Question: Pregunta 1 Consider a company whose Total Assets are $2,000. This company is financed with $1,200 of debt at 15% annual interest, and the rest

Pregunta 1

Consider a company whose Total Assets are $2,000. This company is financed with $1,200 of debt at 15% annual interest, and the rest with equity. If it generates an operating profit of $500 for the year, what is the ROA of this company?

Please select an alternative:

A)16%

B)60%

C15%

D25%

Pregunta 2

Suppose a company finds, through DuPont analysis, that its ROA is lower than the average ROA for the industry in which it operates. According to the DuPont model, the next components to be analyzed are:

Please select an alternative:

A. Operating Margin and Administrative and Selling Expenses

B. Operating Margin and Asset Rotation

C. Net Sales and Debt/Equity Ratio

D. Operating Income and Net Income

Pregunta 3

Consider that you are part of the board of an agribusiness company whose results were lower than expected during the 2016 period. The board expected an ROA of 25%, and the result for the period was an ROA of 18%. You are aware that the industry had a bad year, as the harvests were poor due to the El Nio phenomenon. Your recommendation to the rest of the board should be:

Please select an alternative:

A. Fire the General Manager for not reaching the ROA expected by the shareholders

B. Justify the lower ROA due to climate problems

C. Compare the ROA obtained with the ROA of competing companies before taking any action

D. Do nothing, because the weather is an uncontrollable variable

Pregunta 4

If a company's operating margin is 5% and its ROA is 15%, what is the asset turnover for this company?

Please select an alternative:

A. Cannot be determined with so little information

b. 3 times

c. 6 times

D. 0.33 times

Pregunta 5

Consider company ABC whose sales are 100% on credit and whose policies during 2016 were as follows:

Credit term granted to clients: 30 days

Average accounts receivable: $50,000

Average accounts payable: 45,000

Average inventory level: $50,000

Expected inventory days: 212 days

Net sales: 150,000

Cost of sales: 85,000

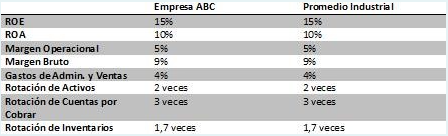

The company has carried out a DuPont analysis and obtained the following indices or ratios, which are compared with the industrial average (see figure):

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts