On January 1, 20X7, CP Co. (a Canadian company) purchased 80% of SF Co. (a U.S....

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

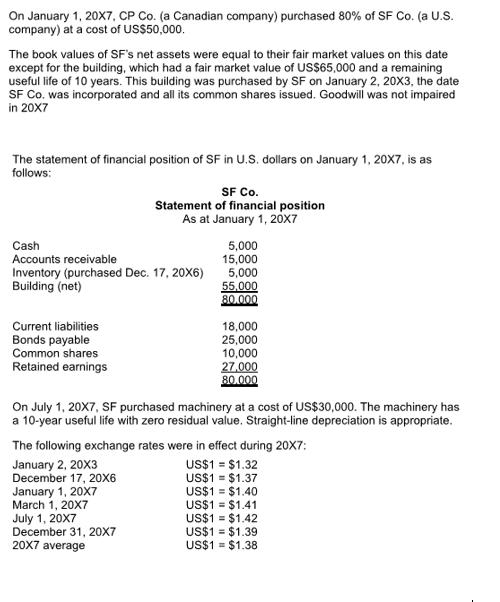

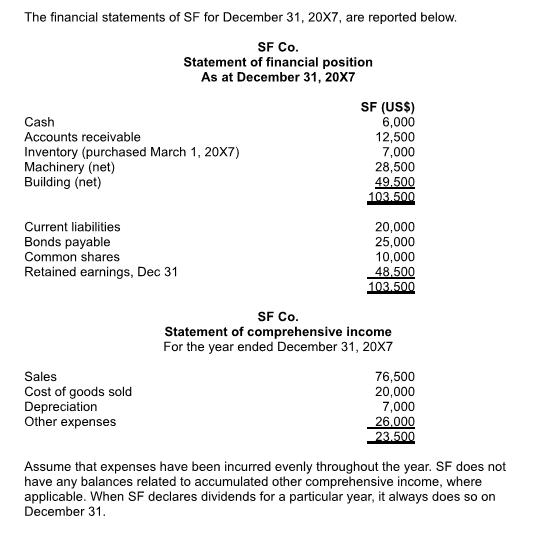

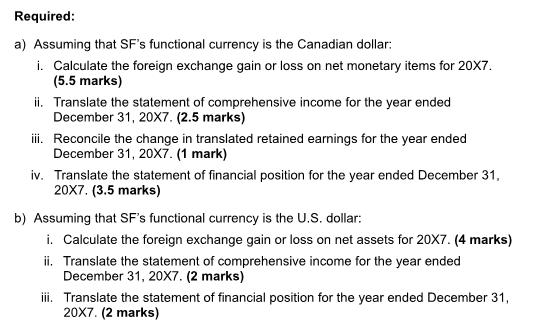

On January 1, 20X7, CP Co. (a Canadian company) purchased 80% of SF Co. (a U.S. company) at a cost of US$50,000. The book values of SF's net assets were equal to their fair market values on this date except for the building, which had a fair market value of US$65,000 and a remaining useful life of 10 years. This building was purchased by SF on January 2, 20X3, the date SF Co. was incorporated and all its common shares issued. Goodwill was not impaired in 20X7 The statement of financial position of SF in U.S. dollars on January 1, 20X7, is as follows: Cash Accounts receivable Inventory (purchased Dec. 17, 20X6) Building (net) Current liabilities Bonds payable Common shares Retained earnings SF Co. Statement of financial position As at January 1, 20X7 5,000 15,000 January 1, 20X7 March 1, 20X7 July 1, 20X7 December 31, 20X7 20X7 average 5,000 55,000 80.000 18,000 25,000 10,000 27,000 80.000 On July 1, 20X7, SF purchased machinery at a cost of US$30,000. The machinery has a 10-year useful life with zero residual value. Straight-line depreciation is appropriate. The following exchange rates were in effect during 20X7: January 2, 20X3 US$1 = $1.32 December 17, 20X6 US$1 = $1.37 US$1 = $1.40 US$1 = $1.41 US$1 = $1.42 US$1 = $1.39 US$1= $1.38 The financial statements of SF for December 31, 20X7, are reported below. SF Co. Statement of financial position As at December 31, 20X7 Cash Accounts receivable Inventory (purchased March 1, 20X7) Machinery (net) Building (net) Current liabilities Bonds payable Common shares Retained earnings, Dec 31 Sales Cost of goods sold Depreciation Other expenses SF (US$) 6,000 12,500 7,000 28,500 49,500 103.500 20,000 25,000 10,000 48,500 103.500 SF Co. Statement of comprehensive income For the year ended December 31, 20X7 76,500 20,000 7,000 26,000 23.500 Assume that expenses have been incurred evenly throughout the year. SF does not have any balances related to accumulated other comprehensive income, where applicable. When SF declares dividends for a particular year, it always does so on December 31. Required: a) Assuming that SF's functional currency is the Canadian dollar: i. Calculate the foreign exchange gain or loss on net monetary items for 20X7. (5.5 marks) ii. Translate the statement of comprehensive income for the year ended December 31, 20X7. (2.5 marks) iii. iv. Translate the statement of financial position for the year ended December 31. 20X7. (3.5 marks) Reconcile the change in translated retained earnings for the year ended December 31, 20X7. (1 mark) b) Assuming that SF's functional currency is the U.S. dollar: i. Calculate the foreign exchange gain or loss on net assets for 20X7. (4 marks) ii. Translate the statement of comprehensive income for the year ended December 31, 20X7. (2 marks) iii. Translate the statement of financial position for the year ended December 31, 20X7. (2 marks) On January 1, 20X7, CP Co. (a Canadian company) purchased 80% of SF Co. (a U.S. company) at a cost of US$50,000. The book values of SF's net assets were equal to their fair market values on this date except for the building, which had a fair market value of US$65,000 and a remaining useful life of 10 years. This building was purchased by SF on January 2, 20X3, the date SF Co. was incorporated and all its common shares issued. Goodwill was not impaired in 20X7 The statement of financial position of SF in U.S. dollars on January 1, 20X7, is as follows: Cash Accounts receivable Inventory (purchased Dec. 17, 20X6) Building (net) Current liabilities Bonds payable Common shares Retained earnings SF Co. Statement of financial position As at January 1, 20X7 5,000 15,000 January 1, 20X7 March 1, 20X7 July 1, 20X7 December 31, 20X7 20X7 average 5,000 55,000 80.000 18,000 25,000 10,000 27,000 80.000 On July 1, 20X7, SF purchased machinery at a cost of US$30,000. The machinery has a 10-year useful life with zero residual value. Straight-line depreciation is appropriate. The following exchange rates were in effect during 20X7: January 2, 20X3 US$1 = $1.32 December 17, 20X6 US$1 = $1.37 US$1 = $1.40 US$1 = $1.41 US$1 = $1.42 US$1 = $1.39 US$1= $1.38 The financial statements of SF for December 31, 20X7, are reported below. SF Co. Statement of financial position As at December 31, 20X7 Cash Accounts receivable Inventory (purchased March 1, 20X7) Machinery (net) Building (net) Current liabilities Bonds payable Common shares Retained earnings, Dec 31 Sales Cost of goods sold Depreciation Other expenses SF (US$) 6,000 12,500 7,000 28,500 49,500 103.500 20,000 25,000 10,000 48,500 103.500 SF Co. Statement of comprehensive income For the year ended December 31, 20X7 76,500 20,000 7,000 26,000 23.500 Assume that expenses have been incurred evenly throughout the year. SF does not have any balances related to accumulated other comprehensive income, where applicable. When SF declares dividends for a particular year, it always does so on December 31. Required: a) Assuming that SF's functional currency is the Canadian dollar: i. Calculate the foreign exchange gain or loss on net monetary items for 20X7. (5.5 marks) ii. Translate the statement of comprehensive income for the year ended December 31, 20X7. (2.5 marks) iii. iv. Translate the statement of financial position for the year ended December 31. 20X7. (3.5 marks) Reconcile the change in translated retained earnings for the year ended December 31, 20X7. (1 mark) b) Assuming that SF's functional currency is the U.S. dollar: i. Calculate the foreign exchange gain or loss on net assets for 20X7. (4 marks) ii. Translate the statement of comprehensive income for the year ended December 31, 20X7. (2 marks) iii. Translate the statement of financial position for the year ended December 31, 20X7. (2 marks)

Expert Answer:

Answer rating: 100% (QA)

ii Translate the statement of comprehensive income for the year ended December 31 20X7 SF Company St... View the full answer

Related Book For

Management Fundamentals Concepts, Applications and Skill Development

ISBN: 978-1506303277

7th edition

Authors: Robert N. Lussier

Posted Date:

Students also viewed these accounting questions

-

a. Why is it important to keep paid-in capital separate from earned capital? b. As an investor, is paid-in or earned capital more important? Why? c. As an investor, are basic or diluted earnings per...

-

Write a 700 to 1 050 word paper explaining how e-business has affected your selected organization's business processes. Analyze the advantages limitations and risks of using or not using the Internet...

-

Why is it important to keep records of meeting assignments?

-

Is the PS assessment a valid predictor of performance as a store manager? Would you recommend the PS be used in the future to select sales people for promotion to store manager?

-

In late 2007, it was reported that 79% of U.S. adults owned a cell phone (data extracted from E. C. Baig, "Tips Help Navigate Tech-Buying Maze," USA Today, November 28, 2007, p. 5B). Suppose that by...

-

Under the assumptions of Sect. 6.4, prove that the following asset pricing relation holds true, for all \(n=0,1, \ldots, N\) and \(t=0,1, \ldots, T-1\) : \[s_{t}^{n}=\sum_{s=1}^{T-t}...

-

Shiloh supplies equipment to the automotive and commercial vehicle markets and other industrial customers. It specializes in materials and designs that reduce vehicle weight and increase fuel...

-

Recording Adjusting and Closing Entries and Preparing a Balance Sheet and Income Statement Including Earnings per Share South Bend Repair Service Co. keeps its records without the help of an...

-

We need to map following EERD into RELATIONAL MODEL. Map the following EERD into relational model ArtistNumber Artist Name N FormationDate Group Group-Member SoloPerformer BirthDate JoinedDate...

-

Reconsider the Fly-Right Airplane Co. problem introduced in Prob. 12.3-7. A more detailed analysis of the various cost and revenue factors now has revealed that the potential profit from producing...

-

The hospital took out a $2,000,000 mortgage to facilitate the construction of a new sports performance center. The term of the mortgage is 30 years, the annual interest rate is 4.25%, and payment is...

-

Consider the following rates of return for the period from 1970 through 1975 (taken from Table 12.1 in your textbook): Year Large-Company Stocks U.S. Treasury Bills 1970 3.94% 6.50% 1971 14.30 4.36...

-

At present the currency with the people and their demand deposits with banks contribute 2 0 0 million to the economy. This value is derived from the people s behavior where they used to deposit 8 0...

-

2. For the system with nonlinear spring described by the equation of motion 3x + 0.2x -x+x = 0 a. Find the equilibrium positions. b. Linearize the equations of motion about each equilibrium, find the...

-

A firm purchases $4,562,500 in goods over a 1-year period from its sole supplier. The supplier offers trade credit under the following terms: 2/15, net 50 days. Davis finally chooses to pay on time...

-

The Australian Blueberry Growers Association recently reported findings that blueberry flowers provide a good source of nectar to the beekeepers to help produce more honey. (a) Using an appropriate...

-

At what points on the graph of f(x) = 2x - 6x - 49x is the slope of the tangent line -1? (A) (0, 0), (-2, 58) (B) (4, -164), (1, -53) (4, -164), (-2, 58) D) (-4,-28), (-164,-106)

-

Identify one local business that uses a perpetual inventory system and another that uses a periodic system. Interview an individual in each organization who is familiar with the inventory system and...

-

What is a new venture, and who starts it?

-

Why is a company situation analysis part of the strategic planning process?

-

What are the five leadership styles identified by the normative leadership model?

-

A surface with \(N_{0}\) adsorption centers has \(N\left(\leq N_{0}ight)\) gas molecules adsorbed on it. Show that the chemical potential of the adsorbed molecules is given by \[ \mu=k T \ln...

-

Assuming that the latent heat of vaporization of water \(L_{\mathrm{V}}=2260 \mathrm{~kJ} / \mathrm{kg}\) is independent of temperature and the specific volume of the liquid phase is negligible...

-

Define a quantity \(J\) as \[ J=E-N \mu=T S-P V \] Show that for a system in the grand canonical ensemble \[ \overline{(\Delta J)^{2}}=k T^{2} C_{V}+\left\{\left(\frac{\partial U}{\partial...

Study smarter with the SolutionInn App