Question: Prepare a cash flow statement and evaluate its cash flow position The following are the summarised accounts of Pearl Ltd for the two years ended

Prepare a cash flow statement and evaluate its cash flow position

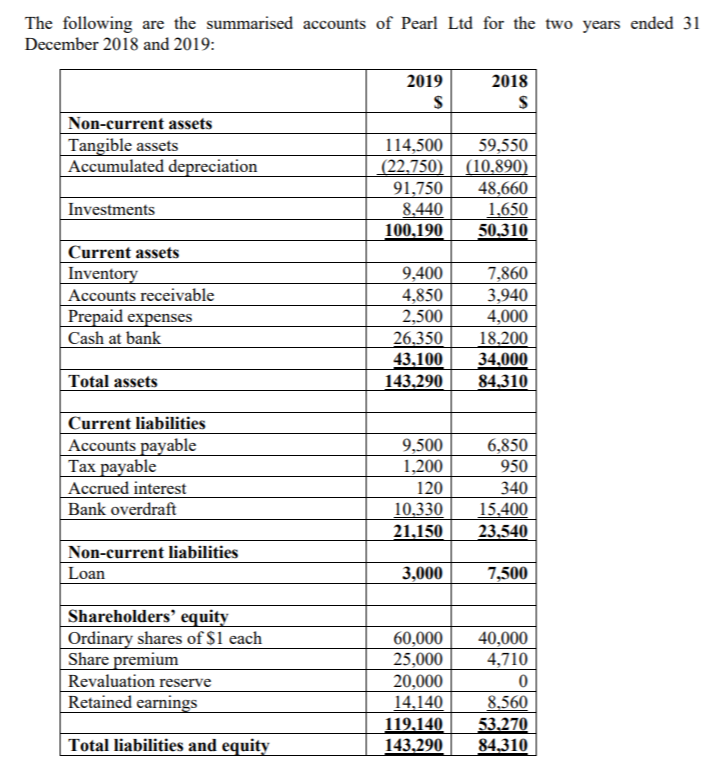

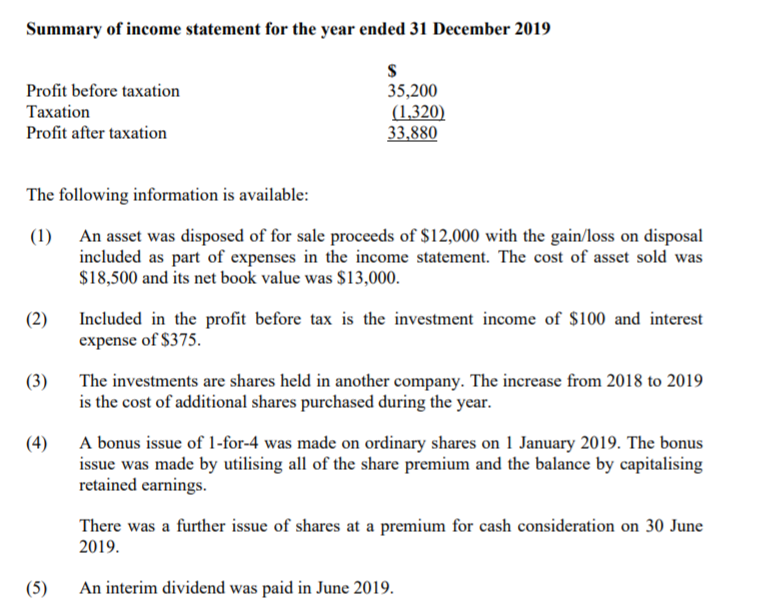

The following are the summarised accounts of Pearl Ltd for the two years ended 31 December 2018 and 2019: 2019 2018 $ Non-current assets Tangible assets Accumulated depreciation 114,500 59,550 (22.750) (10.890) 91,750 48,660 8.440 1.650 100,190 50.310 Investments Current assets Inventory Accounts receivable Prepaid expenses Cash at bank 9,400 4,850 2,500 26.350 43,100 143,290 7,860 3,940 4,000 18.200 34,000 84,310 Total assets Current liabilities Accounts payable Tax payable Accrued interest Bank overdraft 9.500 1,200 120 10,330 21,150 6,850 950 340 15,400 23,540 Non-current liabilities Loan 3,000 7,500 Shareholders' equity Ordinary shares of $1 each Share premium Revaluation reserve Retained earnings 60,000 25,000 20,000 14.140 119,140 143,290 40,000 4,710 0 8.560 53.270 84,310 Total liabilities and equity Summary of income statement for the year ended 31 December 2019 Profit before taxation Taxation Profit after taxation $ 35,200 (1,320) 33,880 The following information is available: (1) An asset was disposed of for sale proceeds of $12,000 with the gain/loss on disposal included as part of expenses in the income statement. The cost of asset sold was $18,500 and its net book value was $13,000. (2) 2 Included in the profit before tax is the investment income of $100 and interest expense of $375. (3) The investments are shares held in another company. The increase from 2018 to 2019 is the cost of additional shares purchased during the year. (4) A bonus issue of 1-for-4 was made on ordinary shares on 1 January 2019. The bonus issue was made by utilising all of the share premium and the balance by capitalising retained earnings. There was a further issue of shares at a premium for cash consideration on 30 June 2019. (5) An interim dividend was paid in June 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts