Question: prater.. russel... the exchange is as follows: T r ang f erreg Warehous e Land Mortgage on warehouse Cash ss FMV Prater Inc. enters into

prater..

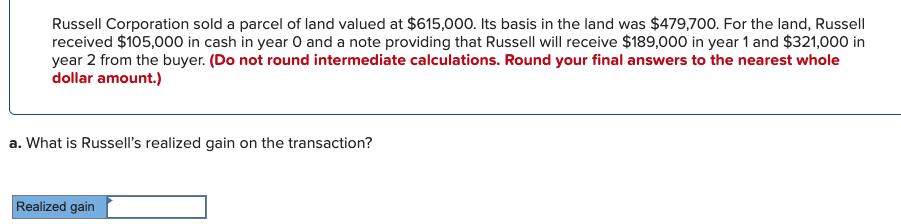

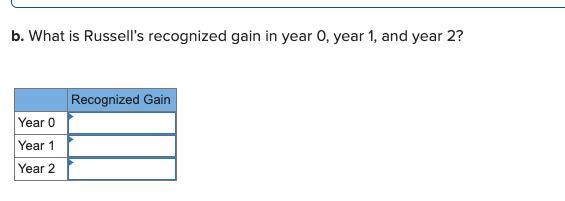

russel...

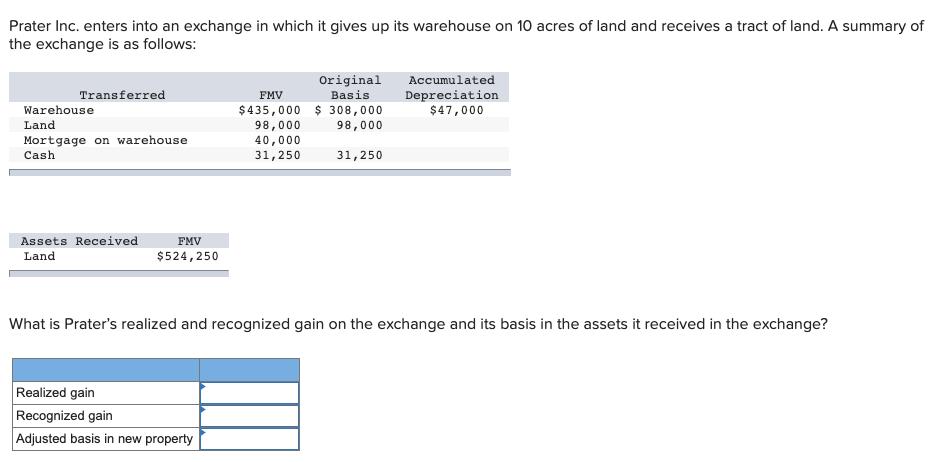

the exchange is as follows: T r ang f erreg Warehous e Land Mortgage on warehouse Cash ss FMV Prater Inc. enters into an exchange in which it gives up its warehouse on 10 acres of land and receives a tract of land. A summary of $435,000 9B, 000 40,000 31,250 Or igxnal Bas is $ 308,000 98,000 31,250 ecumuIae Deprec i at ion $47,000 Land $524,250 What is Prater's realized and recognized gain on the exchange and its basis in the assets it received in the exchange? Realized gain Recognized gain Adjusted basis in new property

Step by Step Solution

3.43 Rating (169 Votes )

There are 3 Steps involved in it

First answer Description Amount Explanation 1 Amount realized in likekind 524250 FMV of land 2 ... View full answer

Get step-by-step solutions from verified subject matter experts