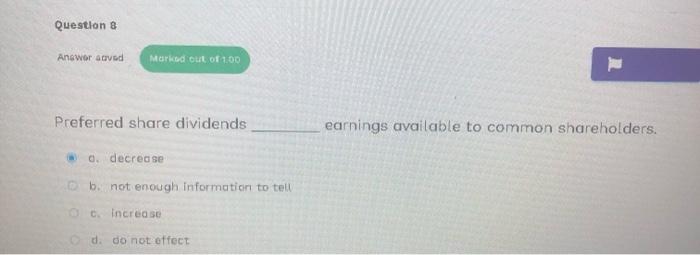

Question: Preferred share dividends earnings available to common shareholders. 0. decrease b. not enough information to tell c. increase d. do not offect Which of the

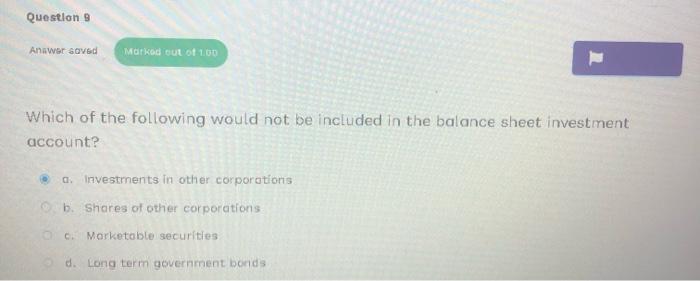

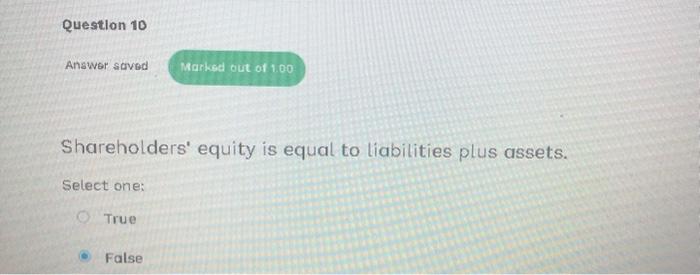

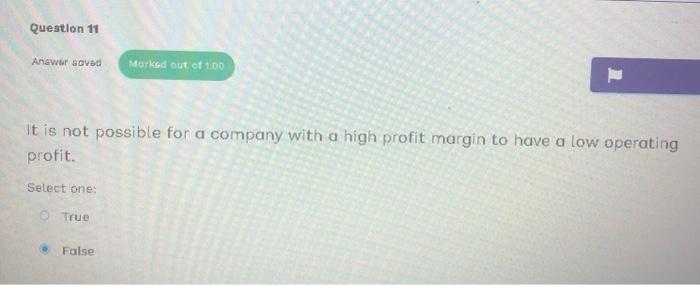

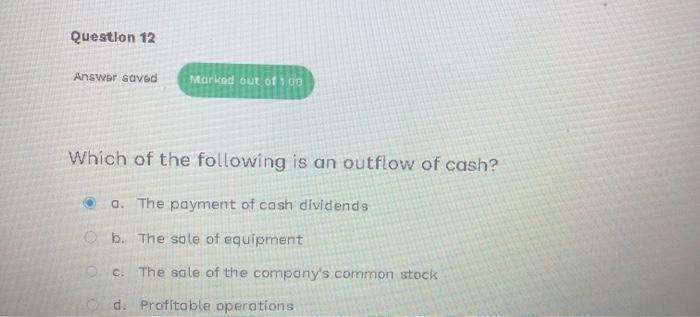

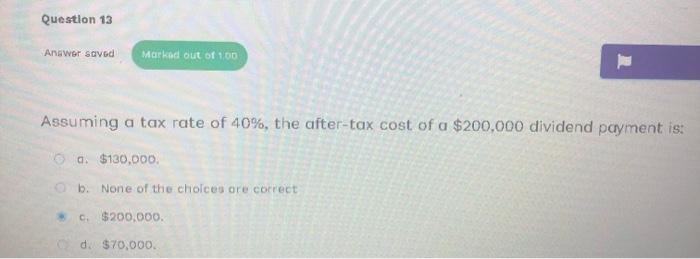

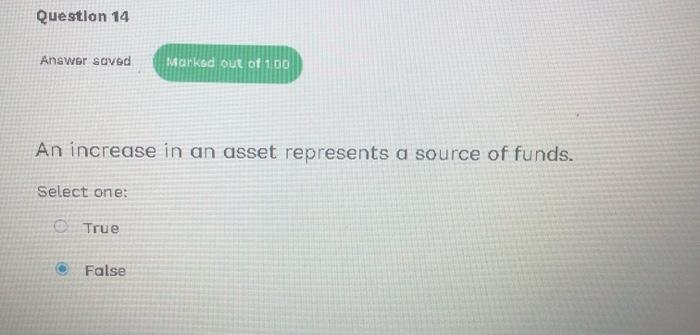

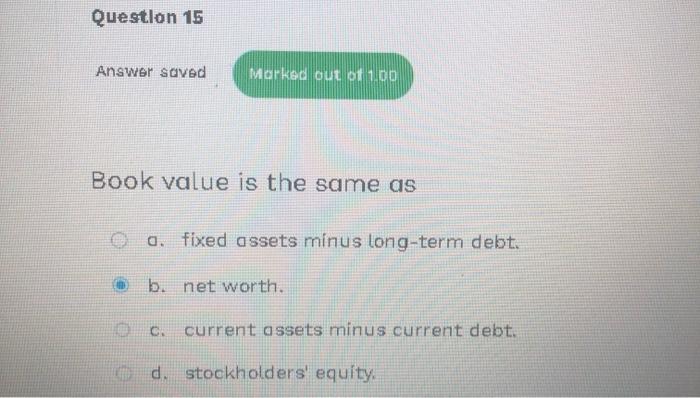

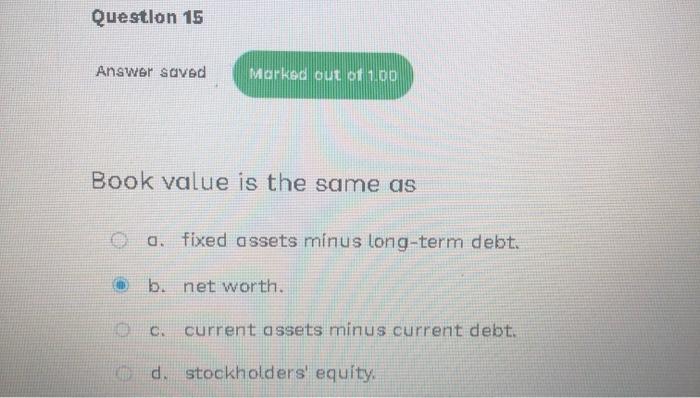

Preferred share dividends earnings available to common shareholders. 0. decrease b. not enough information to tell c. increase d. do not offect Which of the following would not be included in the balance sheet investment account? a. Investments in other corporations b. Shares of other corporations c. Morketoble securities d. Long term government bonds Shareholders' equity is equal to liabilities plus assets. Select one: True False It is not possible for a company with a high profit margin to have a low operating profit. Select one: True False Which of the following is an outflow of cash? a. The payment of cash dividends b. The sole of equipment c. The sale of the compony's common stock d. Profitable operations Assuming a tax rate of 40%, the after-tax cost of a $200,000 dividend payment is: a. $130,000. b. None of the choices ore correct c. $200,000. d. $70,000. An increase in an asset represents a source of funds. Select one: True False Book value is the same as a. fixed assets minus long-term debt. b. net worth. c. current assets minus current debt. d. stockholders' equity. Book value is the same as a. fixed assets minus long-term debt. b. net worth. c. current assets minus current debt. d. stockholders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts