Question: Prepare a full statement of cash flows using the indirect method for the year ended December 31, 2018 Prepare the operating section using the direct

| Prepare a full statement of cash flows using the indirect method for the year ended December 31, 2018 | |||||

| Prepare the operating section using the direct method for the year ended December 31, 2018 | |||||

| Prepare a vertical analysis on the income statement for both years | |||||

| Prepare a vertical analysis on the balance sheet for both years | |||||

| Prepare a horizontal analysis on the income statement | |||||

| Prepare a horizontal analysis on the balance sheet | |||||

| In regards to the statement of cash flow, comment on | |||||

| a | quality of earning | ||||

| b | areas of opportunity | ||||

| Calculate the following ratios for 2018 and 2017 and comment on each: | |||||

| Working capital | |||||

| Current ratio | |||||

| Quick ratio | |||||

| Ratio of fixed assets to long-term liabilities | |||||

| Ratio of liabilities to equity | |||||

| Gross margin | |||||

| Operating margin | |||||

| Profit margin | |||||

| Calculate the following ratios for 2018 and comment on each: | |||||

| AR turnover | |||||

| Number of days's sales in receivable | |||||

| Inventory turnover | |||||

| Number of days' sales in inventory | |||||

| Ratio of sales to assets | |||||

| Rate earned on total assets | |||||

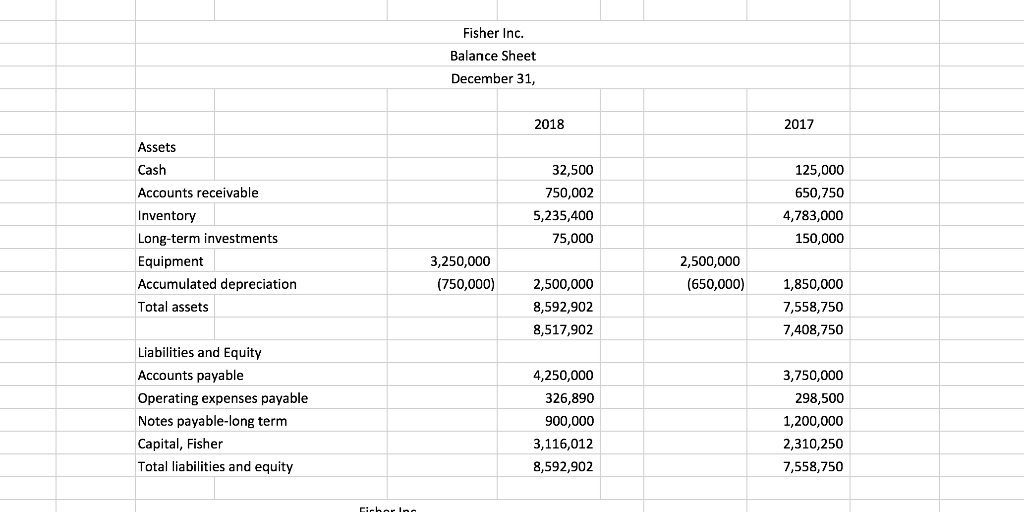

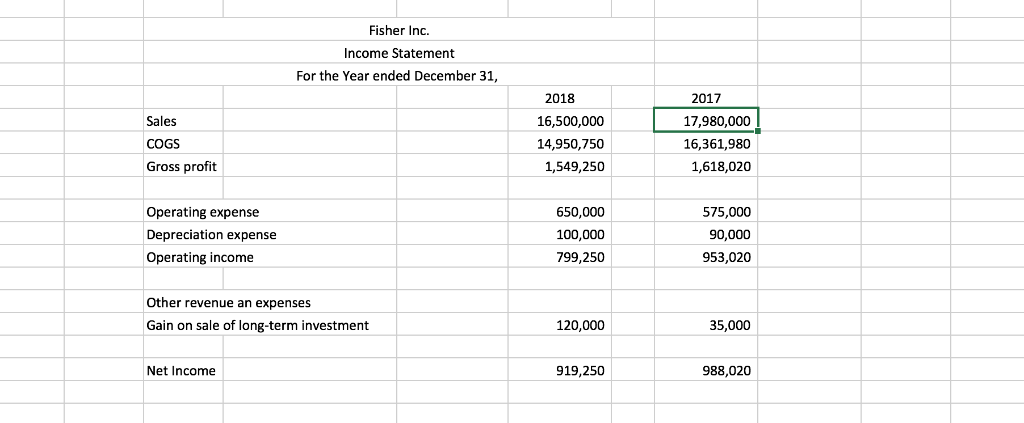

Fisher Inc. Balance Sheet December 31 2018 2017 Assets Cash Accounts receivable Inventory Long-term investments Equipment Accumulated depreciation Total assets 32,500 750,002 5,235,400 75,000 125,000 650,750 4,783,000 150,000 3,250,000 (750,000) 2,500,000 (650,000) 2,500,000 8,592,902 8,517,902 1,850,000 7,558,750 7,408,750 Liabilities and Equity Accounts payable Operating expenses payable Notes payable-long term Capital, Fisher Total liabilities and equity 4,250,000 326,890 900,000 3,116,012 8,592,902 3,750,000 298,500 1,200,000 2,310,250 7,558,750 Fisher Inc. Income Statement For the Year ended December 31, 2018 2017 Sales COGS Gross profit 16,500,000 14,950,750 1,549,250 17,980,000 16,361,980 1,618,020 Operating expense Depreciation expense Operating income 650,000 100,000 799,250 575,000 90,000 953,020 Other revenue an expenses Gain on sale of long-term investment 120,000 35,000 Net Income 919,250 988,020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts