Question: Prepare a balance sheet using the information below, including a column for the beginning of the year and a column for the end of the

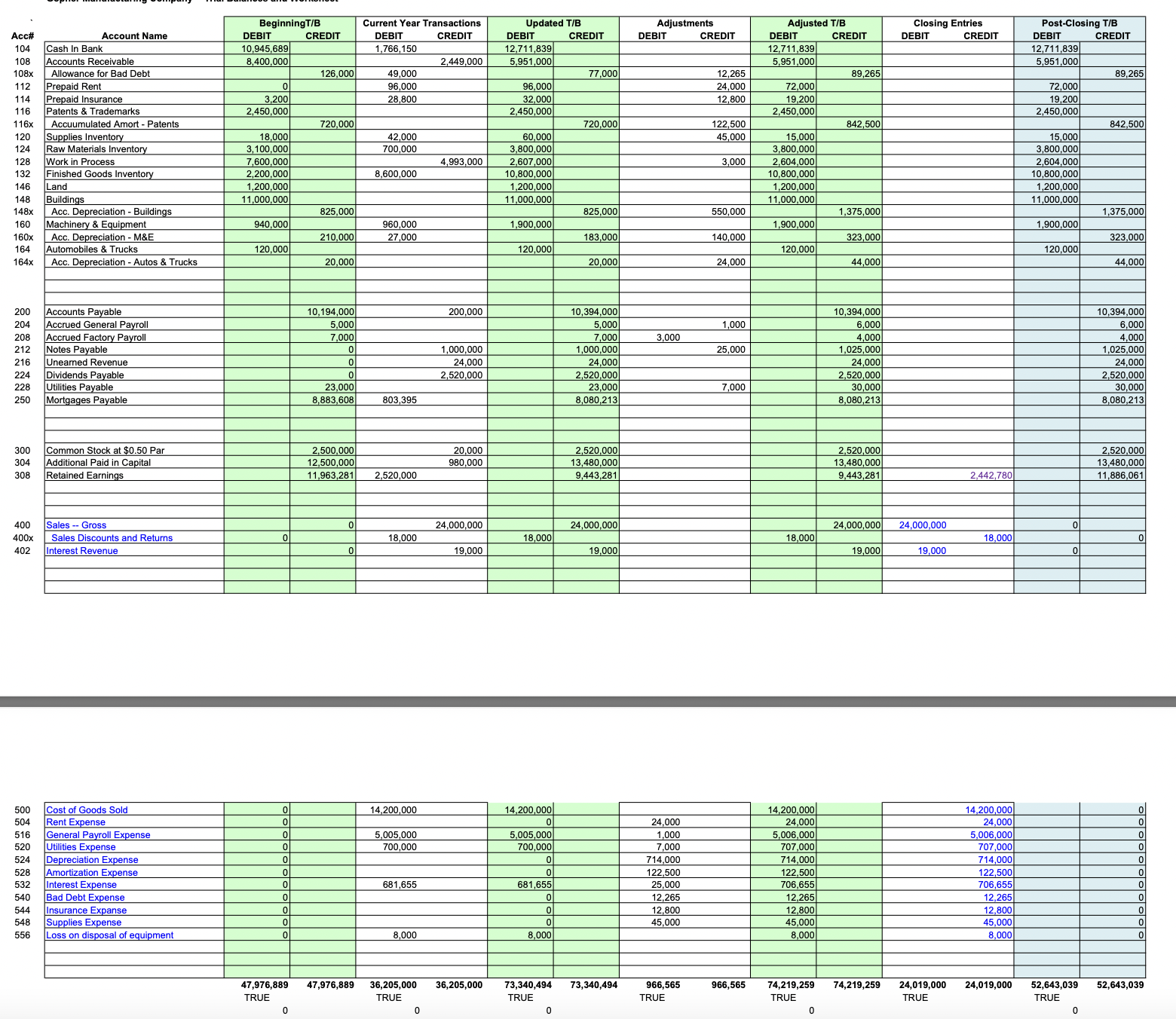

Prepare a balance sheet using the information below, including a column for the beginning of the year and a column for the end of the year. Then, prepare a reconciliation of owners' equity accounts and the cash flow statement using both the indirect and direct presentation method. For the indirect method, start with net income and make the necessary adjustments (e.g., depreciation, gains/losses, and changes in current asset and current liabilities) to get to operating cash flow. For the direct method, covert each line on the income statement to its cash equivalent (e.g., convert Revenues to Cash collected from customers).

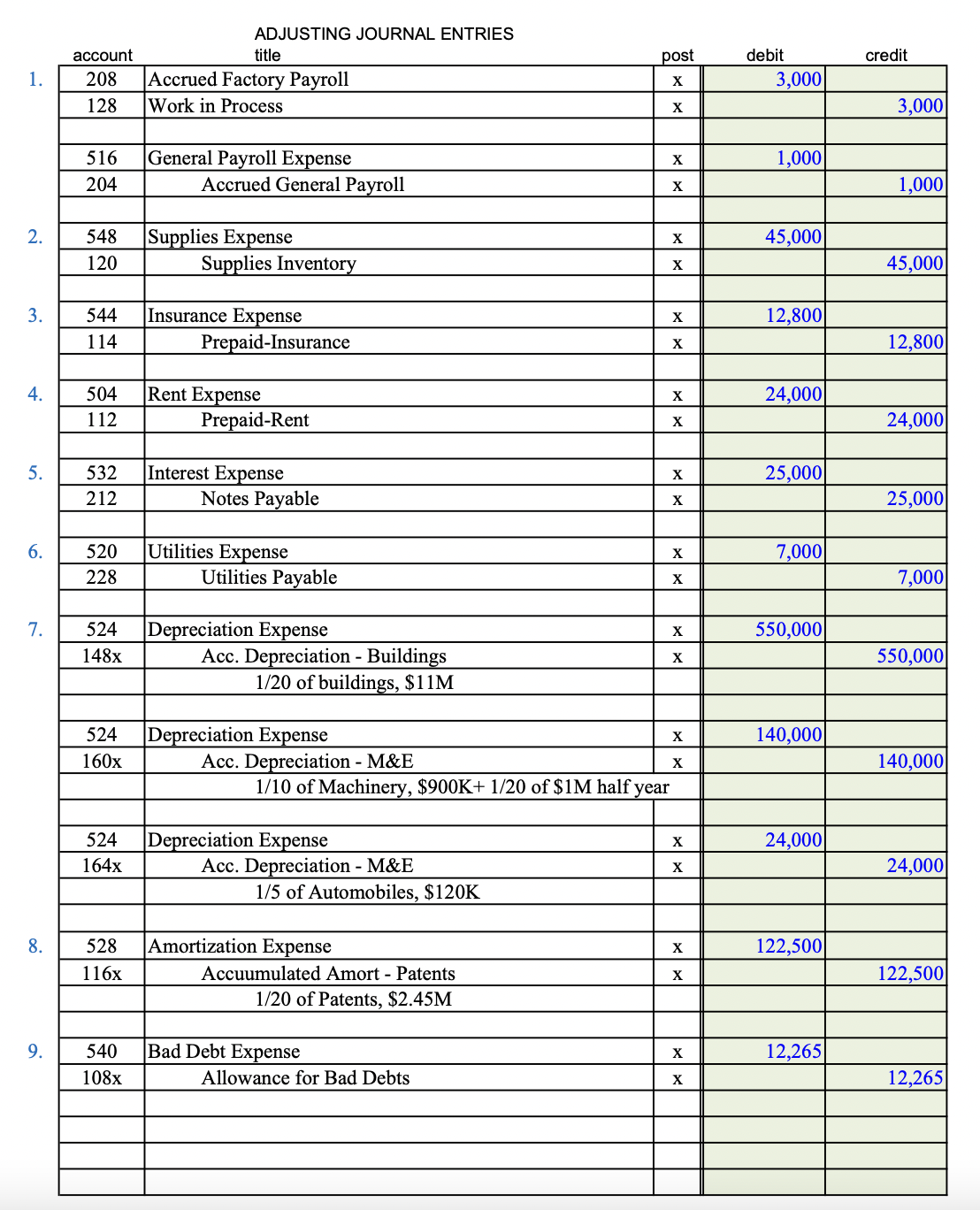

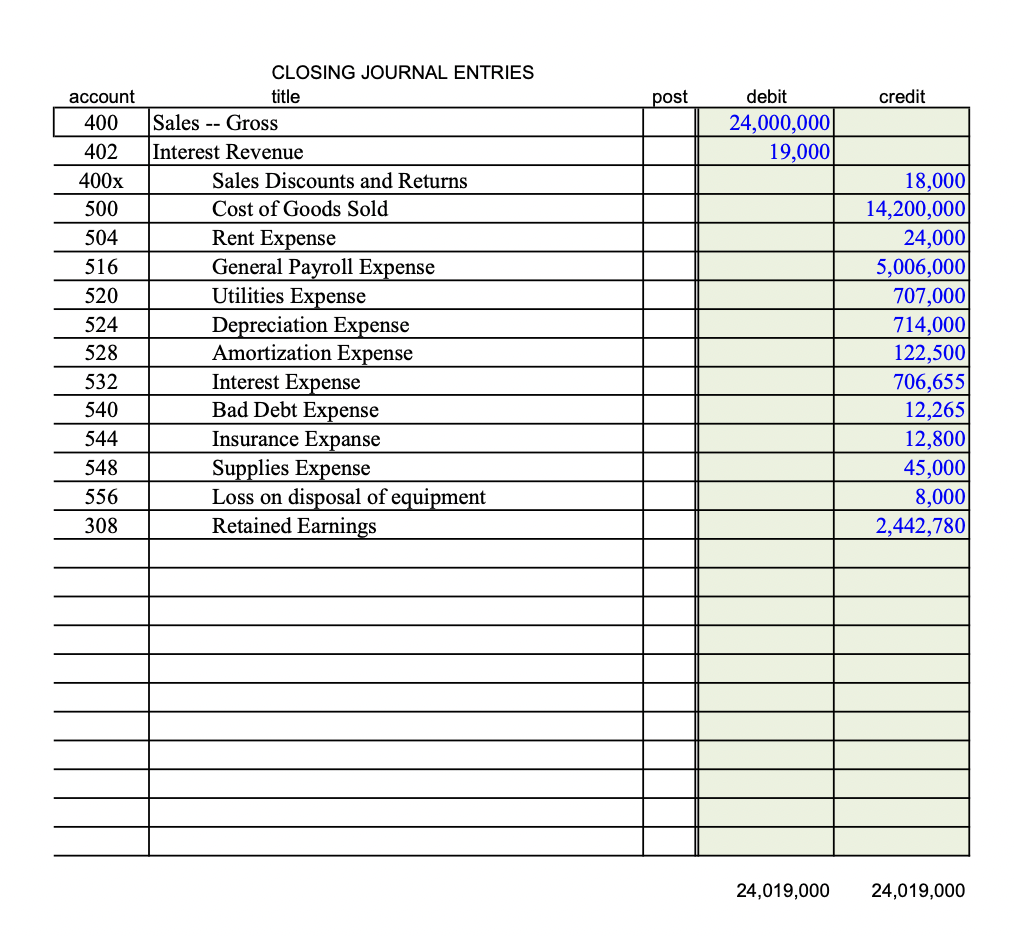

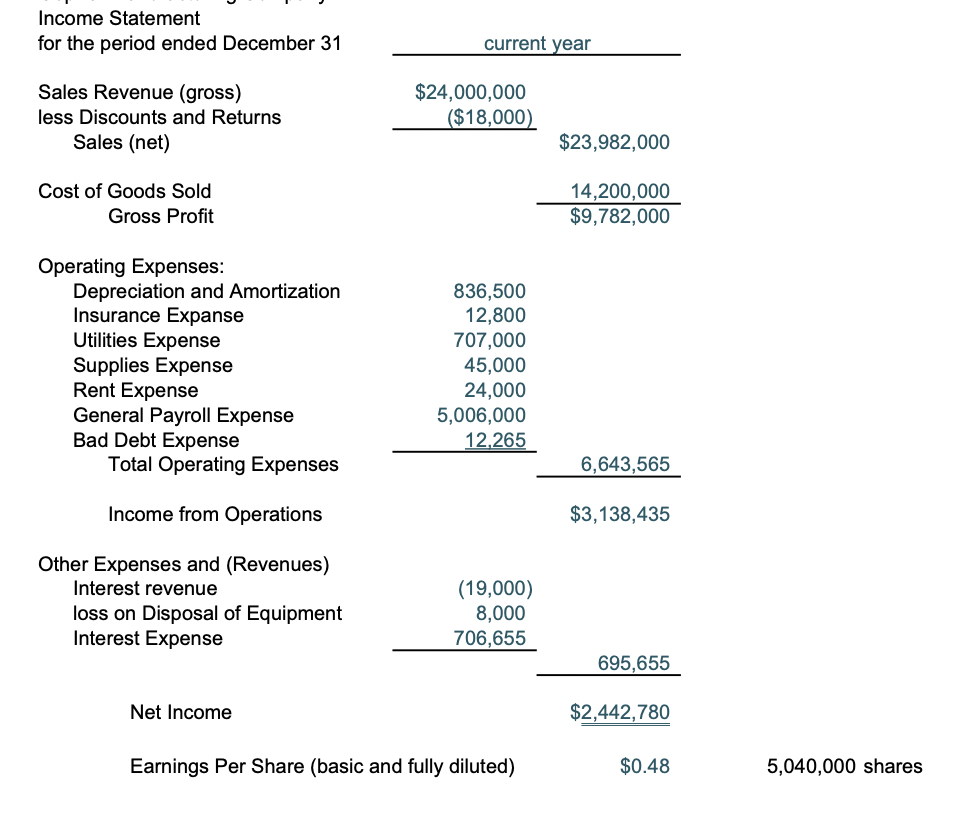

Income Statement for the period ended December 31 Sales Revenue (gross) less Discounts and Returns Sales (net) Cost of Goods Sold Gross Profit Operating Expenses: Depreciation and Amortization Insurance Expanse Utilities Expense Supplies Expense Rent Expense General Payroll Expense Bad Debt Expense Total Operating Expenses Income from Operations Other Expenses and (Revenues) Interest revenue loss on Disposal of Equipment Interest Expense current year 836,50012,800707,00045,00024,0005,006,00012,265 6,643,565 $3,138,435 (19,000) 8,000 706,655 695,655 Net Income $2,442,780 Earnings Per Share (basic and fully diluted) $0.48 5,040,000 shares ADJUSTING JOURNAL ENTRIES account title post debit credit 1. Income Statement for the period ended December 31 Sales Revenue (gross) less Discounts and Returns Sales (net) Cost of Goods Sold Gross Profit Operating Expenses: Depreciation and Amortization Insurance Expanse Utilities Expense Supplies Expense Rent Expense General Payroll Expense Bad Debt Expense Total Operating Expenses Income from Operations Other Expenses and (Revenues) Interest revenue loss on Disposal of Equipment Interest Expense current year 836,50012,800707,00045,00024,0005,006,00012,265 6,643,565 $3,138,435 (19,000) 8,000 706,655 695,655 Net Income $2,442,780 Earnings Per Share (basic and fully diluted) $0.48 5,040,000 shares ADJUSTING JOURNAL ENTRIES account title post debit credit 1. 24,019,00024,019,000 24,019,00024,019,000 Income Statement for the period ended December 31 Sales Revenue (gross) less Discounts and Returns Sales (net) Cost of Goods Sold Gross Profit Operating Expenses: Depreciation and Amortization Insurance Expanse Utilities Expense Supplies Expense Rent Expense General Payroll Expense Bad Debt Expense Total Operating Expenses Income from Operations Other Expenses and (Revenues) Interest revenue loss on Disposal of Equipment Interest Expense current year 836,50012,800707,00045,00024,0005,006,00012,265 6,643,565 $3,138,435 (19,000) 8,000 706,655 695,655 Net Income $2,442,780 Earnings Per Share (basic and fully diluted) $0.48 5,040,000 shares ADJUSTING JOURNAL ENTRIES account title post debit credit 1. Income Statement for the period ended December 31 Sales Revenue (gross) less Discounts and Returns Sales (net) Cost of Goods Sold Gross Profit Operating Expenses: Depreciation and Amortization Insurance Expanse Utilities Expense Supplies Expense Rent Expense General Payroll Expense Bad Debt Expense Total Operating Expenses Income from Operations Other Expenses and (Revenues) Interest revenue loss on Disposal of Equipment Interest Expense current year 836,50012,800707,00045,00024,0005,006,00012,265 6,643,565 $3,138,435 (19,000) 8,000 706,655 695,655 Net Income $2,442,780 Earnings Per Share (basic and fully diluted) $0.48 5,040,000 shares ADJUSTING JOURNAL ENTRIES account title post debit credit 1. 24,019,00024,019,000 24,019,00024,019,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts