Question: Pre-Built Problems Saved Help Save & Exit Subr Check my wor Required information [The following information applies to the questions displayed below.) In 2019, Nina

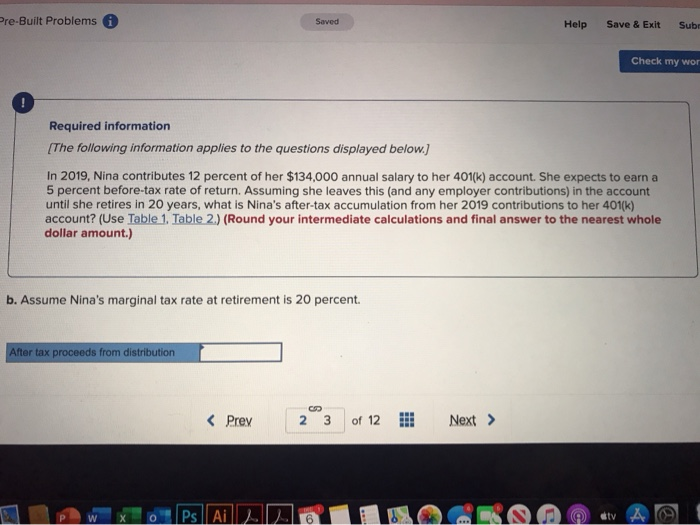

Pre-Built Problems Saved Help Save & Exit Subr Check my wor Required information [The following information applies to the questions displayed below.) In 2019, Nina contributes 12 percent of her $134,000 annual salary to her 401(k) account. She expects to earn a 5 percent before-tax rate of return. Assuming she leaves this (and any employer contributions) in the account until she retires in 20 years, what is Nina's after-tax accumulation from her 2019 contributions to her 401(k) account? (Use Table 1, Table 2.) (Round your intermediate calculations and final answer to the nearest whole dollar amount.) b. Assume Nina's marginal tax rate at retirement is 20 percent. After tax proceeds from distribution 2 3 of 12 ... Ps Ai 6 etv A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts