Question: prepare a cash flow statement using the indirect method Given an income statement and a balance sheet, prepare a cash flow statement using the indirect

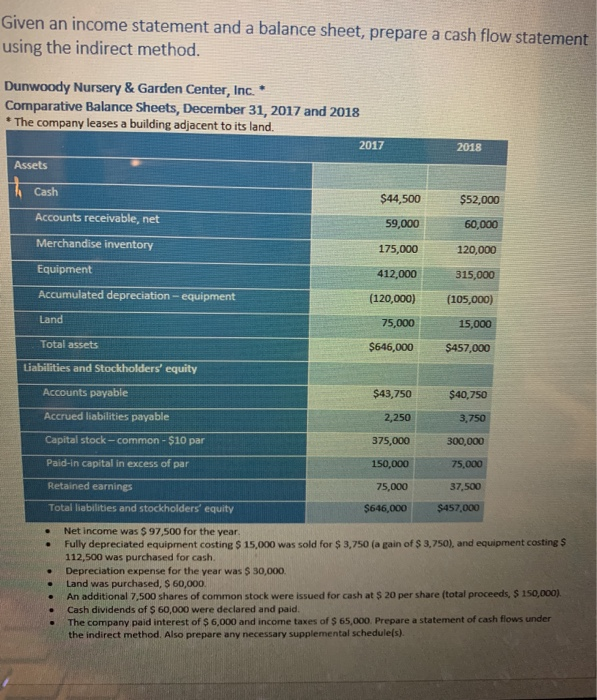

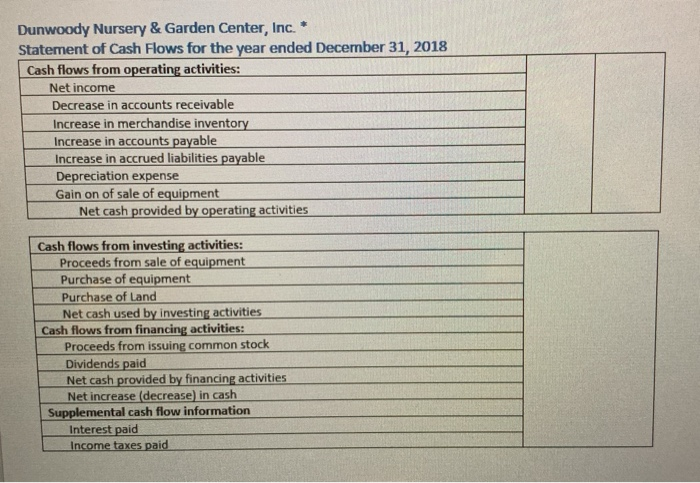

Given an income statement and a balance sheet, prepare a cash flow statement using the indirect method. Dunwoody Nursery & Garden Center, Inc. * Comparative Balance Sheets, December 31, 2017 and 2018 * The company leases a building adjacent to its land. 2017 2018 Assets Cash $44,500 Accounts receivable, net 59,000 $52,000 60,000 120,000 Merchandise inventory 175,000 Equipment 412,000 315,000 Accumulated depreciation equipment (105,000) Land (120,000) 75,000 $646,000 15,000 $457,000 Total assets Liabilities and Stockholders' equity Accounts payable $43,750 $40,750 Accrued liabilities payable 2,250 3,750 Capital stock-common - $10 par 375,000 300,000 Paid-in capital in excess of par 150,000 75,000 Retained earnings 75,000 37,500 Total liabilities and stockholders' equity $646,000 $457,000 Net income was $ 97,500 for the year. Fully depreciated equipment costing $ 15,000 was sold for $ 3.750 (again of $ 3.750), and equipment costines 112,500 was purchased for cash. Depreciation expense for the year was $ 30,000 Land was purchased, $ 60,000 An additional 7.500 shares of common stock were issued for cash at $ 20 per share (total proceeds, $ 150,000 Cash dividends of $ 60,000 were declared and paid. The company paid interest of $ 6,000 and income taxes of $ 65,000. Prepare a statement of cash flows under the indirect method. Also prepare any necessary supplemental schedule(s). Dunwoody Nursery & Garden Center, Inc. Statement of Cash Flows for the year ended December 31, 2018 Cash flows from operating activities: Net income Decrease in accounts receivable Increase in merchandise inventory Increase in accounts payable Increase in accrued liabilities payable Depreciation expense Gain on of sale of equipment Net cash provided by operating activities Cash flows from investing activities: Proceeds from sale of equipment Purchase of equipment Purchase of Land Net cash used by investing activities Cash flows from financing activities: Proceeds from issuing common stock Dividends paid Net cash provided by financing activities Net increase (decrease) in cash Supplemental cash flow information Interest paid Income taxes paid Given an income statement and a balance sheet, prepare a cash flow statement using the indirect method. Dunwoody Nursery & Garden Center, Inc. * Comparative Balance Sheets, December 31, 2017 and 2018 * The company leases a building adjacent to its land. 2017 2018 Assets Cash $44,500 Accounts receivable, net 59,000 $52,000 60,000 120,000 Merchandise inventory 175,000 Equipment 412,000 315,000 Accumulated depreciation equipment (105,000) Land (120,000) 75,000 $646,000 15,000 $457,000 Total assets Liabilities and Stockholders' equity Accounts payable $43,750 $40,750 Accrued liabilities payable 2,250 3,750 Capital stock-common - $10 par 375,000 300,000 Paid-in capital in excess of par 150,000 75,000 Retained earnings 75,000 37,500 Total liabilities and stockholders' equity $646,000 $457,000 Net income was $ 97,500 for the year. Fully depreciated equipment costing $ 15,000 was sold for $ 3.750 (again of $ 3.750), and equipment costines 112,500 was purchased for cash. Depreciation expense for the year was $ 30,000 Land was purchased, $ 60,000 An additional 7.500 shares of common stock were issued for cash at $ 20 per share (total proceeds, $ 150,000 Cash dividends of $ 60,000 were declared and paid. The company paid interest of $ 6,000 and income taxes of $ 65,000. Prepare a statement of cash flows under the indirect method. Also prepare any necessary supplemental schedule(s). Dunwoody Nursery & Garden Center, Inc. Statement of Cash Flows for the year ended December 31, 2018 Cash flows from operating activities: Net income Decrease in accounts receivable Increase in merchandise inventory Increase in accounts payable Increase in accrued liabilities payable Depreciation expense Gain on of sale of equipment Net cash provided by operating activities Cash flows from investing activities: Proceeds from sale of equipment Purchase of equipment Purchase of Land Net cash used by investing activities Cash flows from financing activities: Proceeds from issuing common stock Dividends paid Net cash provided by financing activities Net increase (decrease) in cash Supplemental cash flow information Interest paid Income taxes paid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts