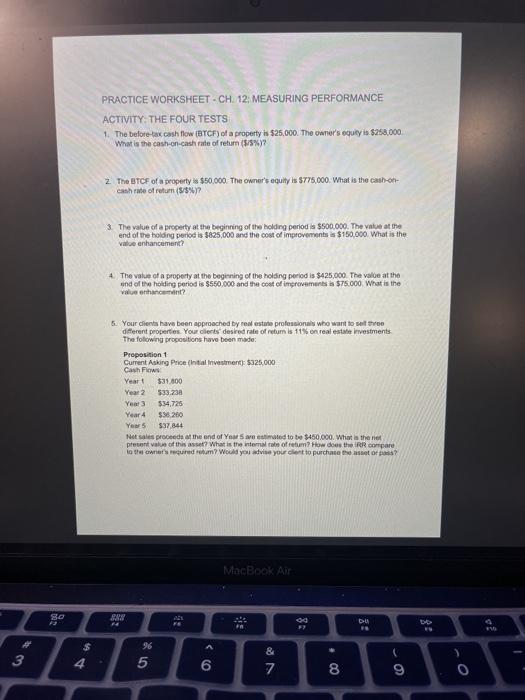

Question: PRACTICE WORKSHEET-CH. 12 MEASURING PERFORMANCE ACTIVITY. THE FOUR TESTS 1. The before tax cash flow (BTCF) of a property is $25,000. The owner's equity is

PRACTICE WORKSHEET-CH. 12 MEASURING PERFORMANCE ACTIVITY. THE FOUR TESTS 1. The before tax cash flow (BTCF) of a property is $25,000. The owner's equity is $250.000 What is the cash on-cash rate of retum (5/8%? 2 The BTCF of a property $60,000. The owner's equity is $775,000. What is the caso cash rate of return (83%? 3 The value of a property at the beginning of the holding period is $500.000. The value at the end of the holding period is $825,000 and the cost of improvements is $150,000. What is the vale enhancement? 4. The value of a property at the beginning of the holding period is $425,000. The value at the und of the holding period is $550.000 and the cost of improvements $75.000. What is the vale enhancem? 6. Your clients have been approached by real estate professionals who want to sell three different properties. Your clients desired rate of retum is 11% real estate investments The following propositions have been made: Proposition 1 Current Asking Price (Intial Investments: $325,000 Cash Flows Yeart $35.000 Year 2 $33.238 Year $34.725 Year 4 $36.200 Yes $37.844 Net sales proceeds of the end of You are stimated to be $450,000. What the net present value of this asset? What is the internal role of return? How does the IRR compare to the owners are rom? Would you advise your client to purchase the stor? MacBook Air so od Du DO 3 $ 4 96 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts