Question: Prepare a financial forecasting report for ExxonMobil for 2017 (Please show work on Excel) To simplify analysis, assume the following: 2. Sales for 2017 are

Prepare a financial forecasting report for ExxonMobil for 2017 (Please show work on Excel)

To simplify analysis, assume the following:

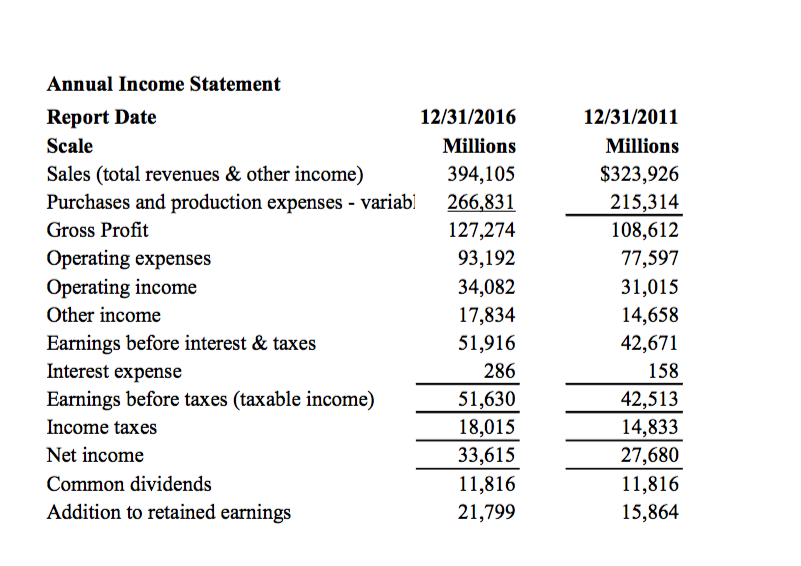

2. Sales for 2017 are expected to grow as the same as rate as in the past, say from 2011 to 2016. Note: Please compute growth rate for XOM sales using past data, for example from 2011 to 2016.

3. About 50 percent of the operating expenses are variable.

4. All variable expenses are expected to vary at the same rate as sales. For example, if sales are expected to increase by 8 percent in 2017, variable expenses are also expected to increase by 8 percent in 2017.

5. Tax rate (taxes divided by taxable income or before tax income or earnings before taxes for 2016) will remain constant in 2017.

6. Interest expenses will remain constant (before financing decision is made) next year.

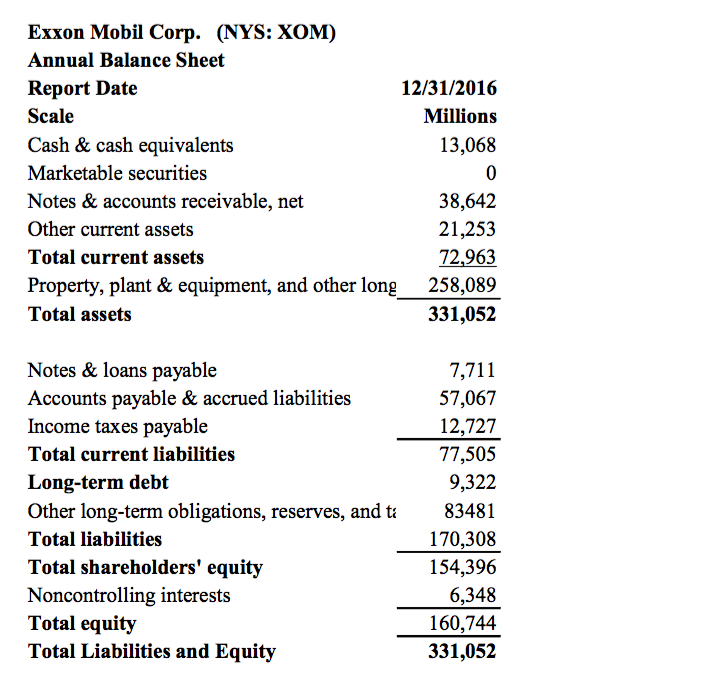

7. Dividend payments in 2017 will be the same as in 2016 (if any). Click on Cash Flow tab to determine Dividend Paid.

8. All current assets and long-term assets, notes, payables, and accruals will vary proportionately with projected sales for 2017.

Annual Income Statement Report Date Scale Sales (total revenues & other income) Purchases and production expenses - variabl 266,831 Gross Profit Operating expenses Operating income Other income Earnings before interest & taxes Interest expense Earnings before taxes (taxable income) Income taxes Net income Common dividends Addition to retained earnings 12/31/2011 Millions S323,926 215,314 108,612 77,597 31,015 14,658 42,671 158 42,513 14,833 27,680 11,816 15,864 12/31/2016 Millions 394,105 127,274 93,192 34,082 17,834 51,916 286 51,630 18,015 33,615 11,816 21,799

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts