Question: Practise Question ? ? & 3 3 Megrawhill Page 9 9 Blue Bell Inc ( BBI ) is a company that collects smartwatches. Reprocesses them

Practise Question & Megrawhill Page

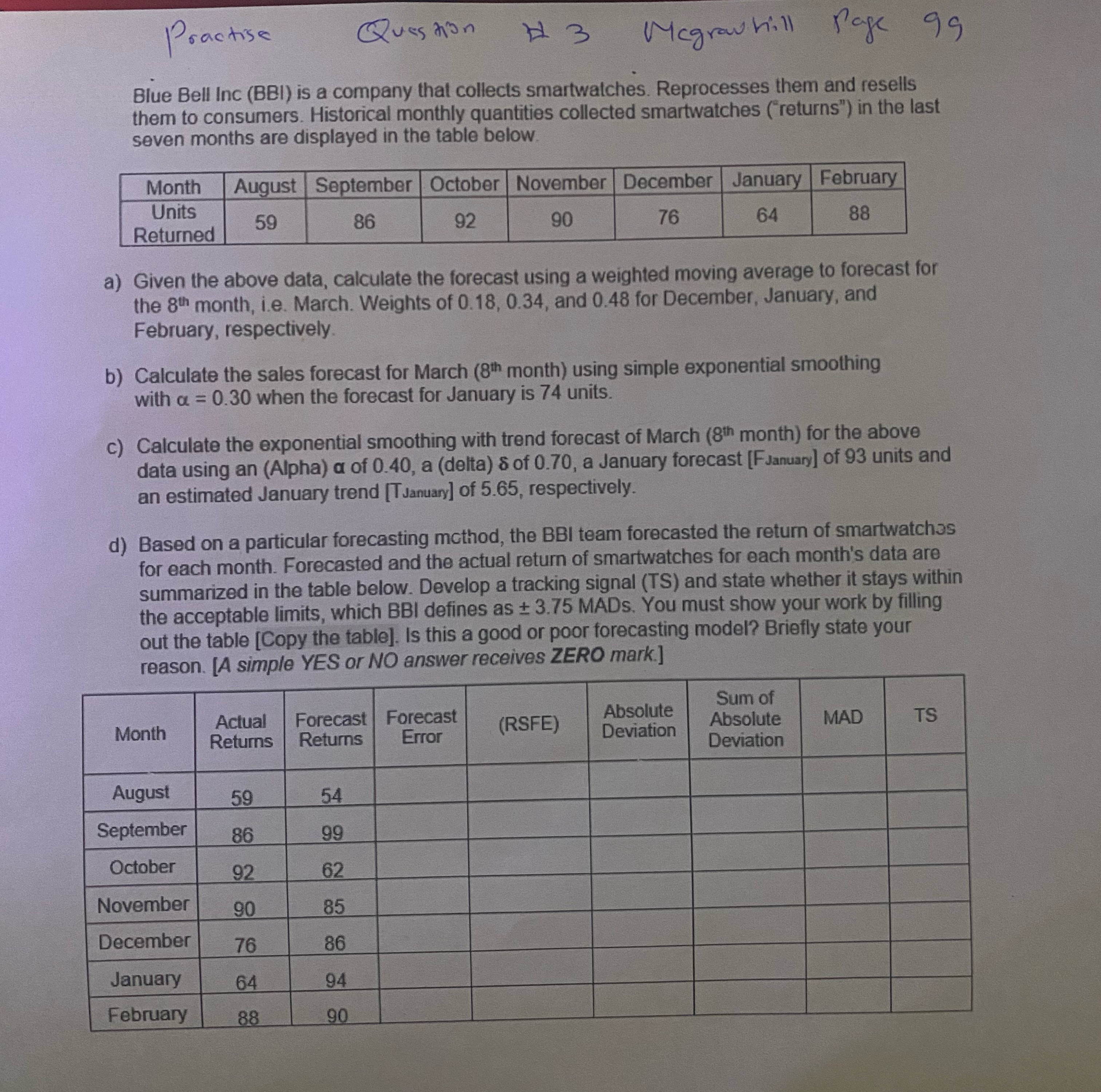

Blue Bell Inc BBI is a company that collects smartwatches. Reprocesses them and resells them to consumers. Historical monthly quantities collected smartwatches returns in the last seven months are displayed in the table below.

tableMonthAugust,September,October,November,December,January,FebruarytableUnitsReturned

a Given the above data, calculate the forecast using a weighted moving average to forecast for the month, ie March. Weights of and for December, January, and February, respectively.

b Calculate the sales forecast for March month using simple exponential smoothing with when the forecast for January is units.

c Calculate the exponential smoothing with trend forecast of March month for the above data using an Alpha of a delta of a January forecast FJanuary of units and an estimated January trend TJanuary of respectively.

d Based on a particular forecasting mothod, the BBI team forecasted the return of smartwatch for each month. Forecasted and the actual return of smartwatches for each month's data are summarized in the table below. Develop a tracking signal TS and state whether it stays within the acceptable limits which BBI defines as MADs. You must show your work by filling out the table Copy the table Is this a good or poor forecasting model? Briefly state your reason. A simple YES or NO answer receives ZERO mark.

tableMonthtableActualReturnstableForecastReturnstableForecastErrorRSFEtableAbsoluteDeviationtableSum ofAbsoluteDeviationMAD,TSAugustSeptemberOctoberNovemberDecemberJanuaryFebruary

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock