporation is considering one of the following three options: 1. Paying a $0.50 cash dividend 2. Distributing a 10% stock dividend 3. Effecting a 3-for-1 stock split. The current fair value is $5 per share. Instructions: Indicate the balance for each of the following nancial statement elements after adopting each proposal: _- (1) After Cash (2) After Stock (3) After Stock Action Dividend Dividend S - lit Total assets $1,800,000 Total liabilities $ 75,000 $1,200,000 Retained $ 500,000 earnings Total $1,700,000 shareholders' equity Total liabilities $1,775,000 and shareholders' equity Number of 50,000 common shares Before (1) After Cash (2) After Stock (3) After Stock Action Dividend Dividend S - lit Total assets $1,800,000 Total liabilities $1,200,000 Total $1 ,700,000 shareholders' equity Total liabilities $1,775,000 and shareholders' equity Number of common shares Retained $ 500,000 earnings NOTE: You may recreate the table in your response, fill in the table as it is shown above, or use an alternate format to present your answer to this question. Round amounts to the nearest dollar. Show ALL calculations for full marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts