Question: prepare a economic balance sheet based on the exhibit that is attached below.Its share price is $12.08 and it has 1,200 shares outstanding. It's debt

prepare a economic balance sheet based on the exhibit that is attached below.Its share price is $12.08 and it has 1,200 shares outstanding. It's debt is trading at 102% of market value, It owns $3,000 in unused land.IT creates $3,800 from financing

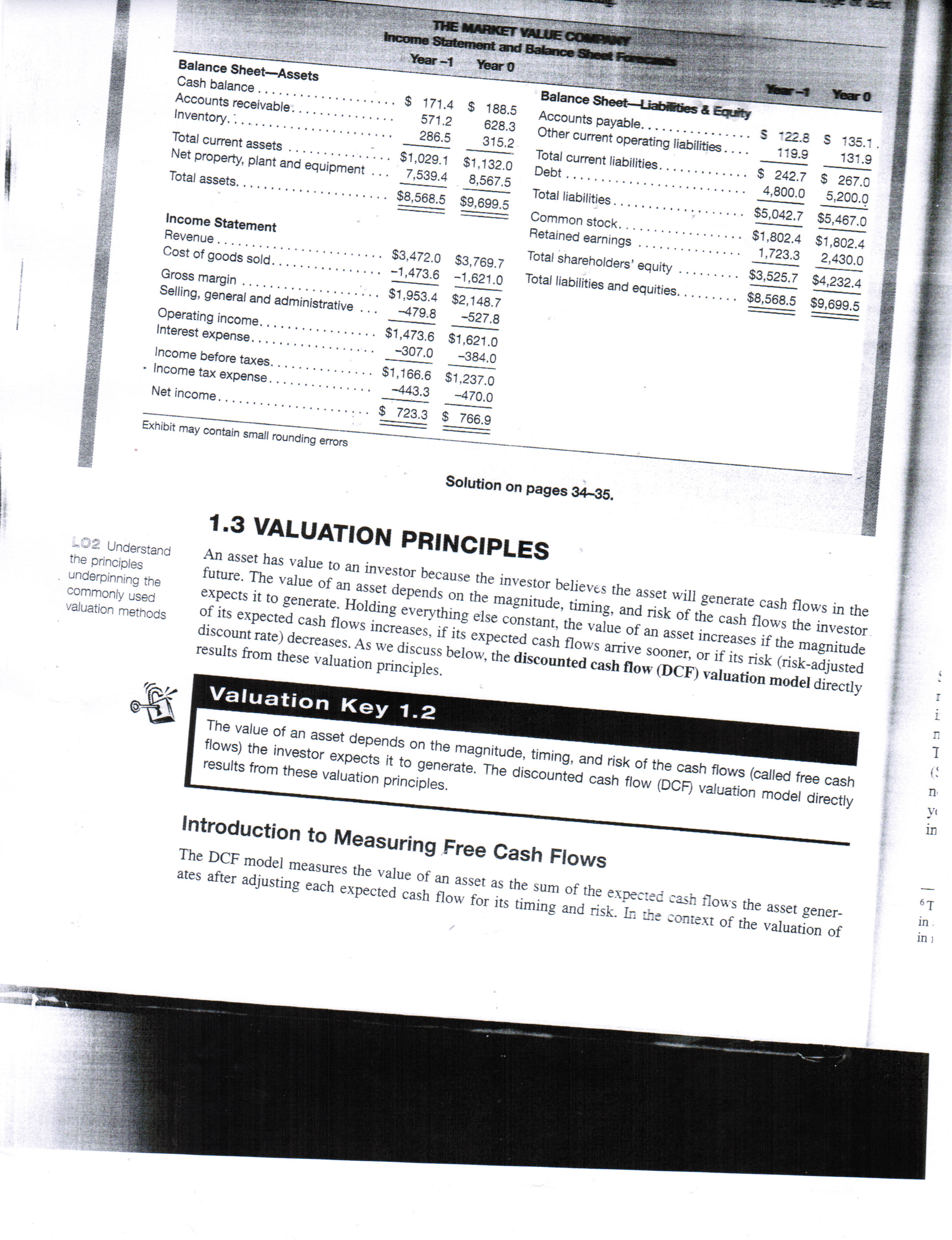

THE ARKET Income Statement and Year -1 Year 0 Year 0 Balance Sheet-Assets Balance Sheet-Liabilities & Equity Cash balance . . . . . . . . . . . . . . . $ 171.4 $ 188.5 Accounts payable. . . . . . . . . . . . . . . . $ 122.8 $ 135.1 . Accounts receivable. .. 571.2 628.3 Other current operating liabilities . . . . 119.9 131.9 Inventory. ...... . . . 286.5 315.2 $1,029.1 $1, 132.0 Total current liabilities . . . . . . . . . . . . . $ 242.7 $ 267.0 Total current assets . . . . . . . . . . . . .. . 4,800.0 5,200.0 Net property, plant and equipment . . . 7,539.4 8,567.5 Debt . . . . . . . . . . . .. ... . . . . . . . . .. $5,042.7 $5,467.0 Total assets. . . . . . . . . . . $8,568.5 $9,699.5 Total liabilities . . . Common stock. . ... . . . . $1,802.4 $1,802.4 Retained earnings . 1,723.3 2,430.0 Income Statement Revenue . . .. . ..... $3,525.7 $4,232.4 . .. . .. .. ... $3,472.0 $3,769.7 Total shareholders' equity . . .. . . . . . Cost of goods sold. . . . . .... -1,473.6 -1,621.0 Total liabilities and equities. . . . . . . . . $8,568.5 $9,699.5 Gross margin . . . . . . . . . . . . . . . . . . .. $1,953.4 $2, 148.7 Selling, general and administrative . . . -479.8 -527.8 Operating income. . $1,473.6 $1,621.0 Interest expense . . -307.0 -384.0 Income before taxes. . . . . . . . . $1, 166.6 $1,237.0 Income tax expense . .. . . . . . . . -443.3 -470.0 Net income . . . . . . . . . . . $ 723.3 $ 766.9 Exhibit may contain small rounding errors Solution on pages 34-35. 1.3 VALUATION PRINCIPLES 102 Understand An asset has value to an investor because the investor believes the asset will generate cash flows in the the principles underpinning the future. The value of an asset depends on the magnitude, timing, and risk of the cash flows the investor commonly used expects it to generate. Holding everything else constant, the value of an asset increases if the magnitude valuation methods of its expected cash flows increases, if its expected cash flows arrive sooner, or if its risk (risk-adjusted discount rate) decreases. As we discuss below, the discounted cash flow (DCF) valuation model directly results from these valuation principles. Valuation Key 1.2 The value of an asset depends on the magnitude, timing, and risk of the cash flows (called free cash flows) the investor expects it to generate. The discounted cash flow (DCF) valuation model directly results from these valuation principles. Introduction to Measuring Free Cash Flows 6 T The DCF model measures the value of an asset as the sum of the expected cash flows the asset gener- in ates after adjusting each expected cash flow for its timing and risk. In the context of the valuation of in 1