Question: prepare a differential analysis for this problem Instructions Crystal Displays Inc. recently began production of a new product, flat panel displays, which required the investment

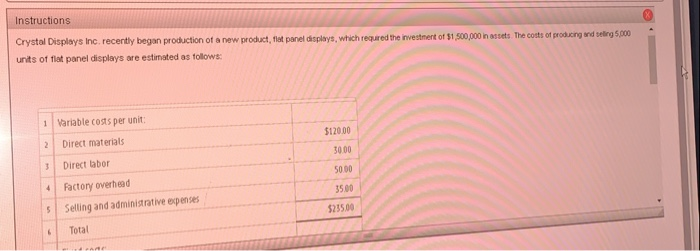

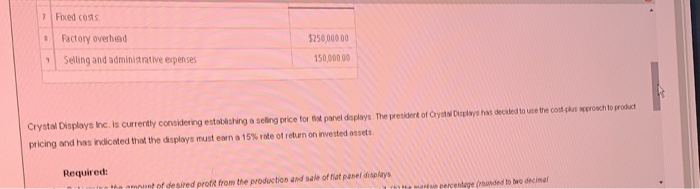

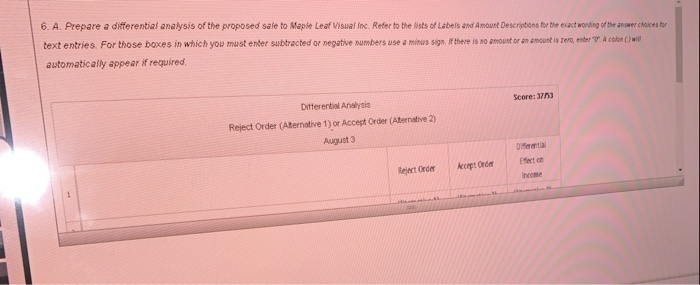

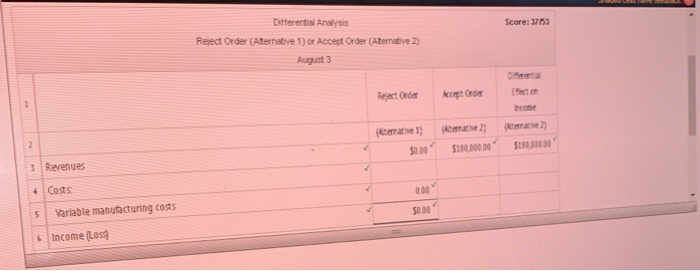

Instructions Crystal Displays Inc. recently began production of a new product, flat panel displays, which required the investment of $1,500,000 in assets. The cost of producing and selling 5,000 units of flat panel displays are estimated as follows: 1 Variable costs per unit: $120.00 30.00 2 Direct materials 3 Direct labor 50.00 35.00 4 Factory overhead Selling and administrative expenses Total $235.00 6 Foxed costs Factory overhead $250,000.00 1 Selling and administrative expenses 150,000.00 Crystal Displays Inc. is currently considering establishing a seling price for the panel displays. The president of Oryat Dplays has decided to use the color rochto product pricing and has indicated that the displays must earn a 15% rote of return on invested assets Required: of desired profit from the production and sale of fut panel displays marcentage bonded to be decima 6. A. Prepare a differential analysis of the proposed sale to Maple Leaf Visual Inc. Refer to the list of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If there is no amount of an amount is zero, enter A colon () will automatically appear if required, Score: 373 Differential Analysis Reject Order (Aternative 1) or Accept Order (Aternative 2) August Dea Efecto Income React Order kecept Order Score: 1753 Differential Analysis Reject Order (Aternative 1) or Accest Order (Aternative 2) August 3 Bert Order kot Order 1 ncome 2 rate 1) $0.00 $100.000.00 $100,000 3 Revenues 4 Costs 0.00 $0.00 5 Variable manufacturing costs Income (Los

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts