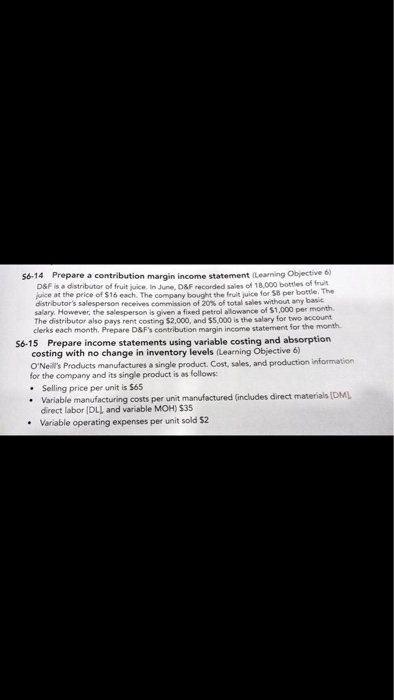

Question: Prepare a contribution margin income statement (Leaning Objective 6 D&F is a distributor of fruit juice. In June, D&F recorded sales of 18,000 bottles of

Prepare a contribution margin income statement (Leaning Objective 6 D&F is a distributor of fruit juice. In June, D&F recorded sales of 18,000 bottles of fruit 56-14 for $8 per bottle. The dstributor's salesperson receves commission of 20% of total sales without any salary. However, the salesperson is given a fixed petrol allowance The distributor also pays rent costing $2,000, and $5,000 is the salary for two accourt clerks each month. Prepare D&Fs contribution margin income statement for of $1,000 per month Prepare income statements using variable costing and absorption costing with no change in inventory levels (Learning Objective 6) O'Neil's Products manufactures a single product. Cost, sales, and production information for the company and its single product is as follows 56-15 Selling price per unit is $65 . . Variable manufacturing costs per unit manufactured (includes direct materials IDML direct labor IDLI and variable MOH) $35 . Variable operating expenses per unit sold $2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts