Question: Prepare a FULL cash flow statement for Winston Enterprises for the year 2020. For the operating section, use the indirect method. Please label all sections,

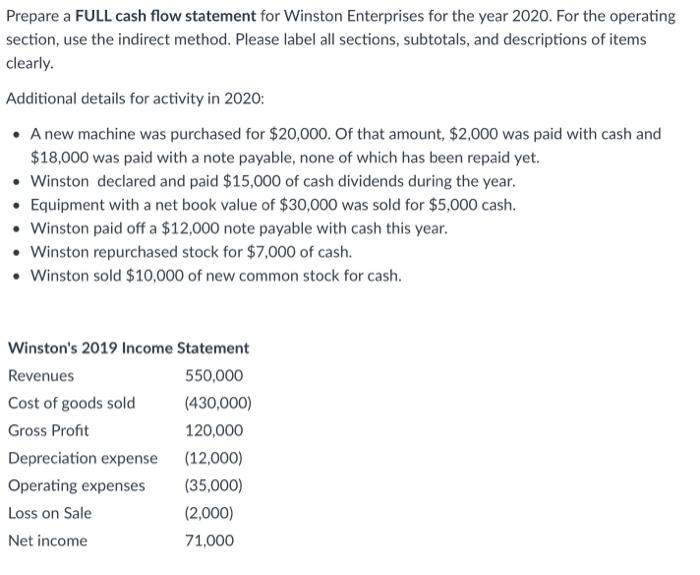

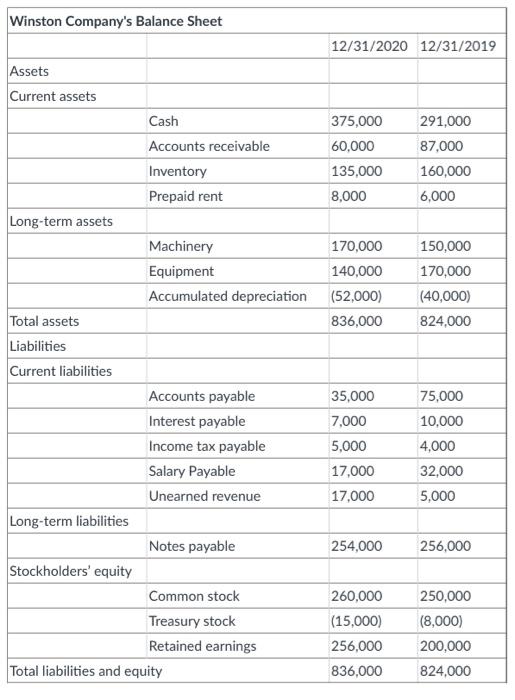

Prepare a FULL cash flow statement for Winston Enterprises for the year 2020. For the operating section, use the indirect method. Please label all sections, subtotals, and descriptions of items clearly. Additional details for activity in 2020: A new machine was purchased for $20,000. Of that amount, $2,000 was paid with cash and $18,000 was paid with a note payable, none of which has been repaid yet. Winston declared and paid $15,000 of cash dividends during the year. Equipment with a net book value of $30,000 was sold for $5,000 cash. Winston paid off a $12,000 note payable with cash this year. Winston repurchased stock for $7,000 of cash. Winston sold $10,000 of new common stock for cash. Winston's 2019 Income Statement Revenues 550,000 Cost of goods sold (430,000) Gross Profit 120,000 Depreciation expense (12,000) Operating expenses (35,000) Loss on Sale (2,000) Net income 71,000 Winston Company's Balance Sheet 12/31/2020 12/31/2019 375,000 60,000 135,000 8,000 291,000 87,000 160,000 6,000 170,000 140,000 (52,000) 836,000 150,000 170,000 (40,000) 824,000 Assets Current assets Cash Accounts receivable Inventory Prepaid rent Long-term assets Machinery Equipment Accumulated depreciation Total assets Liabilities Current liabilities Accounts payable Interest payable Income tax payable Salary Payable Unearned revenue Long-term liabilities Notes payable Stockholders' equity Common stock Treasury stock Retained earnings Total liabilities and equity 35,000 7,000 5,000 17,000 17,000 75,000 10,000 4,000 32,000 5,000 254,000 256,000 260,000 (15,000) 256,000 250,000 (8,000) 200,000 824,000 836,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts