Question: Prebilem 5 4 - 6 3 , 1 4 - 6 4 ( Algo ) ( L . O 1 4 - 4 , 2

Prebilem AlgoLO

Neen

For the most recent year frear data from the twe divisors shows the fulliviry

tableaReresultics, SorlineAllecated erperate evercead istupTimislity,DisisiveCost of sales, defe,Other operal atol adainsstrative couts, Nehas centy,the,Sales she, mest,Feiai antels idehary Tear ee

The tax rate appled at Bentier is percent.

Problem Algo Divisional Income, ROI, and Residual Income LO

Required:

Compute divisional income for year for each of the divisions.

bt Evaluate the two divisions based on the information foom the divisional income consulad.

b In leems of divitional income, which division performed better?

cL Compute ROI for year for each of the diverions.

c Which division performed better?

Compute residual income for year for each of the divisions. Bentler uses a cost of caplar of th percent.

d Which division performed better?

Cemplete this question by entering your anwwers in the tabs below.

Req

Neq

Req Cl

New G

Here #:

How by

Compute dividional income for year for each of the diviluans.

Note: Enter your answers in thousands of folluri.

tabletableAeronsuticaDivisiontableMariseDivisionDivisional income,,

polich

Problem AlgoLO

The following intormarion applies to the questions displayed below

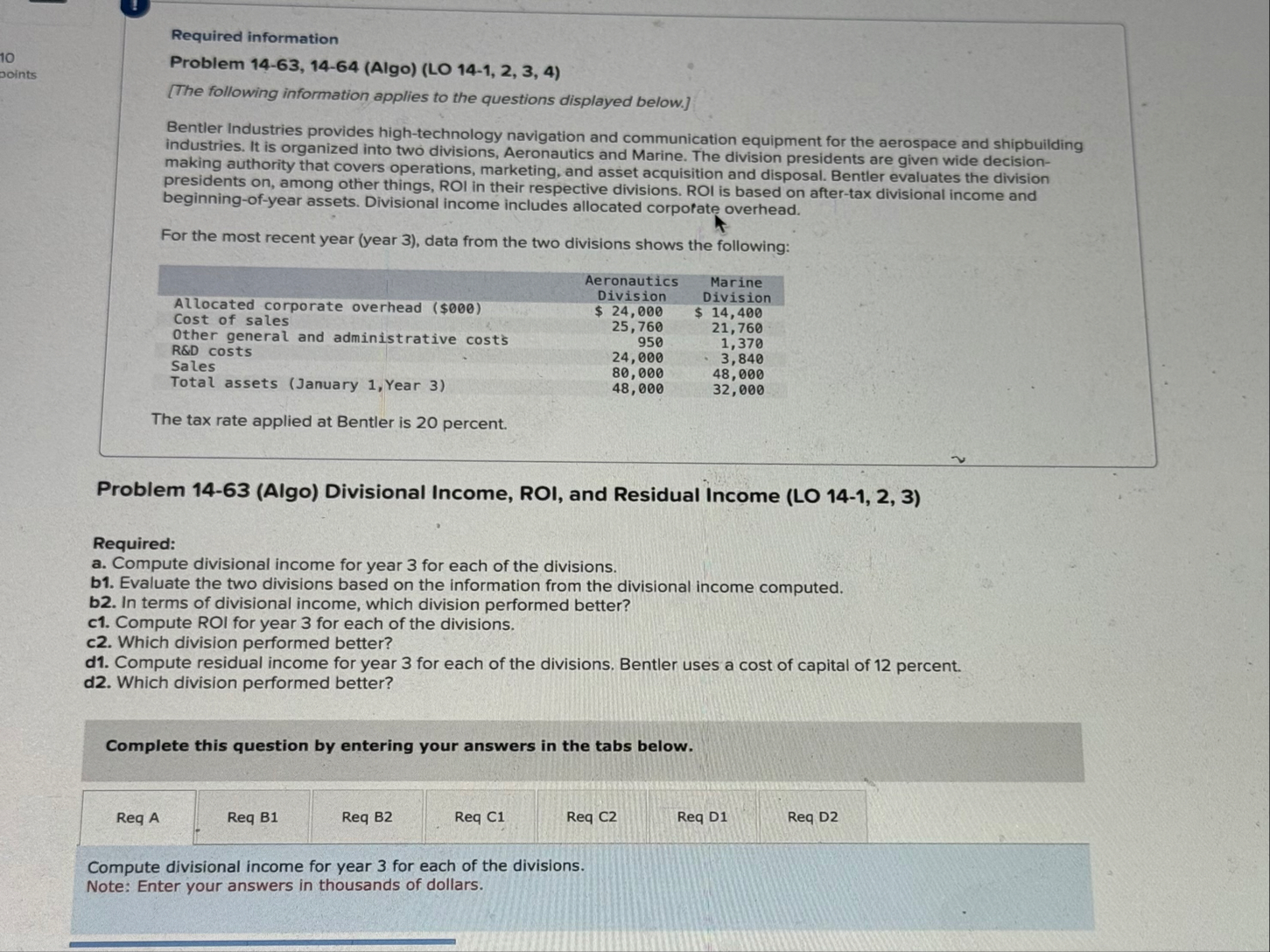

Bentler industries provides hightechnology navigation and communication equipment for the aerospace and shipbuilding Industries. It is organized into two divisions, Aeronbutics and Marine. The division presidents are given wide decisionmaking authority that covers operations, marketing, and asset acquisition and disposal. Bentler evaluates the division presidents on among other things, ROI in their respective divisions. ROI is based on aftertax divisional income and beginningof year assets. Divisional income includes allocated corpofate overhead.

For the most recent year year data from the two divisions shows the following:

tableAerenautics,MarimeDivisian,DivisionAllocated cerporate overhead seeeebCost of sales,eOther general, and administrative costs,eRWD cests,eeSaleseTetal assets Jawary Year ee

The tax rate applied at Bentler is percent.

Problem Algo Divisional Income, ROI, and Residual Income LO

Required:

a Compute divisional income for year for each of the divisions.

b Fivaluate the two divisions based on the information from the divisional income computed.

b In terms of divisional income, which division performed better?

c Compute ROI for year for each of the divisions.

c Which division performed better?

d Compute residual income for year for each of the divisions. Bentler uses a cost of capital of percent.

d Which division performed better?

Complete this question by entering your answers in the tabs below.

Req B

Req

Req Cl Req D

Compute divisional income for year for each of the divisions.

Note: Finter vour answers in thousands of dollars.

Required information

Problem AlgoLO

The following information applies to the questions displayed below.

Bentler Industries provides hightechnology navigation and communication equipment for the aerospace and shipbuilding industries. It is organized into two divisions, Aeronautics and Marine. The division presidents are given wide decisionmaking authority that covers operations, marketing, and asset acquisition and disposal. Bentler evaluates the division presidents on among other things, ROI in their respective divisions. ROI is based on aftertax divisional income and beginningofyear assets. Divisional income includes allocated corpotate overhead.

For the most recent year year data from the two divisions shows the following:

tableAeronautics Division,Marine DivisionAllocated corporate overhead $$ $ Cost of sales,Other general and administrative costsR&D costs,SalesTotal assets January Year

The tax rate applied at Bentler is percent.

Problem Algo Divisional Income, ROI, and Residual Income LO

Required:

a Compute divisional income for year for each of the divisions.

b Evaluate the two divisions based on the information from the divisional income computed.

b In terms of divisional income, which division performed better?

c Compute ROI for year for each of the divisions.

c Which division performed better?

d Compute residual income for year for each of the divisions. Bentler uses a cost of capital of percent.

d Which division performed better?

Complete this question by entering your answers in the tabs below.

Req D

Com

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock