Question: prepare a budgeted multi step income for the first six months The Due date of the assignment is on Monday May 15th,2023 via blackboard Cook

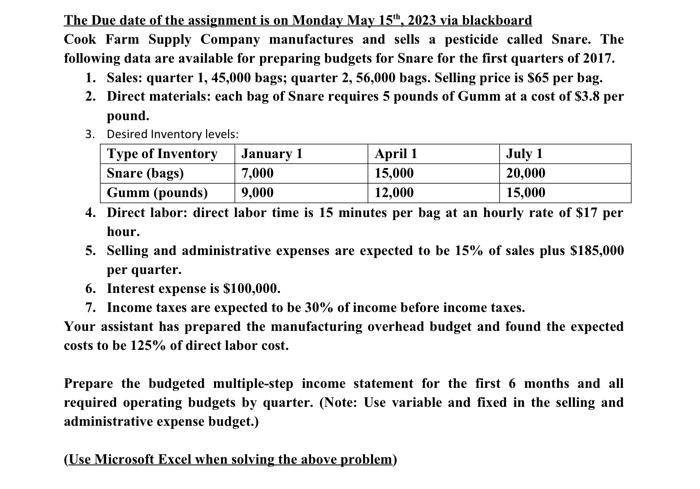

The Due date of the assignment is on Monday May 15th,2023 via blackboard Cook Farm Supply Company manufactures and sells a pesticide called Snare. The following data are available for preparing budgets for Snare for the first quarters of 2017. 1. Sales: quarter 1,45,000 bags; quarter 2,56,000 bags. Selling price is $65 per bag. 2. Direct materials: each bag of Snare requires 5 pounds of Gumm at a cost of $3.8 per pound. 3. Desired Inventory levels: 4. Direct labor: direct labor time is 15 minutes per bag at an hourly rate of $17 per hour. 5. Selling and administrative expenses are expected to be 15% of sales plus $185,000 per quarter. 6. Interest expense is $100,000. 7. Income taxes are expected to be 30% of income before income taxes. Your assistant has prepared the manufacturing overhead budget and found the expected costs to be 125% of direct labor cost. Prepare the budgeted multiple-step income statement for the first 6 months and all required operating budgets by quarter. (Note: Use variable and fixed in the selling and administrative expense budget.) (Use Microsoft Excel when solving the above problem)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts