Question: Prepare a classified balance sheet for the following Assignment Chapter 12- Partnerships Name QUESTION 1-Initial Contributions Jack and Will formed the JW Partnership on January

Prepare a classified balance sheet for the following

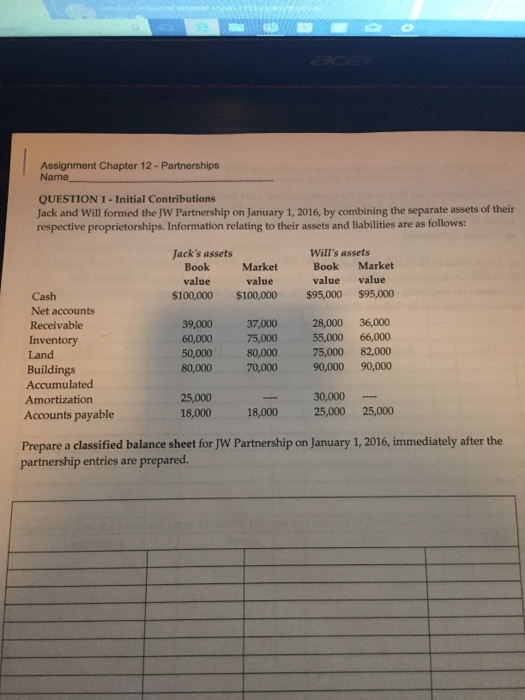

Prepare a classified balance sheet for the following Assignment Chapter 12- Partnerships Name QUESTION 1-Initial Contributions Jack and Will formed the JW Partnership on January 1, 2016, by combining the separate assets of their respective proprietorships. Information relating to their assets and liabilities are as follows: Jack's assets Will's assets Book value MarketBook Market value value value $100,000 $100,000 $95,000 $95,000 Cash Net accounts Receivable Inventory Land Buildings Accumulated Amortization Accounts payable 39,00037,000 28,000 36,000 60,000 0,0008 80,000 70,000 90,000 90,000 75,000 80,00075,000 82,000 55,000 66,000 30,000 25,000 18,000 18,000 25,000 25,000 Prepare a classified balance sheet for JW Partnership on January 1, 2016, immediately after the partnership entries are prepared

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts