Question: Prepare a common size income statement. Express each item on the income statement as a percent of total sales or revenue. Do this for all

Prepare a common size income statement. Express each item on the income statement as a percent of total sales or revenue. Do this for all years on the income statement. Look for major differences over time and between companies. Do any patterns emerge? Some questions to consider:

- What are the major expenses?

- Are there any unusual or discontinued items? Are they large in magnitude?

- Was the company more or less profitable when compared to the prior year?

- We need to calculate Net income/ Sale to get profitability ratios.

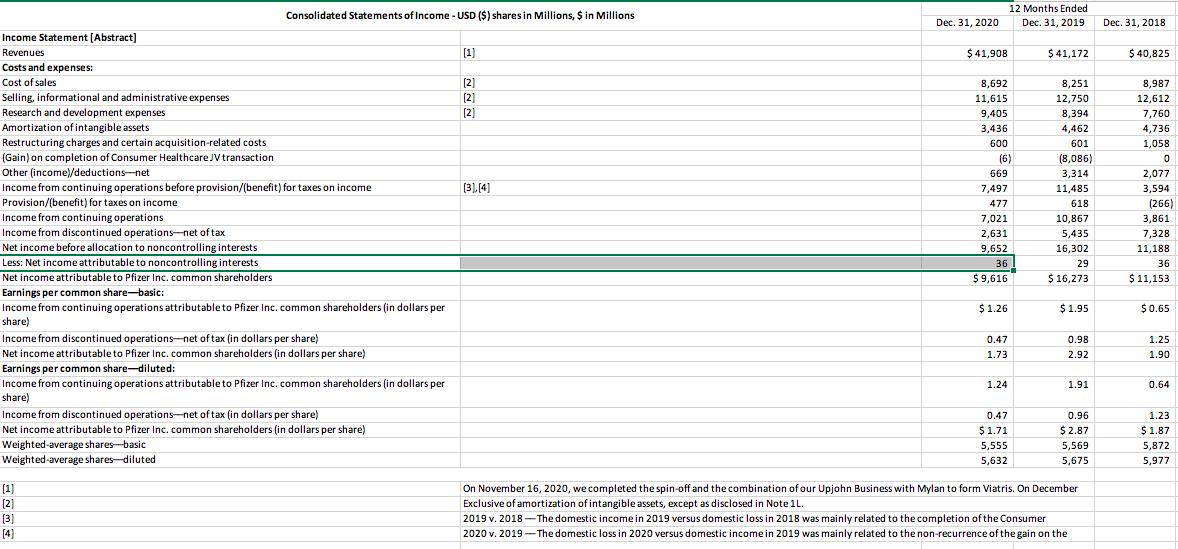

12 Months Ended Consolidated Statements of Income - USD ($) shares in Millions, $ in Millions Dec. 31, 2020 Dec. 31, 2019 Dec. 31, 2018 Income Statement [Abstract] Revenues [1] $ 41,908 $ 41,172 $ 40,825 Costs and expenses: [2] (2] [2] Cost of sales 8,692 8,251 8,987 Selling, informational and administrative expenses Research and development expenses Amortization of intangible assets Restructuring charges and certain acquisition-related costs (Gain) on completion of Consumer Healthcare JV transaction Other (income)/deductions-net Income from continuing operations before provision/(benefit) for taxes on income Provision/(benefit) for taxes on income 11,615 12,750 12,612 9,405 8,394 7,760 3,436 4,462 4,736 600 601 1,058 (6) (8,086) 669 3,314 2,077 [31.(4] 7,497 11,485 3,594 477 618 (266) Income from continuing operations 7,021 10,867 3,861 Income from discontinued operations-net of tax Net income before allocation to noncontrolling interests Less: Net income attributable to noncontrolling interests 5,435 16,302 2,631 7,328 9,652 11,188 36 29 36 Net income attributable to Pfizer Inc. common shareholders $9,616 $ 16,273 $11,153 Earnings per common share-basic: Income from continuing operations attributable to Pfizer Inc. common shareholders (in dollars per $1.26 $1.95 $0.65 share) Income from discontinued operations-net of tax (in dollars per share) Net income attributable to Pfizer Inc. common shareholders (in dollars per share) Earnings per common share-diluted: Income from continuing operations attributable to Pfizer Inc. common shareholders (in dollars per share) Income from discontinued operations-net of tax (in dollars per share) Net income attributable to Pfizer Inc. common shareholders (in dollars per share) Weighted-average shares-basic Weighted-average shares-diluted 0.47 0.98 1.25 1.73 2.92 1.90 1.24 1.91 0.64 0.47 0.96 1.23 $1.71 $2.87 $1.87 5,555 5,569 5,872 5,632 5,675 5,977 On November 16, 2020, we completed the spin-off and the combination of our Upjohn Business with Mylan to form Viatris. On December Exclusive of amortization of intangible assets, except as disclosed in Note 1L. [1] [2] [3] [4] 2019 v. 2018 -The domestic income in 2019 versus domestic loss in 2018 was mainly related to the completion of the Consumer 2020 v. 2019 -The domestic loss in 2020 versus domestic income in 2019 was mainly related to the non-recurrence of the gain on the

Step by Step Solution

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Answer Step by Step Explanation Vertical analysis It is an analysis which lists every item in a fina... View full answer

Get step-by-step solutions from verified subject matter experts