Question: Practice using Weighted Averages to Calculate Expected Return- See Section 8- 2A Consider an investment that you predict will earn 2.8% in a recession, 4.7%

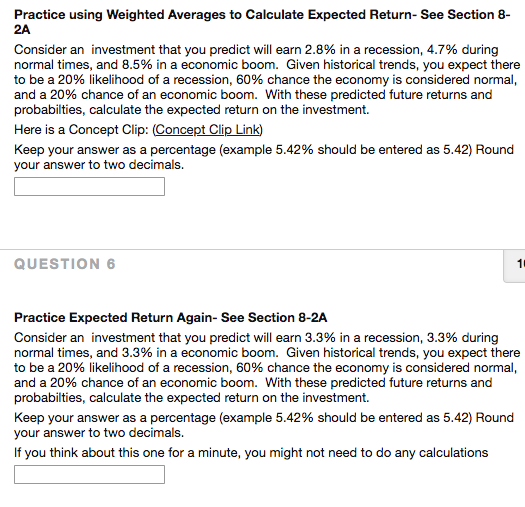

Practice using Weighted Averages to Calculate Expected Return- See Section 8- 2A Consider an investment that you predict will earn 2.8% in a recession, 4.7% during normal times, and 8.5% in a economic boom. Given historical trends, you expect there to be a 20% likelihood of a recession, 60% chance the economy is considered normal, and a 20% chance of an economic boom. With these predicted future returns and probabilties, calculate the expected return on the investment. Here is a Concept Clip: Concept Clip Link) Keep your answer as a percentage (example 5.42% should be entered as 5.42) Round your answer to two decimals. QUESTION 6 1 Practice Expected Return Again-See Section 8-2A Consider an investment that you predict will earn 3.3% in a recession, 3.3% during normal times, and 3.3% in a economic boom. Given historical trends, you expect there to be a 20% likelihood of a recession, 60% chance the economy is considered normal, and a 20% chance of an economic boom. With these predicted future returns and probabilties, calculate the expected return on the investment. Keep your answer as a percentage (example 5.42% should be entered as 5.42) Round your answer to two decimals. If you think about this one for a minute, you might not need to do any calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts