Question: Prepaid expenses are eventually expected to become a. expenses when their future economic value expires b. revenues when services are performed c. expenses in the

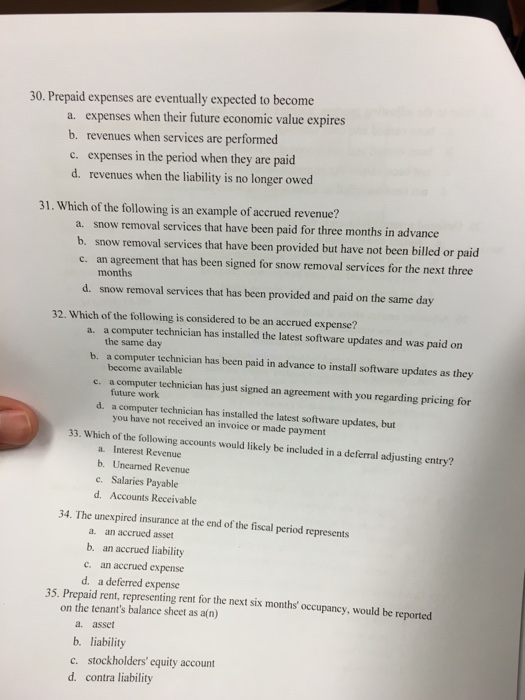

Prepaid expenses are eventually expected to become a. expenses when their future economic value expires b. revenues when services are performed c. expenses in the period when they are paid d. revenues when the liability is no longer owed 31. Which of ihe following is an example of accrued revenue? a. snow removal services that have been paid for three months in advance b. snow removal services that have been provided but have not been billed or paid c. an agreement that has been signed for snow removal services for the next three months d. snow removal services that has been provided and paid on the same day 32. Which of the following is considered to be an accrued expense? a. a computer technician has installed the latest software updates and was paid on the same day b. a computer technician has been paid in advance to install software updates as they become available c. a computer technician has just signed an agreement with your regarding pricing for future work d. a computer technician has installed the latest software updates, but you have not received an invoice or made payment 33. Which of the following accounts would likely be included in a deferral adjusting cntry? a. Interest Revenue b. Unearned Revenue c. Salaries Payable d. Accounts Receivable 34. The unexpired insurance at the end of the fiscal period represents a. an accrued asset b. an accrued liability c. an accrued expense d. a deferred expense 35. Prepaid rent representing rent for the next six months' occupancy, would be reported on the tenant's balance sheet as a(n) a. asset b. liability c. stockholders' equity account d. contra liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts