Question: Prepare a cash flow statement using both the direct and the Indirect methods. Preparing a Statement of Cash Flows (Indirect Method) Dair Company's income statement

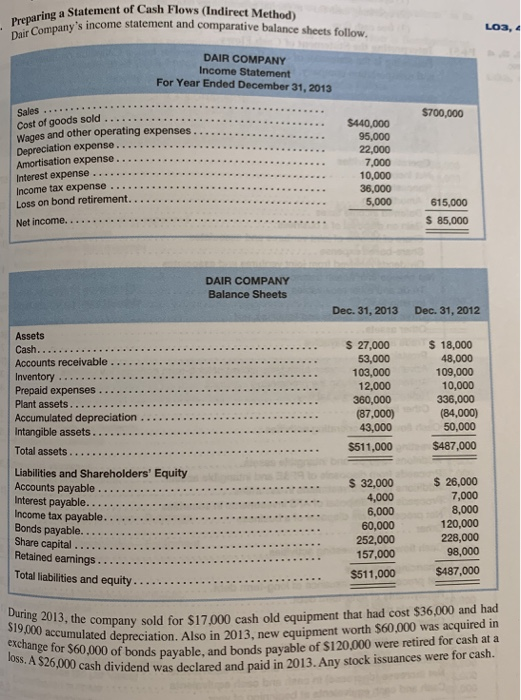

Preparing a Statement of Cash Flows (Indirect Method) Dair Company's income statement and comparative balance sheets follow. LO3, 4 DAIR COMPANY Income Statement For Year Ended December 31, 2013 Sales Cost of goods sold Wages and other operating expenses Depreciation expense. Amortisation expense. Interest expense Income tax expense Loss on bond retirement. $700,000 $440,000 95,000 22,000 7,000 10,000 36,000 5,000 615,000 $ 85,000 Net income. . DAIR COMPANY Balance Sheets Dec. 31, 2013 Dec. 31, 2012 Assets $ 27,000 $ 18,000 Cash... 48,000 53,000 Accounts receivable. 109,000 10,000 336,000 (84,000) 50,000 103,000 12,000 Inventory. Prepaid expenses Plant assets.. Accumulated depreciation Intangible assets 360,000 (87,000) 43,000 $511,000 $487,000 Total assets.. Liabilities and Shareholders' Equity Accounts payable Interest payable. Income tax payable. Bonds payable. Share capital . Retained earnings. $ 32,000 $ 26,000 7,000 8,000 4,000 6,000 60,000 252,000 157,000 120,000 228,000 98,000 $487,000 Total liabilities and equity. $511,000 S10 C2013, the company sold for $17.000 cash old equipment that had cost $36,000 and had accumulated depreciation. Also in 2013. new equipment worth $60,000 was acquired in exchange for $60,000 of bonds payable, and bonds payable of $120,000 were retired for cash at a loss, A $26,000 cash dividend was declared and paid in 2013. Any stock issuances were for cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts