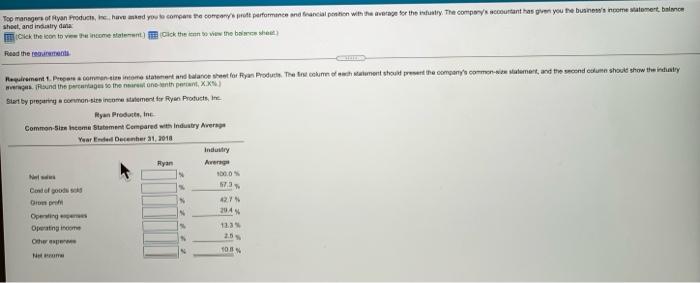

Question: Prepare a common size income statement and balance sheet for Ryan products. The first column of each statement should present the companies common size statement

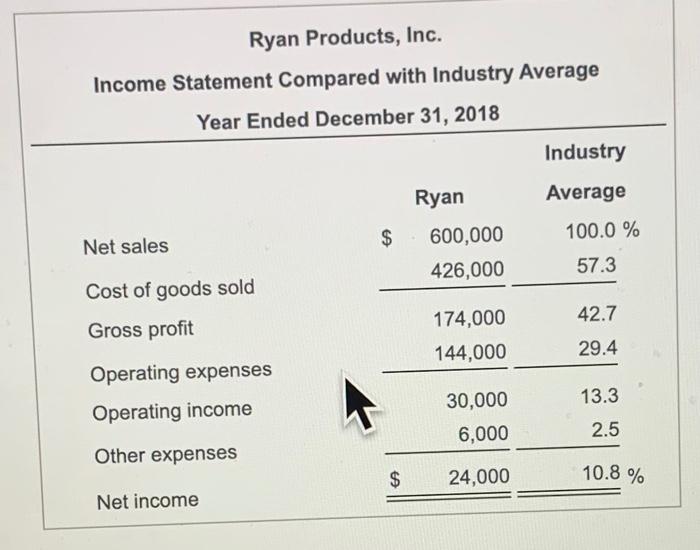

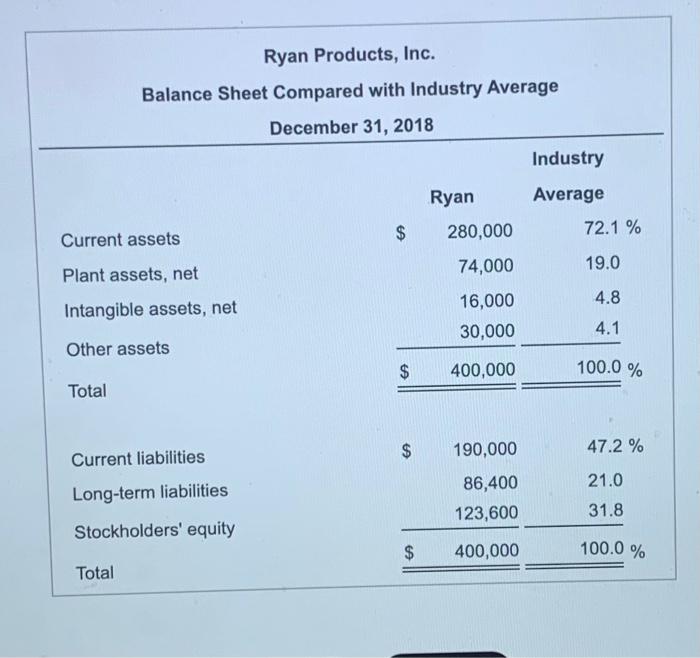

Top range of Ryan rodun, eh mand you to compare the conceputt performance and francia portion with everage for the sty. The company accountant as ven you the business come statement balance shot, and indstrydana Click the icon to view income talent) lok them to view the most Read the remote Requirements. Prepare a comment constant and balanceret for Ryan Products. The secolumn with her should recomen's comment utment, and the second column should show the metaly Pound the pages to the month perint, XX) Start by preparing a common se income statement for Ryan Products, in Ryan Products, ine Comment come Statement compared with industry Average Year Ended December 21, 2018 Industry Ryan Average Www 1000 Cand of good 173 Dior 27 Operating 204 Operating income 11.3 Other 2.0 Ryan Products, Inc. Income Statement Compared with Industry Average Year Ended December 31, 2018 Industry Ryan Average Net sales $ 600,000 100.0 % 426,000 57.3 Cost of goods sold Gross profit 174,000 42.7 144,000 29.4 Operating expenses Operating income 30,000 13.3 6,000 2.5 Other expenses $ 24,000 Net income 10.8 % Ryan Products, Inc. Balance Sheet Compared with Industry Average December 31, 2018 Industry Average $ Ryan 280,000 74,000 72.1 % Current assets 19.0 Plant assets, net 4.8 Intangible assets, net 16,000 30,000 4.1 Other assets $ 400,000 100.0 % Total $ 190,000 47.2 % Current liabilities Long-term liabilities 21.0 86,400 123,600 31.8 Stockholders' equity $ 400,000 100.0 % Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts