Question: prepare a common size balance sheet for the current years balance sheet and a common size income statement for thr current years income statement using

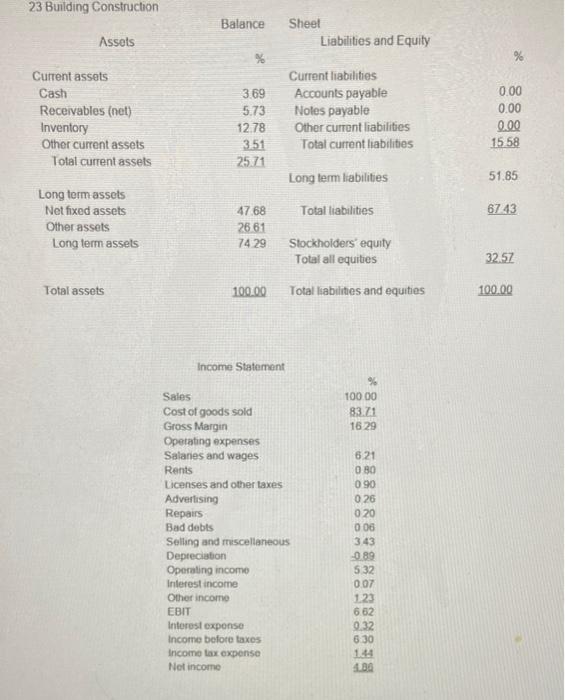

23 Building Construction Balance Sheet Liabilities and Equity Assets % % Current assets Cash Receivables (net) Inventory Other current assets Total current assets 3.69 5.73 12.78 3.51 25.71 Current liabilities Accounts payable Noles payable Other current liabilities Total current liabilities 0.00 0.00 0.00 15 58 Long term liabilities 51.85 Long term assets Net fixed assets Other assets Long term assets Total liabilities 67.43 47 68 26 61 74 29 Stockholders' equity Total all equities 32.57 Total assets 100.00 Total liabilities and equities 100.00 Income Statement % 100 00 83.71 16 29 Sales Cost of goods sold Gross Margin Operating expenses Salaries and wages Rents Licenses and other taxes Advertising Repairs Bad debts Selling and miscellaneous Depreciation Operating income Interest income Other incomo EBIT Interest exponso Income before taxes Income tax expense Not income 6.21 O 80 090 026 020 0 06 3.43 089 532 0.07 123 6.62 0.32 6.30 144 23 Building Construction Balance Sheet Liabilities and Equity Assets % % Current assets Cash Receivables (net) Inventory Other current assets Total current assets 3.69 5.73 12.78 3.51 25.71 Current liabilities Accounts payable Noles payable Other current liabilities Total current liabilities 0.00 0.00 0.00 15 58 Long term liabilities 51.85 Long term assets Net fixed assets Other assets Long term assets Total liabilities 67.43 47 68 26 61 74 29 Stockholders' equity Total all equities 32.57 Total assets 100.00 Total liabilities and equities 100.00 Income Statement % 100 00 83.71 16 29 Sales Cost of goods sold Gross Margin Operating expenses Salaries and wages Rents Licenses and other taxes Advertising Repairs Bad debts Selling and miscellaneous Depreciation Operating income Interest income Other incomo EBIT Interest exponso Income before taxes Income tax expense Not income 6.21 O 80 090 026 020 0 06 3.43 089 532 0.07 123 6.62 0.32 6.30 144

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts