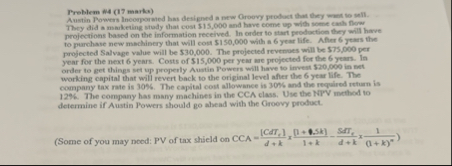

Question: Preblem W 4 ( 1 7 marka ) Thocy did a markeling stody that cust $ 1 5 , 0 0 0 and have come

Preblem marka Thocy did a markeling stody that cust $ and have come up with some each flow projections based on the information received. In onder to shart prodoction they will have to purchase new mechinery that will cost $ with a year life. Aher years the profected Sntvage vehte will be The projected revernoes will be per year for the neat years. Costs of per year me projected for the yeark. In order to get things set up jroperly Austis Powers will have to invent in net working capital that will revert back to the original level after the year life. The company tax rate is The capital cost allowance is and the required retum is The company has many mnehines in whe CCA elass, lise the WIVY method so determaine if Austin Powers should fo ahead with the Groosey product.

Some of you may nocd: PV of tax shield on CCA

Section II questions marka Asrwer all the quentions in the spoce provided. Show all yow mork answers whithost the necessary calcularions will recelve no eradif

Problems marka You are considering two mantaally exelasive projocts that differ greatly on the required investment and projected cash flows. The initial investment reyufinct for PFOVECT I is and for PROTECT II it is Estimated aftertax cash flows are shown below.

tableYearProjectl,ProjectII$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock