Question: - Prepare 2 0 2 4 Forms 1 0 4 0 and 8 9 4 9 - Prepare 2 0 2 4 Schedules 1 ,

Prepare Forms and

Prepare Schedules A B C and D

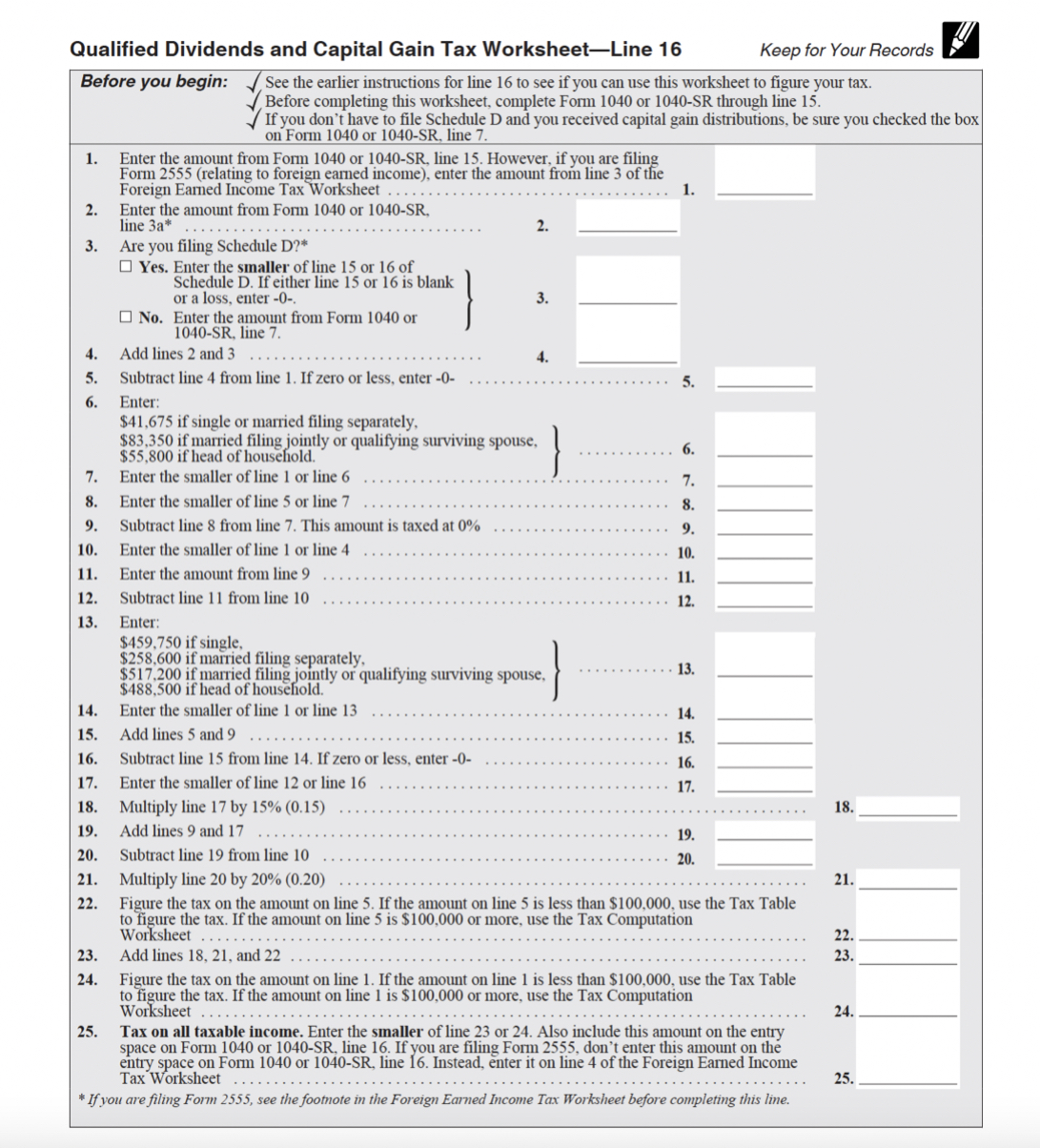

Prepare the Qualified Dividends and Capital Gain Tax Worksheet

A supplement page WordExcel or textbox must be included showing your complete computation of ordinary income tax, as reported on the QDCGTW line

Read and utilize, page additional instructions & hints!Steve and Nancy Harrington are married and have six children. They file their tax returns jointly. Steve is a high school science teacher and head basketball coach and Nancy is a selfemployed investigative journalist. Steve participates in his employers cafeteria plan for benefits. They had the following cash flows during :

Cash Receipts:

Steves Salary reported on Form W box

Interest Income from Indiana State Bank on savings account

Interest Income from Ameriprise investment account not a retirement account

Interest Income from City of Hawkins, IN bond

Gift from friend, Enzo

Qualified Dividend Income from Kellogg Company

Qualified Dividend Income from CocaCola Co

Qualified Dividend Income from Adidas

Nonqualified Dividend Income from Nestle Corporation

Face value life insurance proceeds on death of Nancys father

Flowthrough Income from Enterprise Product Partners

Value of Nancys inheritance from her fathers estate

Proceeds from asset salessee next page

Cash Payments:

Federal Income Tax Withholding from W

State Income Tax Withholding from W

Class materials Steve purchased, unreimbursed by school district

Student loan interest paid for Nancys loans

IRA contributions $ each

Cash Payments, continued

Qualified medical expenses paid outofpocket

Interest on Steves car loan

Property taxes on automobiles not used in Nancys business

State sales taxes paid per IRS tables

State of IN income taxes paid on return in April

Real estate taxes on principle home

Charitable contributions cash contributions to public charities

Mortgage interest on principle home outstanding balance of mortgage was $ and reported on Form

Company provided Benefits paid for by Steves employer:

Health insurance premiums, family coverage

Vision and Dental insurance, family coverage

Contributions to retirement plan for Steve

The Harringtons had the following asset sales during :

On December th Steve sold shares of Kellogg Company stock for $share He had originally bought those shares on February for $share

On November th Steve sold shares of BMW AG stock for $share He bought those shares on March for $share

On November th they sold shares of American Tower Corporation stock for $share They bought those shares on March for $share

On December th Nancy sold share of BerkshireA that she inherited from her fathers estate, which closed on October She received $ of proceeds. Nancys dad paid $ for the share in On the date of her fathers death, January its fair market value was $

On December th Nancy sold a piece of land that she inherited from her fathers estate, which closed on October She received $ of proceeds. Her dad paid $ for that land in and on the date of her fathers death, January its fair market value was $

In addition, they have a $ longterm capital loss carryover from the prior year.

Nancy runs her business as a Sole Proprietorship on a cash basis. She has been in business for years. She did not need to file s for The business name is Nancy Drew Enterprises; EIN is She materially participates in her business. Cash receipts and payments completely business, unless otherwise noted as follows:

Cash Receipts:

Gross receipts

Cash Payments:

Wages for staff

Payroll Taxes for above wages

Office Supplies

Internet & Telephone

Legal & Accounting professional Fees $ for tax return preparation of Sch C; $ for remainder of ; legal fees $

Meals while traveling andor discussing business with clients

Advertising

Business liability insurance

Additional information regarding Nancys business:

Miles: business miles and a total of miles. The nonbusiness miles were personal in nature. Nancy uses the standard mileage rate. The vehicle is a BMW series sports wagon, put in service The vehicle is available for family use. They own other vehicles. Nancy uses an app on her iP

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock