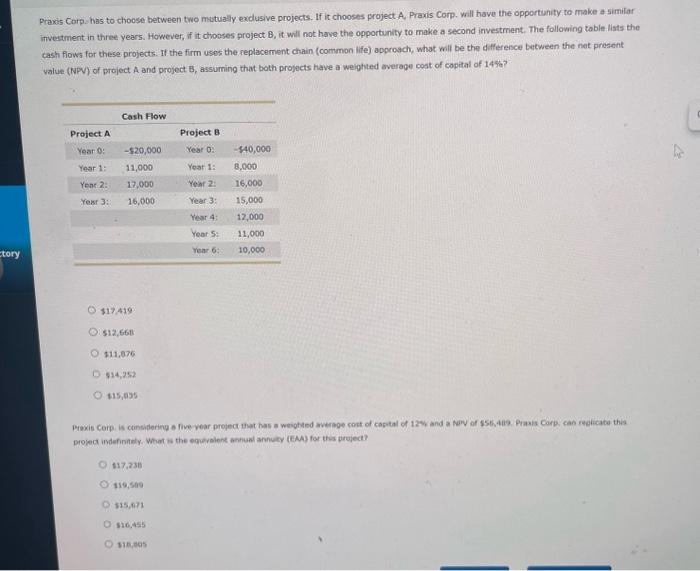

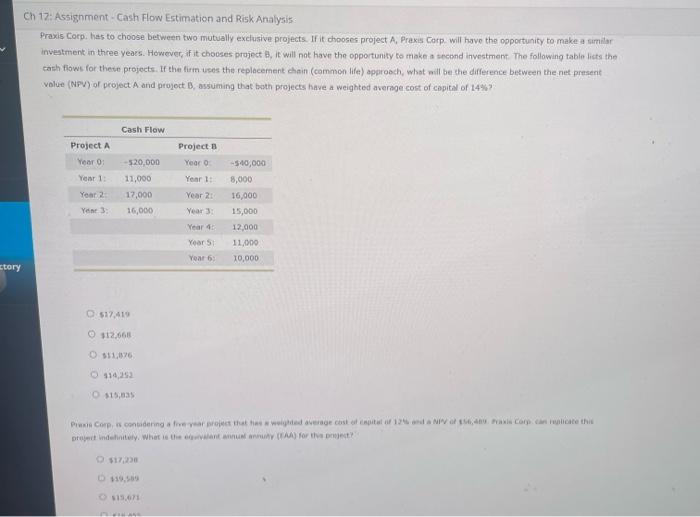

Question: Praxis Corp. has to choose between two mutually exdusive projects. If it chooses project Ay, Praxis Corp. will have the opportunity to make a similar

Praxis Corp. has to choose between two mutually exdusive projects. If it chooses project Ay, Praxis Corp. will have the opportunity to make a similar investment in three years, However, if it chooses project B, it will not have the opportunity to make a second investrnent, The following table tists the cash flows for these projects. If the firm uses the replacement chain (common life) approgch, whot will be the difference between the net present walue (NPV) of project A and project B, assuming that both projects have a weighted average cost of copital of 14% ? $17,419$12,666$11,876514,252415,635 Paxis Corp. is considering a five vear project that has a weighted average cott of casntal of 12*y and a Non of 55 thatis. Pranis Corp. can realicate this projed indefinftly. What is the equavalent anfual annuty (EMA) for this project? 117.231 110,549 135,011 310,455 116,005 17: Assignment - Cash Flow Estimation and Risk Analysis Praxis Corp. has to choose between two mutually exclusive projects. If it ohooser project A, Praxis Corp. will have the opportunity to make a similar investment in three years. However, if it chosses project B, it will not have the opportunity to make a second investment. The following table licts the eath fiows for these projects. If the firm uses the replacernent chain (common life) approech, what aill be the difference between the net present volue (NPV) of project A and project B, ossuming that both projects have a weighted average cost of copital of 14% ? 112,666 914,253 13,635 17,230 149,369 1s.611

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts