Question: Preferred stock would be valued the same as a common stock with a zero dividend growth rate. The constant dividend growth valuation formula is P_0

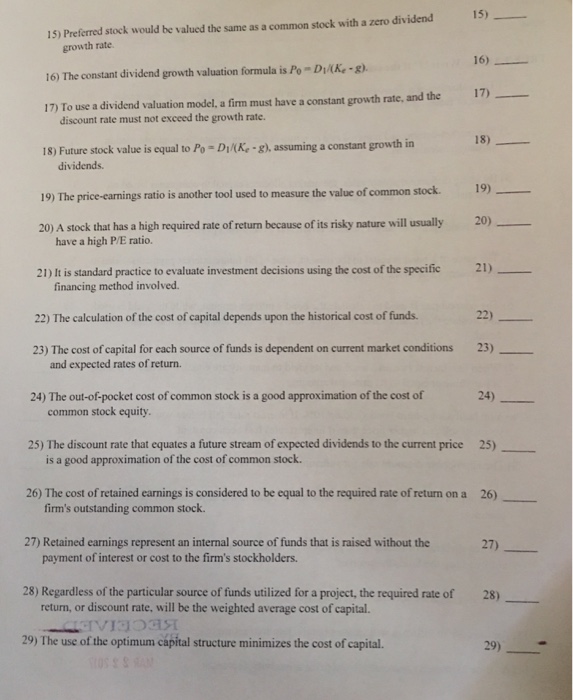

Preferred stock would be valued the same as a common stock with a zero dividend growth rate. The constant dividend growth valuation formula is P_0 = D_1/(K_e g) To use a dividend valuation model, a firm must have a constant growth rate, and the discount rate must not exceed the growth rate. Future stock value is equal to P_0 = D_1/(K g), assuming a constant growth in dividends. The price-earnings ratio is another tool used to measure the value of common stock. A stock that has a high required rate of return because of its risky nature will usually have a high P/E ratio. It is standard practice to evaluate investment decisions using the cost of the specific financing method involved. The calculation of the cost of capital depends upon the historical cost of funds. The cost of capital for each source of funds is dependent on current market conditions and expected rates of return. The out-of-pocket cost of common stock is a good approximation of the cost of common stock equity. The discount rate that equates a future stream of expected dividends to the current price is a good approximation of the cost of common stock. The cost of retained earnings is considered to be equal to the required rate of return on a firm's outstanding common stock. Retained earnings represent an internal source of funds that is raised without the payment of interest or cost to the firm's stockholders. Regardless of the particular source of funds utilized for a project, the required rate of return, or discount rate, will be the weighted average cost of capital. The use of the optimum capital structure minimizes the cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts