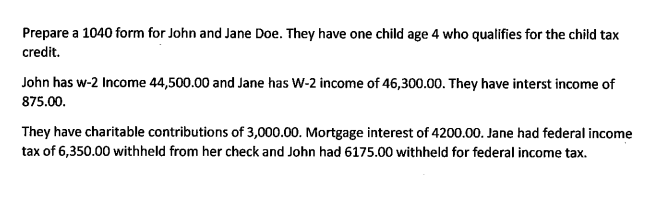

Question: Prepare a 1 0 4 0 form for John and Jane Doe. They have one child, age 4 , who qualifies for the maximum child

Prepare a form for John and Jane Doe. They have one child, age who qualifies for the maximum child tax credit.

John has W income, and Jane has W income of They have interest income of

They have charitable contributions of Mortgage interest of Jane had federal income tax of withheld from her check and John had withheld for federal income tax.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock