Question: Pray Industries is considering a $5 million research and development (R&D) project. Profit projections appear promising, but Pray's president, JJ, is concerned because the probability

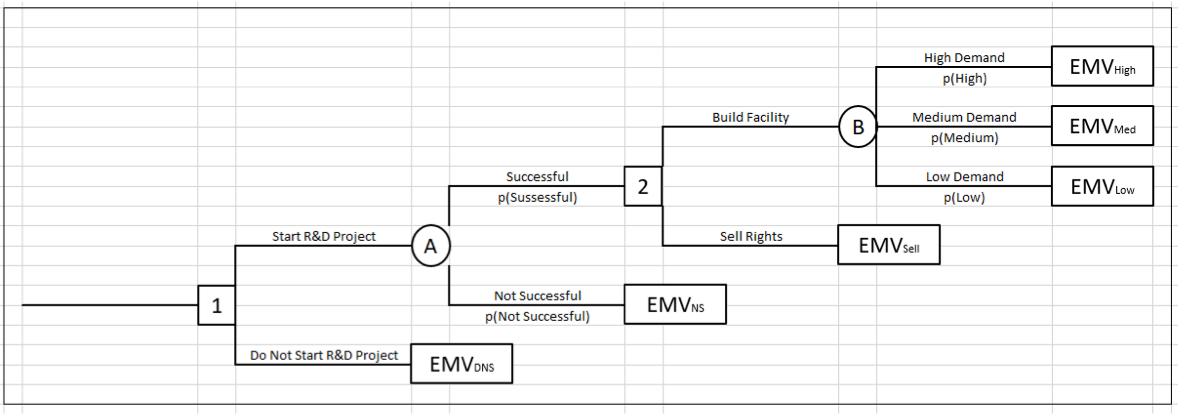

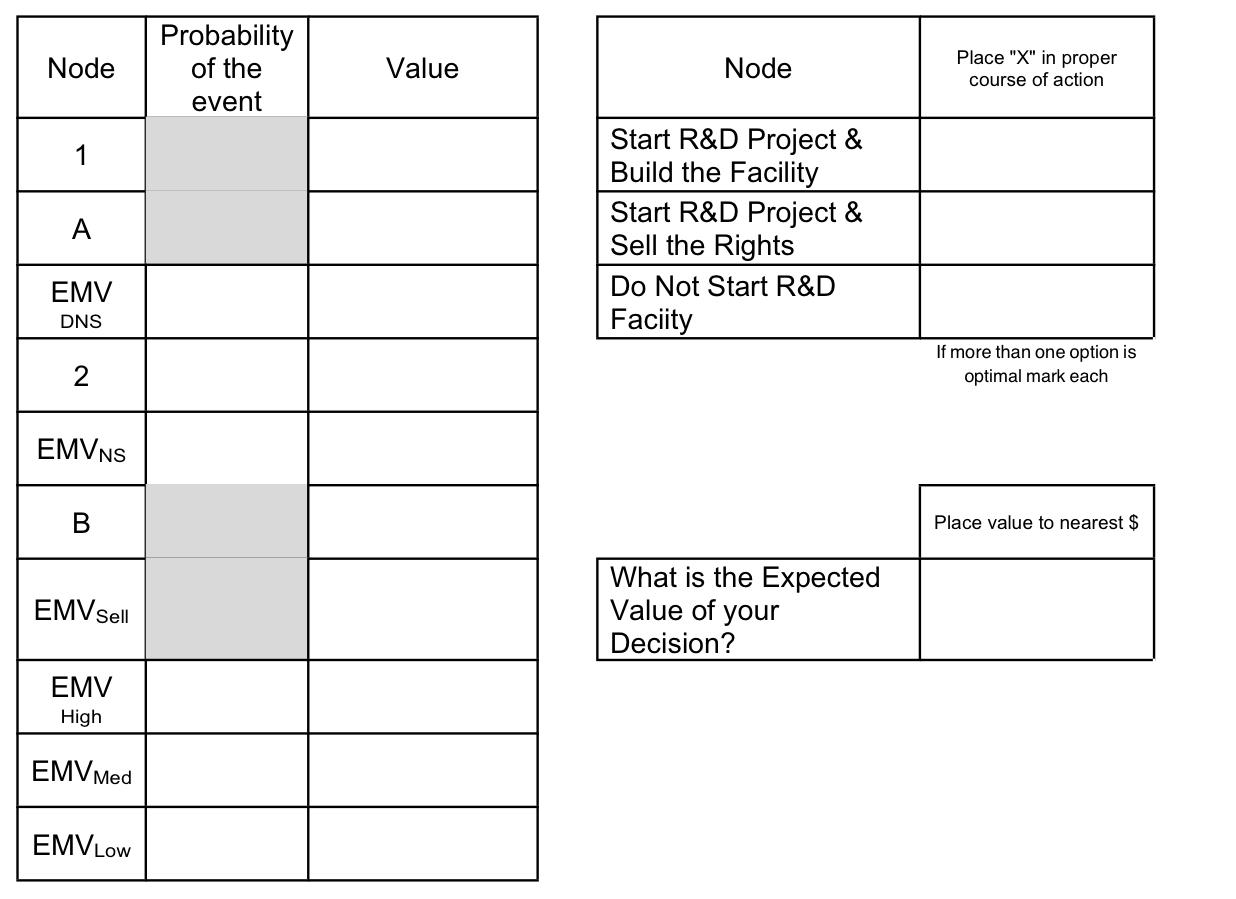

Pray Industries is considering a $5 million research and development (R&D) project. Profit projections appear promising, but Pray's president, JJ, is concerned because the probability that the R&D project will be successful is only 0.50. Furthermore, JJ knows that even if the project is successful, it will require that the company build a new production facility at a cost of $20 million in order to manufacture the product line. If the facility is built, uncertainty about the profit to be expected: high demand $59 million in revenue, medium demand $45 million in revenue, low demand $35 in revenue. Another option is that if the R&D project is successful, the company could sell the rights to the product for an estimated $25 million.

Measure the Expected Monetary Value for each demand state, the EMV based on profit (not revenue) for each of the 4 nodes (A, B, 1, 2).

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts