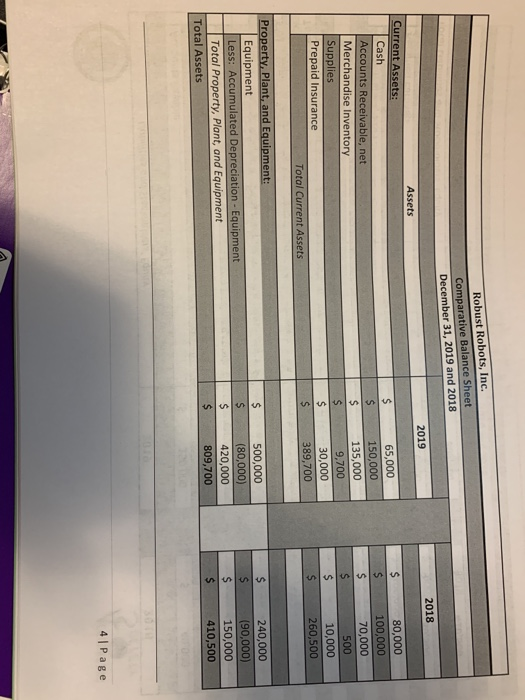

Question: Prepare a Cash Flow Statement. Robust Robots, Inc. Comparative Balance Sheet December 31, 2019 and 2018 2018 2019 $ Assets Current Assets: Cash Accounts Receivable,

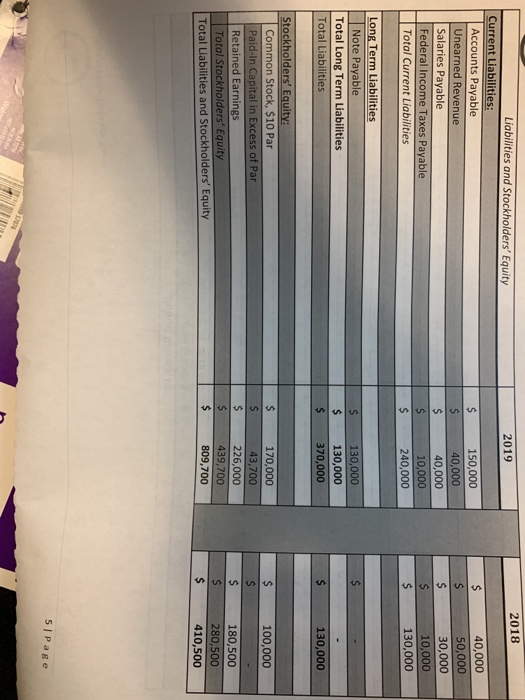

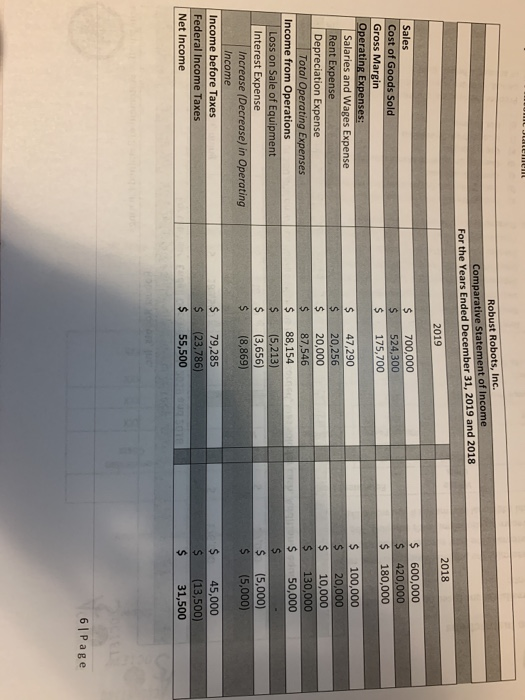

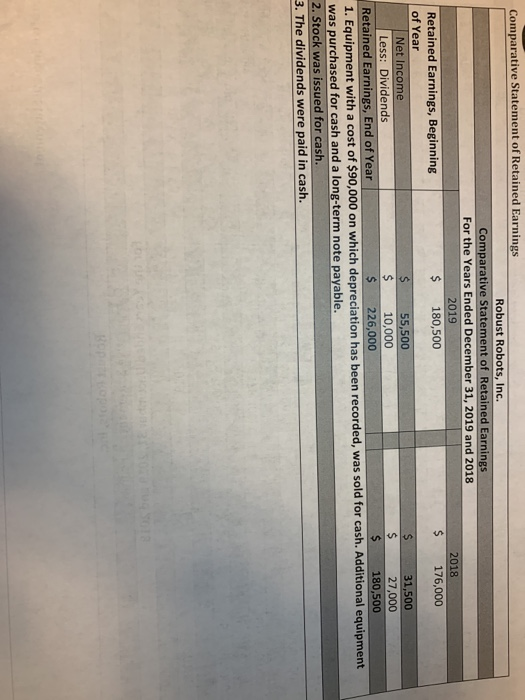

Robust Robots, Inc. Comparative Balance Sheet December 31, 2019 and 2018 2018 2019 $ Assets Current Assets: Cash Accounts Receivable, net Merchandise Inventory Supplies Prepaid Insurance Total Current Assets 65,000 150,000 135,000 9,700 30,000 389,700 $ $ $ $ $ $ 80,000 100,000 70,000 500 10,000 260,500 $ Property, plant, and Equipment: Equipment Less: Accumulated Depreciation - Equipment Total Property, Plant, and Equipment Total Assets $ $ $ $ 500,000 (80,000) 420,000 809,700 $ $ $ 240,000 (90,000) 150,000 410,500 4 Page 2018 2019 Liabilities and Stockholders' Equity Current Liabilities: Accounts Payable Unearned Revenue Salaries Payable Federal Income Taxes Payable Total Current Liabilities $ $ $ $ $ 150,000 40,000 40,000 10,000 240,000 40,000 50,000 30,000 10,000 130,000 $ - Long Term Liabilities Note Payable Total Long Term Liabilities Total Liabilities $ $ $ 130,000 130,000 370,000 $ 130,000 $ 100,000 Stockholders' Equity: Common Stock, $10 Par Paid-In Capital in Excess of Par Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity $ $ $ $ $ 170,000 43,700 226,000 439,700 809,700 $ $ 180,500 280,500 410,500 5 Page Robust Robots, Inc. Comparative Statement of income For the Years Ended December 31, 2019 and 2018 For the 2018 2019 $ $ $ 700,000 524,300 175,700 $ $ $ 600,000 420,000 180,000 Sales Cost of Goods Sold Gross Margin Operating Expenses: Salaries and Wages Expense Rent Expense Depreciation Expense Total Operating Expenses Income from Operations Loss on Sale of Equipment Interest Expense Increase (Decrease) in Operating Income Income before Taxes Federal Income Taxes Net Income $ $ $ $ $ $ $ $ 47,290 20.256 20,000 87,546 88,154 (5,213) (3,656) (8,869) $ $ $ $ $ 100,000 20,000 10,000 130,000 50,000 $ (5,000) $ $ $ 79,285 (23,786) 55,500 $ $ $ 45,000 (13,500) 31,500 6 | Page Comparative Statement of Retained Earnings Robust Robots, Inc. Comparative Statement of Retained Earnings For the Years Ended December 31, 2019 and 2018 2019 2018 Retained Earnings, Beginning $ 180,500 $ 176,000 of Year Net Income $ 55,500 $ 31,500 Less: Dividends $ 10,000 $ 27,000 $ $ Retained Earnings, End of Year 226,000 180,500 1. Equipment with a cost of $90,000 on which depreciation has been recorded, was sold for cash. Additional equipment was purchased for cash and a long-term note payable. 2. Stock was issued for cash. 3. The dividends were paid in cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts