Question: Prepare a correctly formatted production cost report using the FIFO method. (Ex. 8.12 is for report layout reference). I ke Someone keeps sending me an

Prepare a correctly formatted production cost report using the FIFO method. (Ex. 8.12 is for report layout reference).

I ke

I ke

Someone keeps sending me an answer but not answering my questions in the comments.

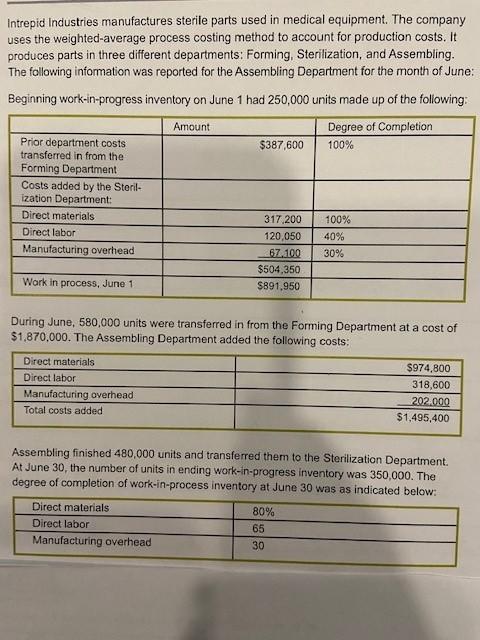

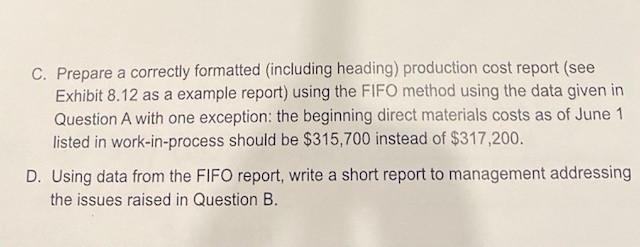

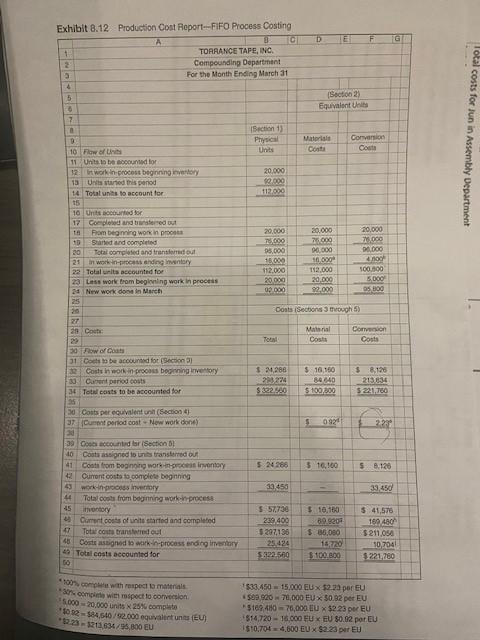

Intrepid Industries manufactures sterile parts used in medical equipment. The company uses the weighted-average process costing method to account for production costs. It produces parts in three different departments: Forming, Sterilization, and Assembling. The following information was reported for the Assembling Department for the month of June: Beginning work-in-progress inventory on June 1 had 250,000 units made up of the following: Amount Degree of Completion Prior department costs $387,600 100% transferred in from the Forming Department Costs added by the Steril- ization Department: Direct materials 317.200 100% Direct labor 120,050 40% Manufacturing overhead 67.100 30% $504,350 Work in process, June 1 S891.950 During June, 580,000 units were transferred in from the Forming Department at a cost of $1,870,000. The Assembling Department added the following costs: Direct materials Direct labor Manufacturing overhead Total costs added $974,800 318,600 202.000 $1,495,400 Assembling finished 480,000 units and transferred them to the Sterilization Department. At June 30, the number of units in ending work-in-progress inventory was 350,000. The degree of completion of work-in-process inventory at June 30 was as indicated below: Direct materials Direct labor Manufacturing overhead 80% 65 30 C. Prepare a correctly formatted (including heading) production cost report (see Exhibit 8.12 as a example report) using the FIFO method using the data given in Question A with one exception: the beginning direct materials costs as of June 1 listed in work-in-process should be $315,700 instead of $317,200. D. Using data from the FIFO report, write a short report to management addressing the issues raised in Question B. D TE F Exhibit 8.12 Production Cost Report--FIFO Process Costing 1 TORRANCE TAPE, INO Compounding Department a For the Month Ending March 4 5 Section 2) Equivalente 7 15ection 1 Physical Units 9 Material Costa Conversion Costa Total costs for Jun in Assembly Department 10 Flow of 11 Units to be accounted for It work in procese beginning investory 13 Una started this period 14 Totatunits to account for 20.000 $9.000 112.000 20,000 20.000 75.000 0.000 10 Untoutor 17 Completed and red out ts From beginning work in prosta D Started and completed 30 Total completed and transitout in work in procats ending intory 22 Total units accounted for 23. Less work from being work in process 24 New work done in March 25 20 20.000 25000 05.000 15,000 112.000 20.000 00.000 0.000 10.000 112.000 20.000 92,000 100.00 5.000 05 g Dosts Sections through 5) 27 2 Cache Material Costs Convention Costa TO 30 Row of Go 31 och to be accounted for Section 31 32 Costin ons beginning over Current period costs 34 Total costs to be accounted for $ 2,988 23 224 $ 332.500 $16.50 86640 $100.000 213834 30 Costs per equivalent unit (Section 4 37 Cum period cost-Now work done) 5 524286 5 1.100 S 8.126 33,450 39 Goccounted bar Section 10 Cats assigned to units transferred out 41 Cont from beginning works inventory Current costs to complete beginning 49 works very 44 Totalcools from beginning work in process 45 ondory Current coolis of units started and completed 47 Total cost transfered out 40 Costeassigned to work process and inventory 45 Total costs accounted for 50 5 57730 239.400 5297,136 25.494 5332.569 $ 10,100 89.9201 $ 80.000 182720 $100.000 $ 41,575 160 4601 $211.050 10.704 $221,760 100com with respect to mais complete with spect to convention 8.000 - 20.000 units X 25% complete 10 02-84.540 72.000 equivalent (EU) 231236/5.300 EU 1$33.450 - 15.000 EUX $2.23 per EU $9.92070,000 EUX 50.82 per EU $109.410 70,000 IU x $2 23 EU $14,720 - 16.000 FU X EU $0.02 por EU $10.7044.600 EUX $223 per Eu

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts