Question: prepapre necessary adjusting journal entries do it in Excel 3. Using the following trial balance and the additional data, prepare the necessary adjusting journal entries

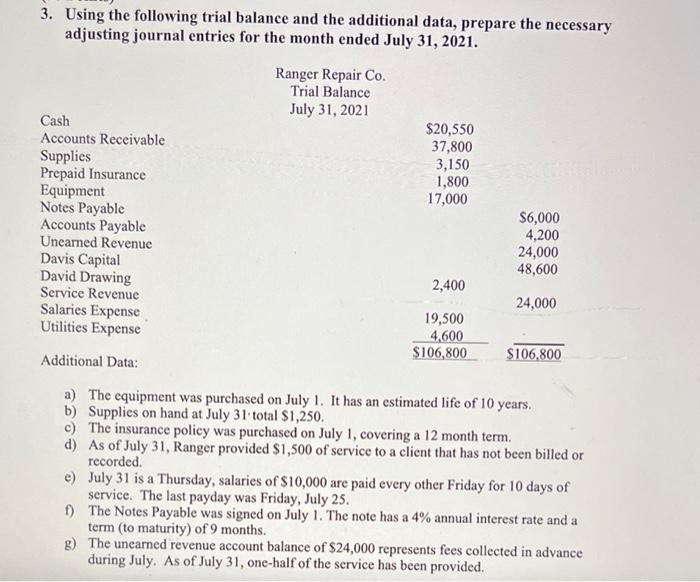

3. Using the following trial balance and the additional data, prepare the necessary adjusting journal entries for the month ended July 31, 2021. Ranger Repair Co. Trial Balance July 31, 2021 $20,550 37,800 3,150 1,800 17,000 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Notes Payable Accounts Payable Unearned Revenue Davis Capital David Drawing Service Revenue Salaries Expense Utilities Expense $6,000 4,200 24,000 48,600 2,400 24,000 19,500 4,600 $106,800 Additional Data: $106,800 a) The equipment was purchased on July 1. It has an estimated life of 10 years. b) Supplies on hand at July 31 total $1,250. c) The insurance policy was purchased on July 1, covering a 12 month term. d) As of July 31, Ranger provided $1,500 of service to a client that has not been billed or recorded. e) July 31 is a Thursday, salaries of $10,000 are paid every other Friday for 10 days of service. The last payday was Friday, July 25. f) The Notes Payable was signed on July 1. The note has a 4% annual interest rate and a term (to maturity) of 9 months. g) The unearned revenue account balance of $24,000 represents fees collected in advance during July. As of July 31, one-half of the service has been provided

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts