Question: Prepare a internal-external (ie) Matrix for the following case (Under Armour, inc., 2013) Under Armour, Inc., 2013 www.ua.com, UA Headquartered in Baltimore, Maryland, Under Armour

Prepare a internal-external (ie) Matrix for the following case (Under Armour, inc., 2013)

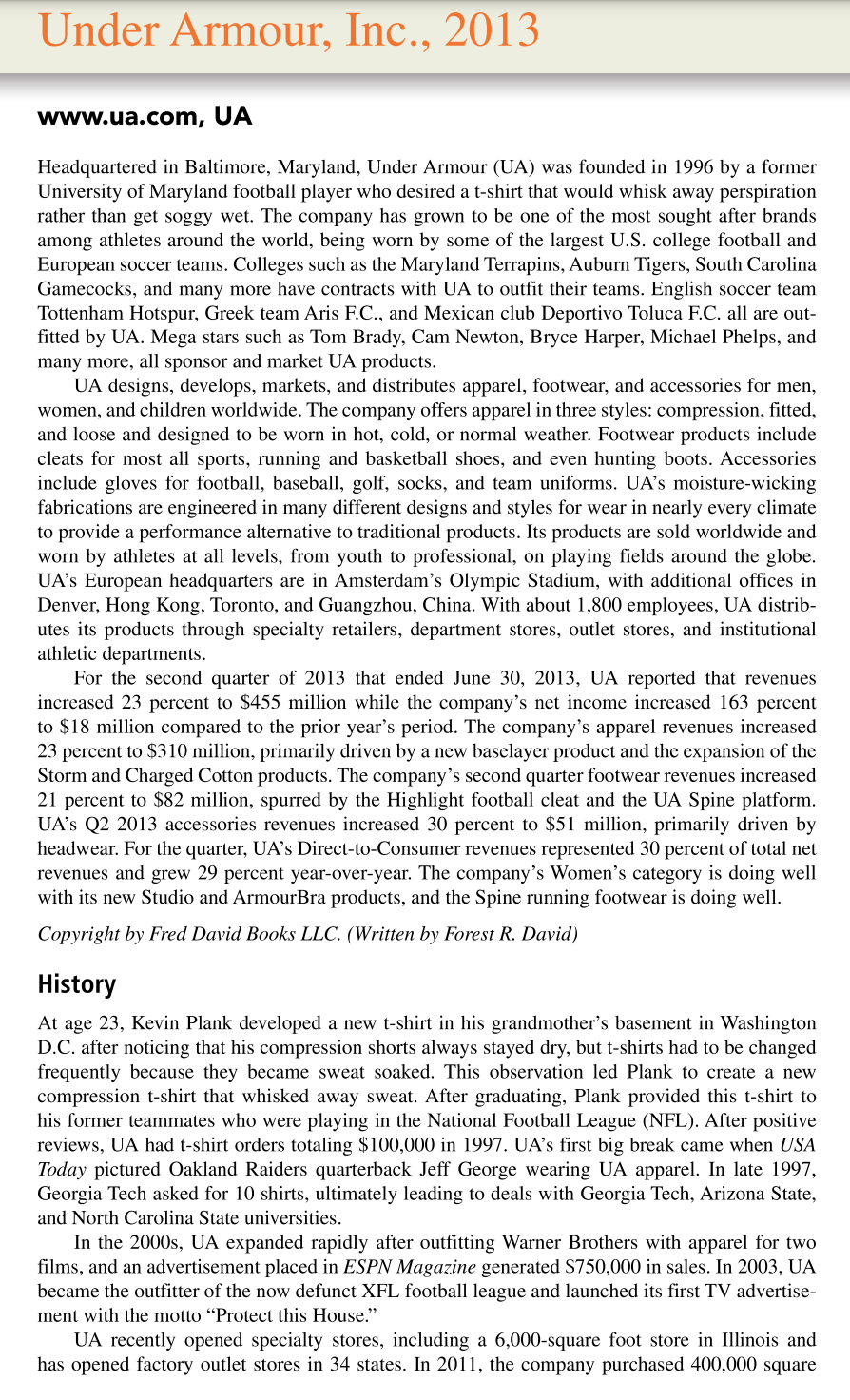

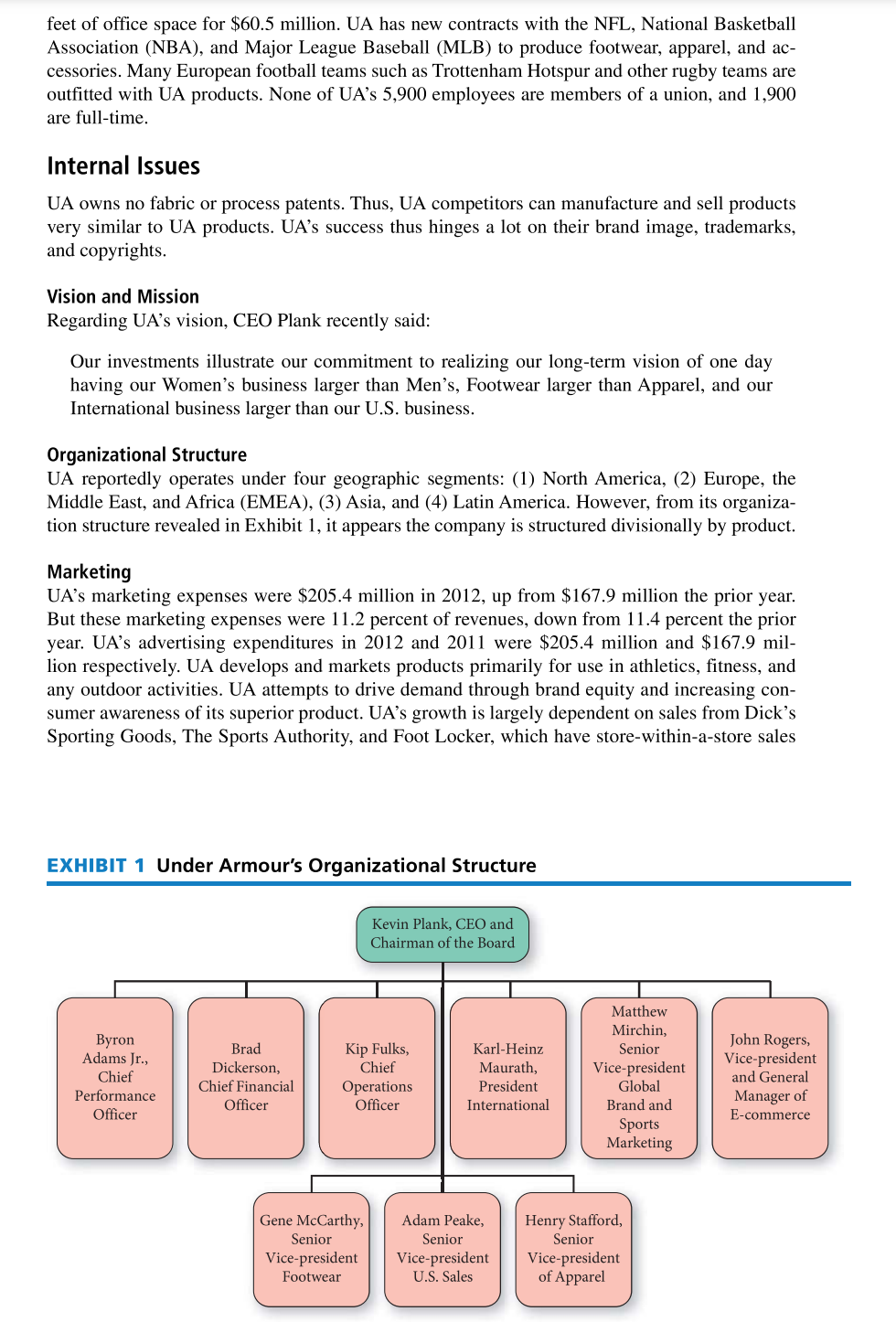

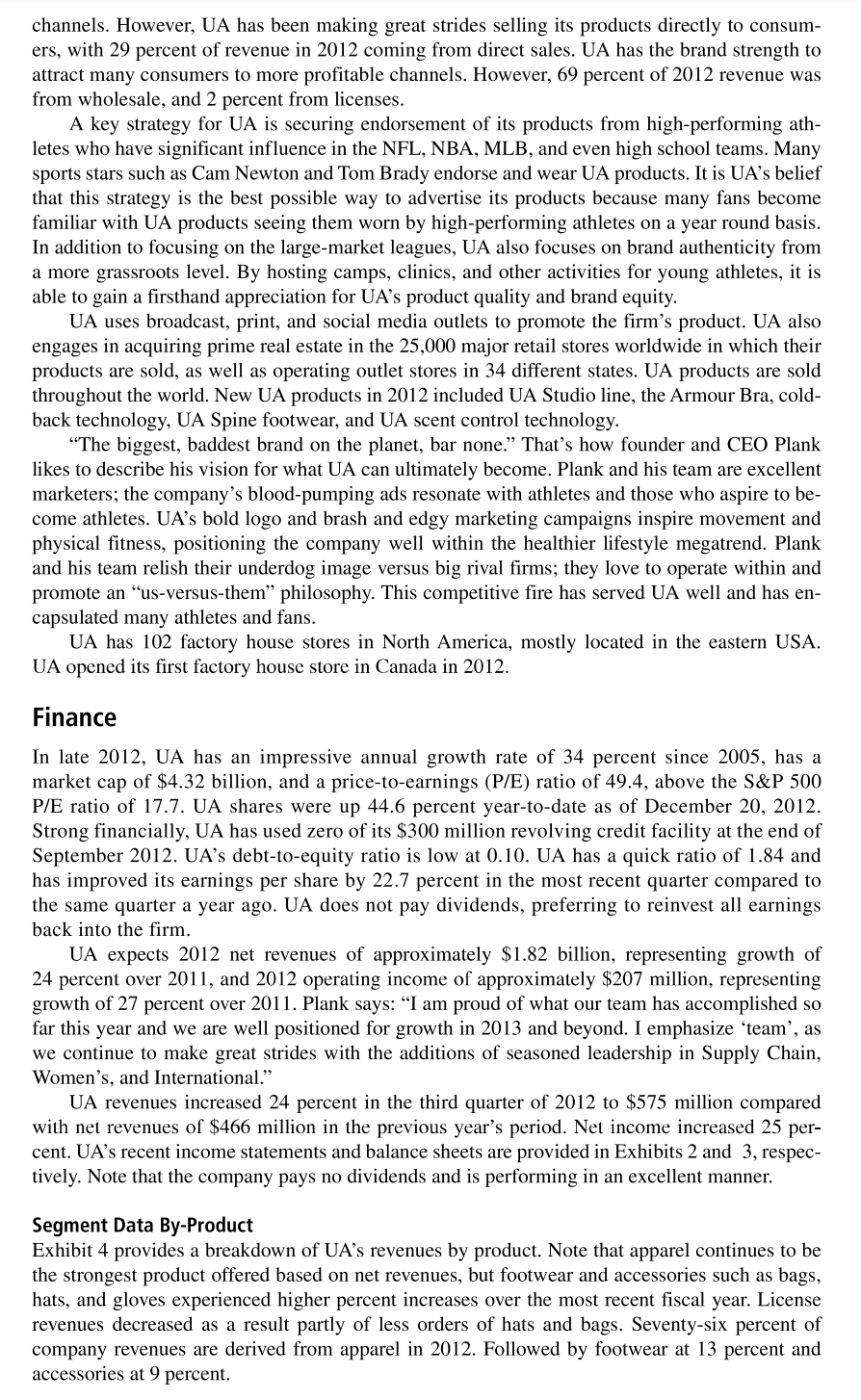

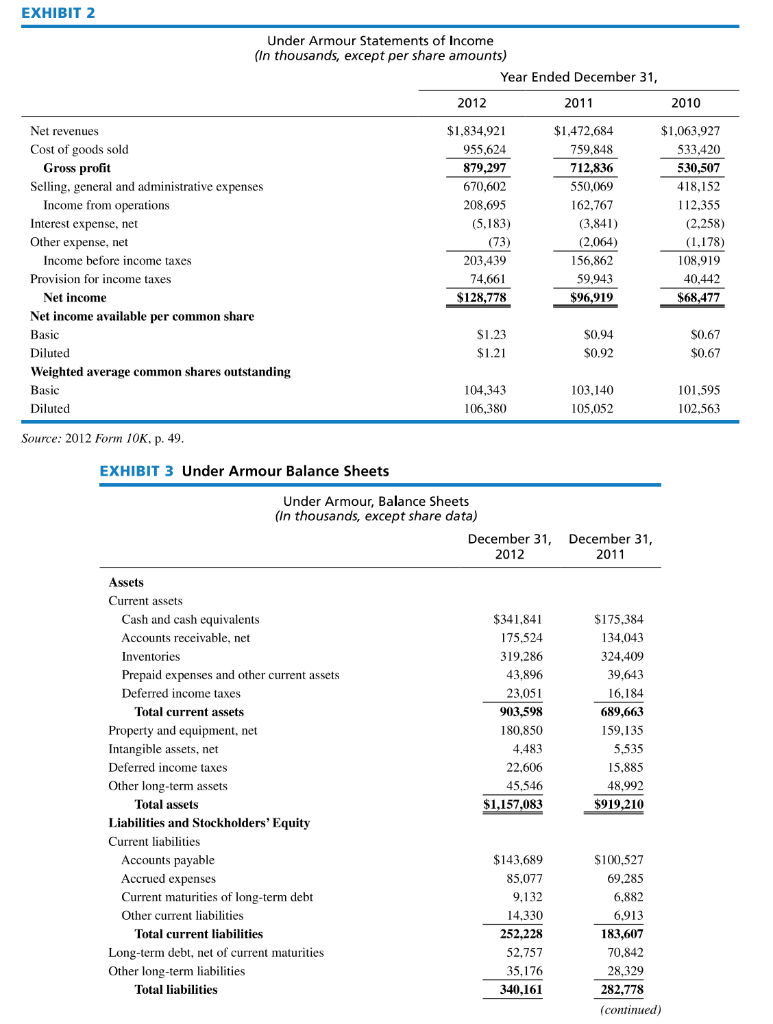

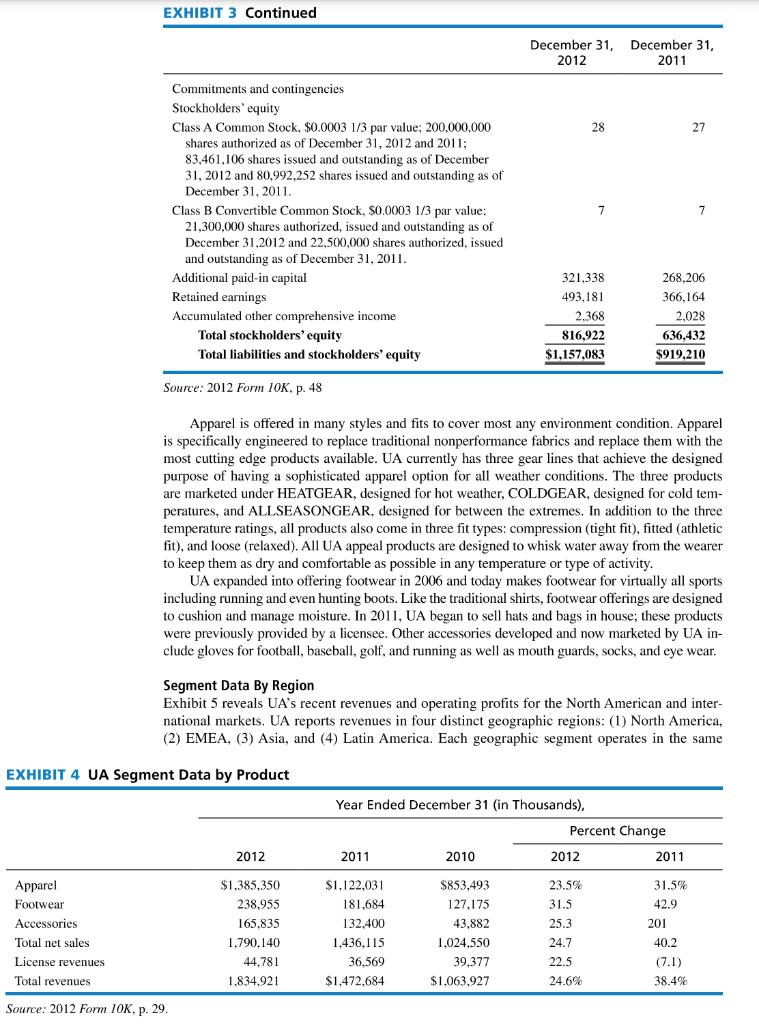

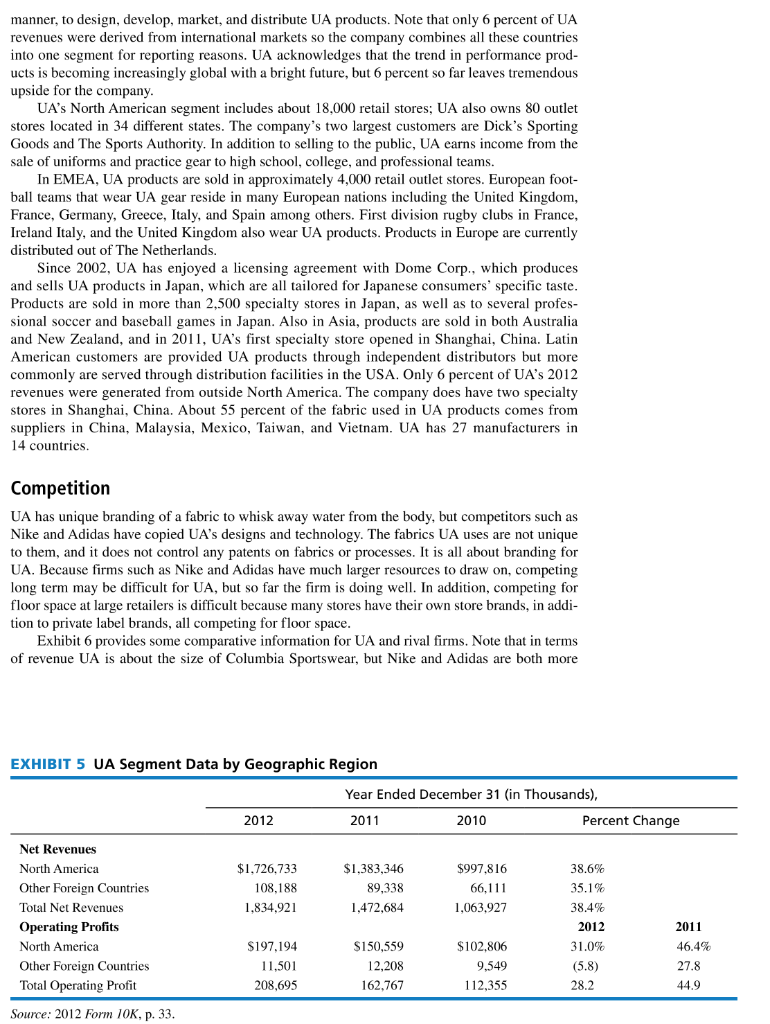

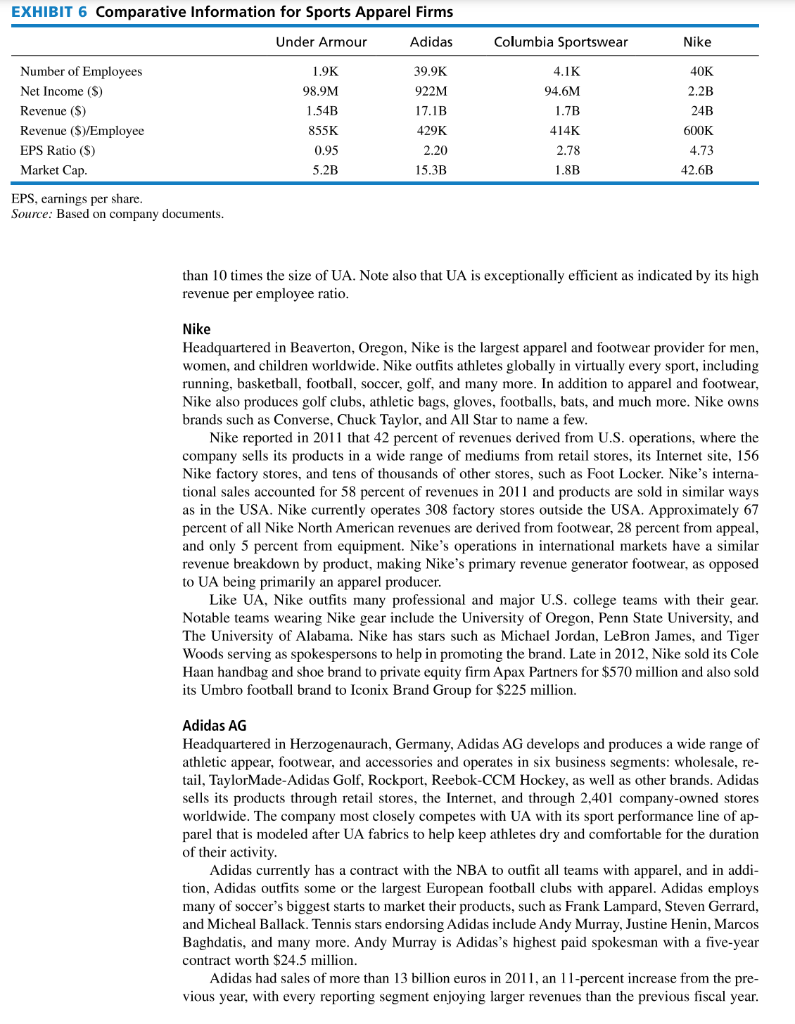

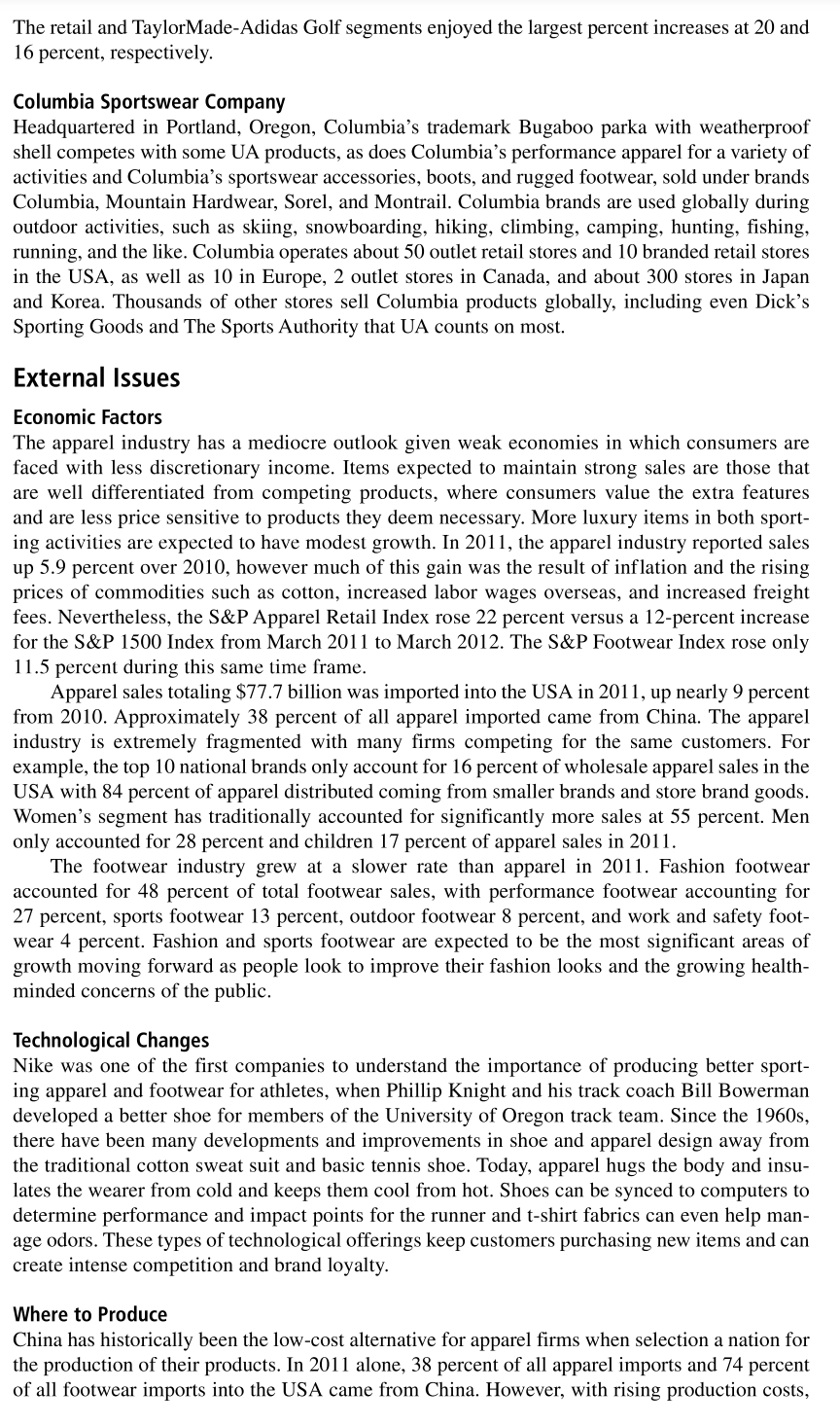

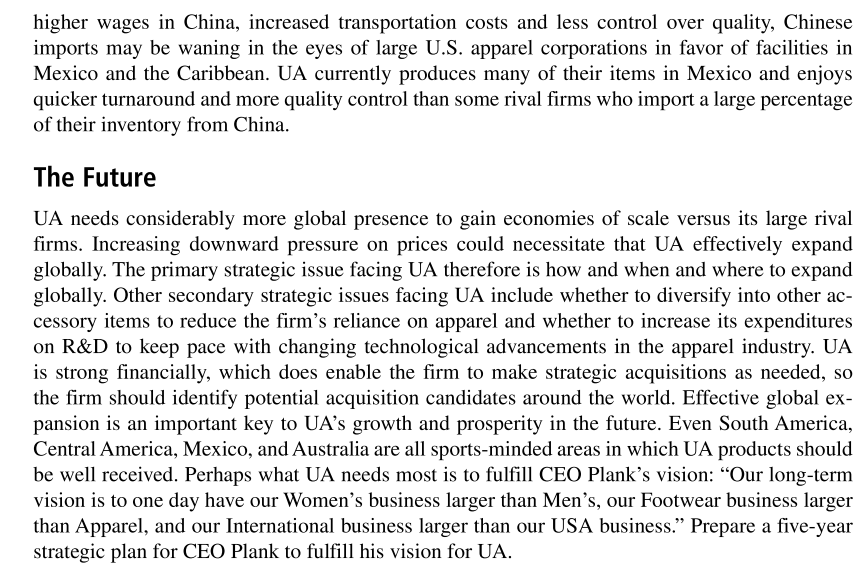

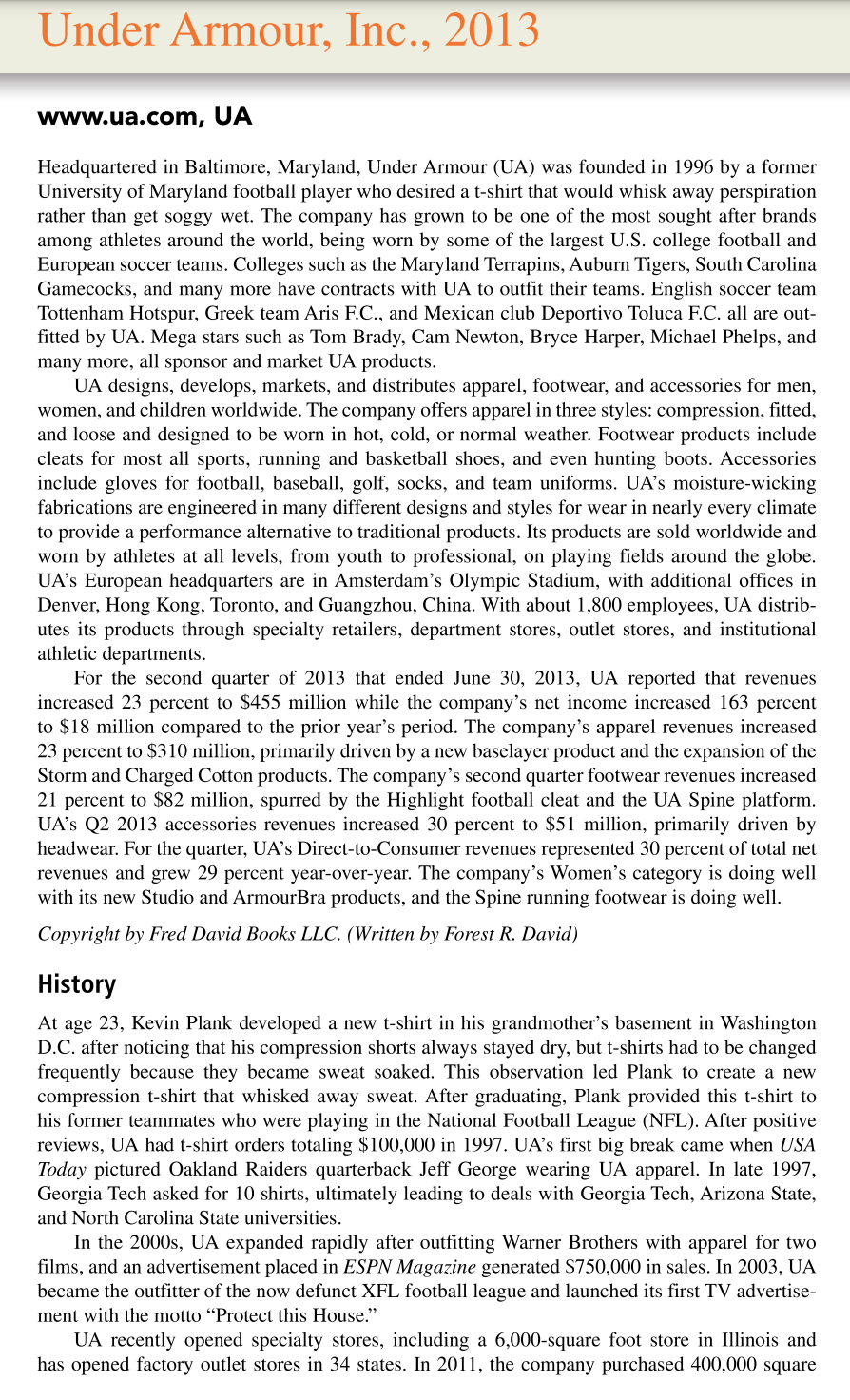

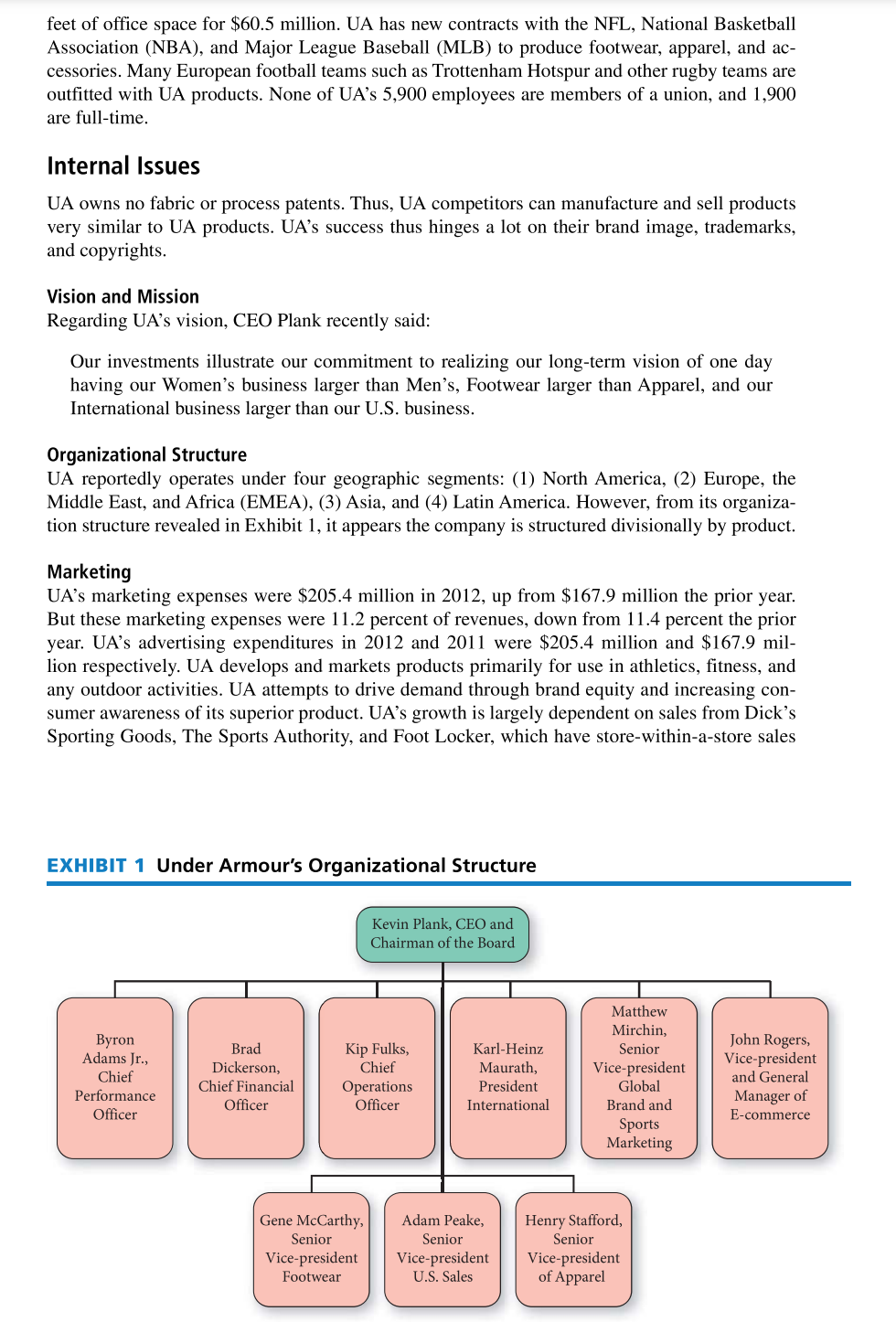

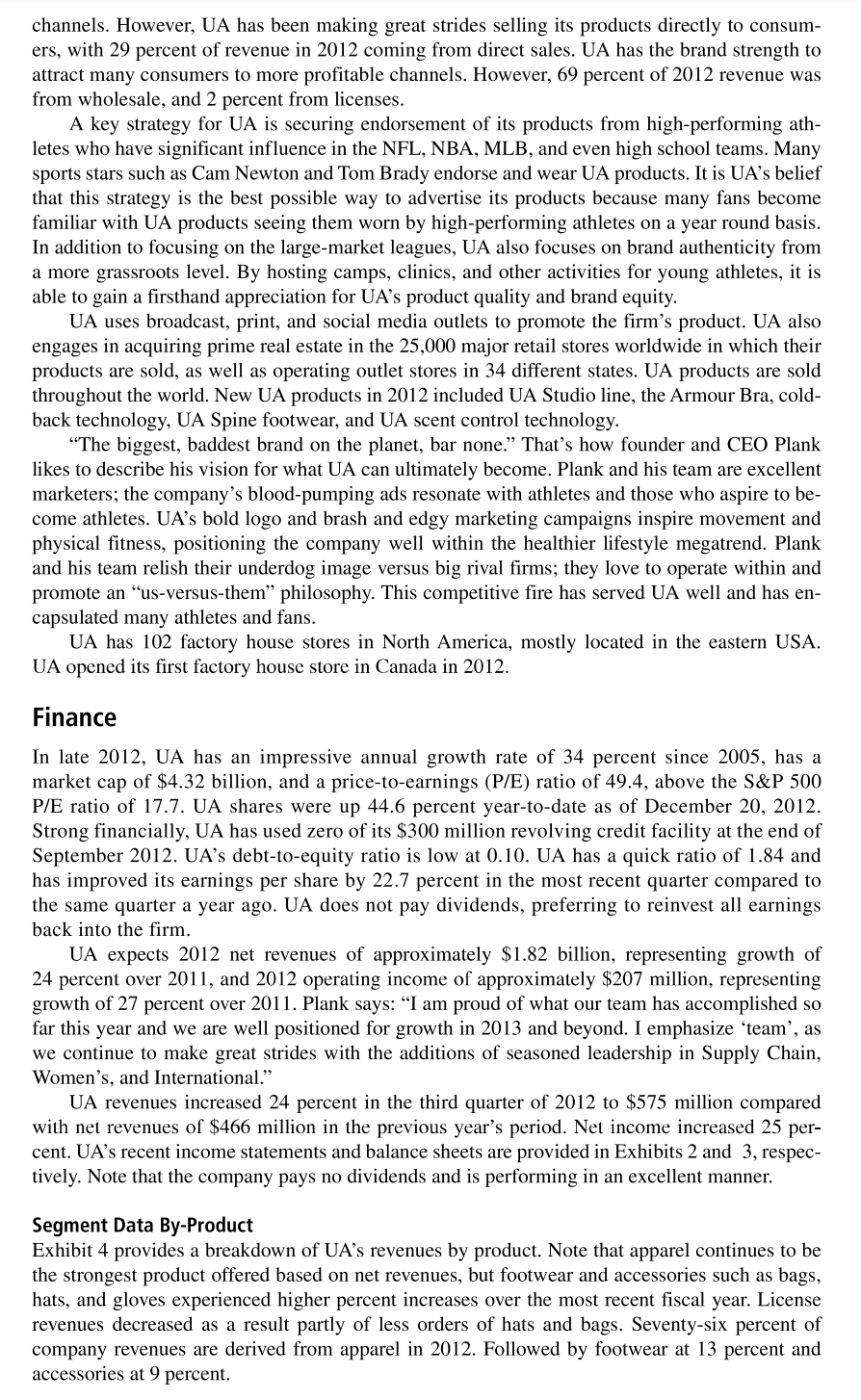

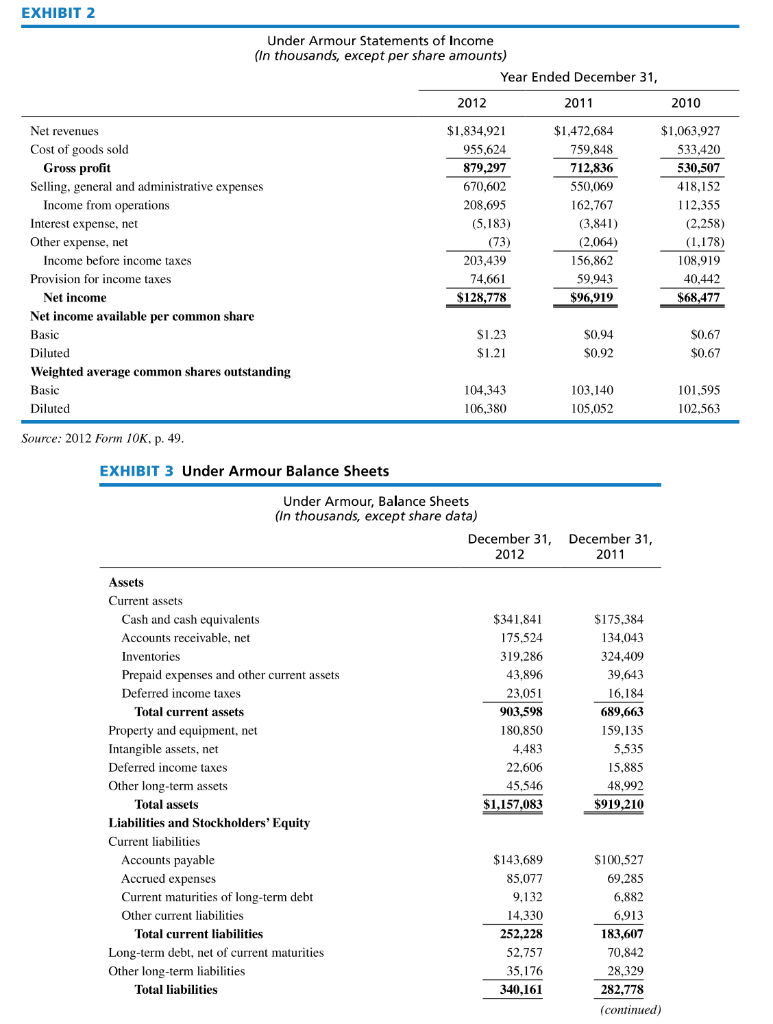

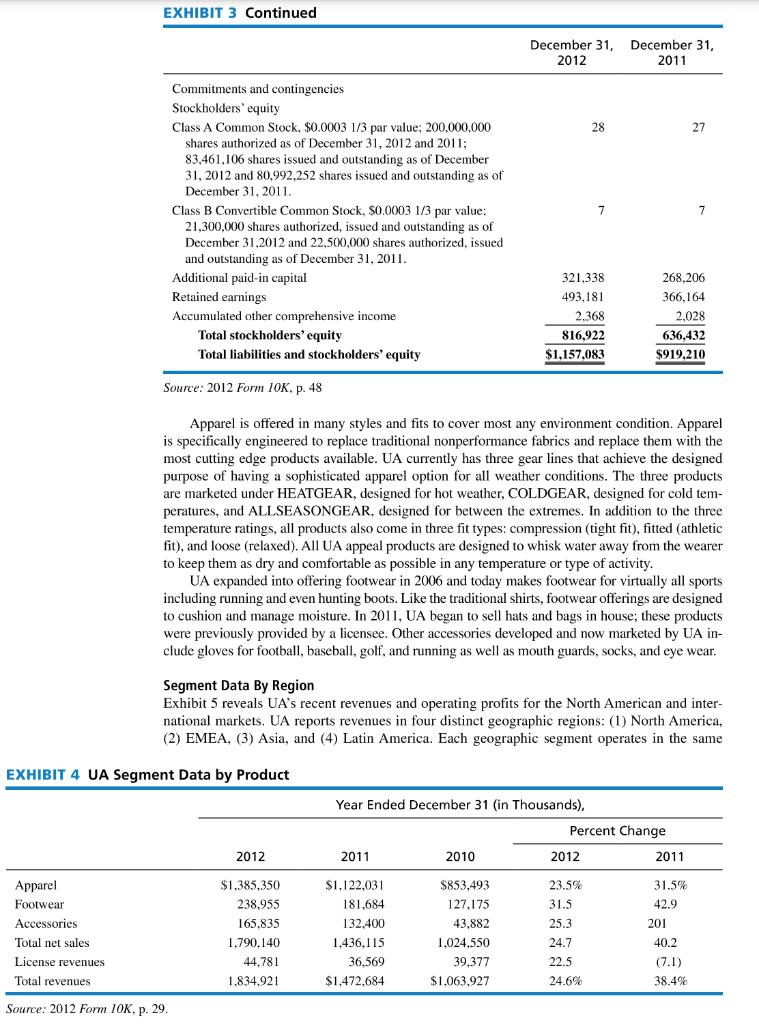

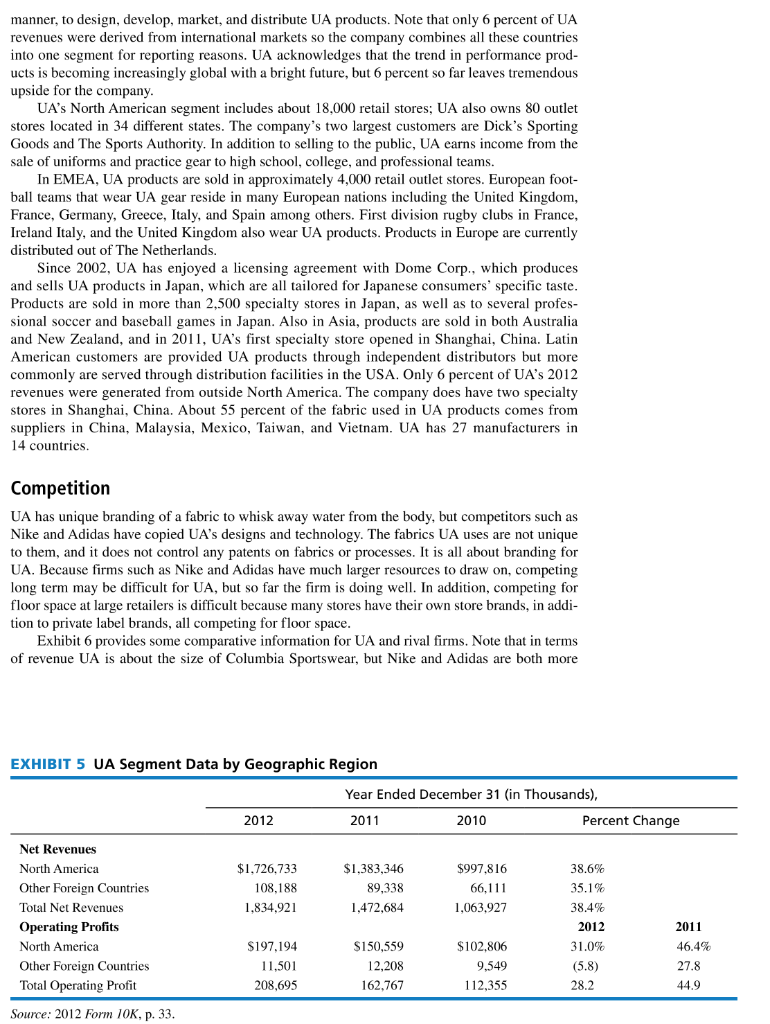

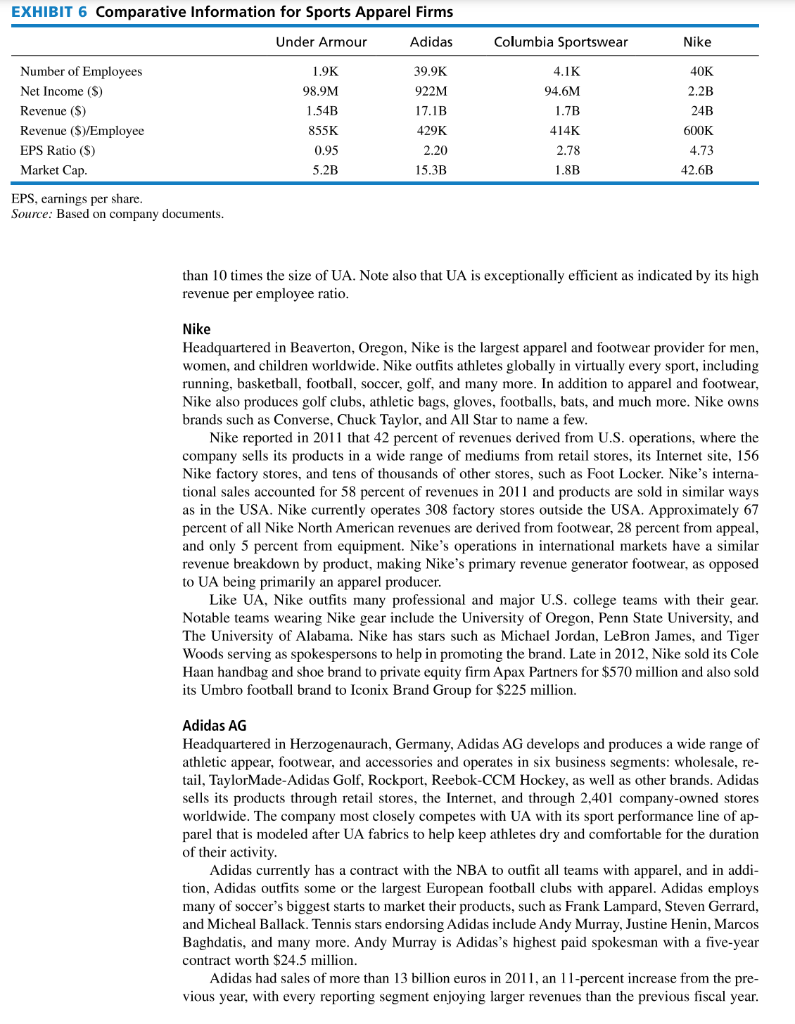

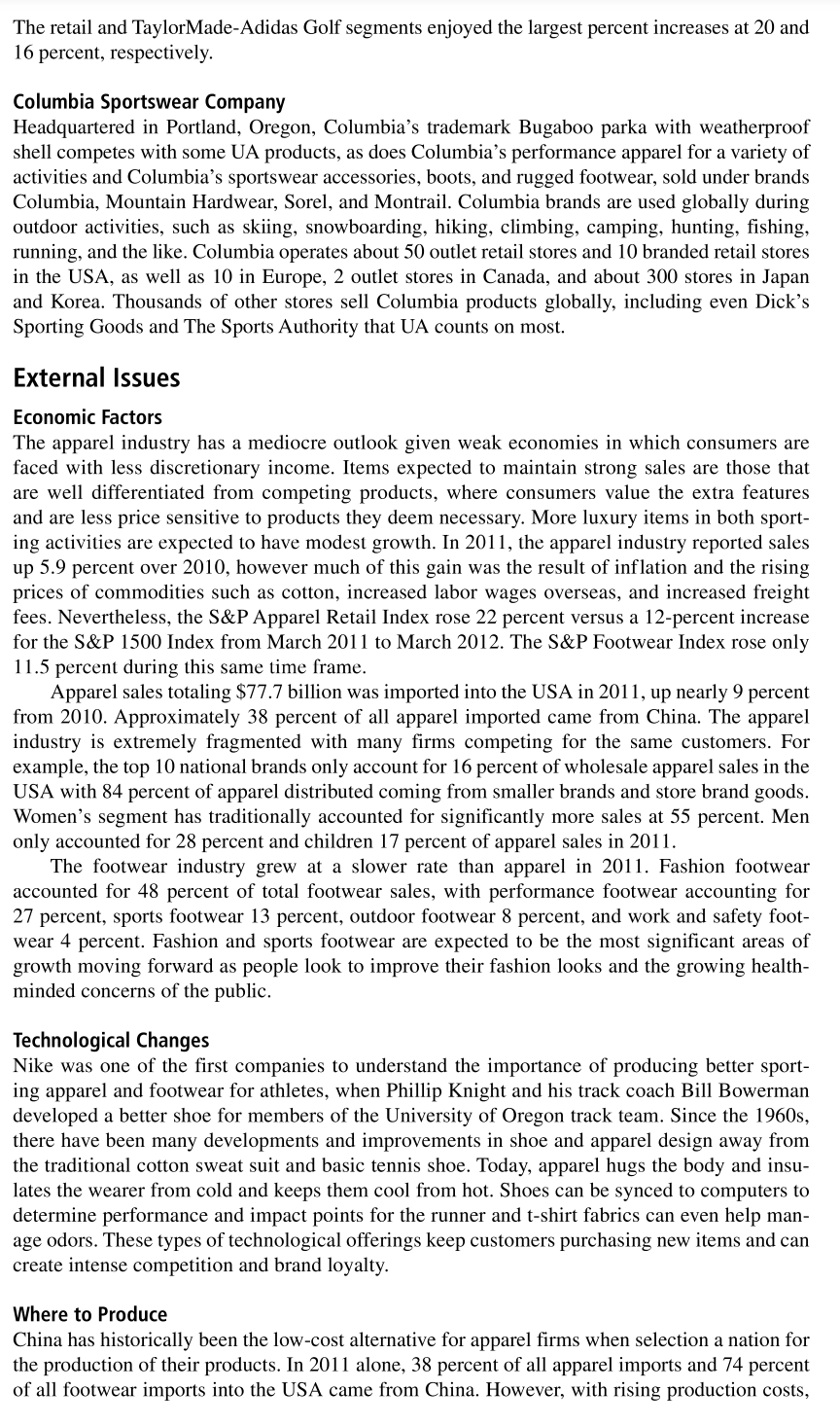

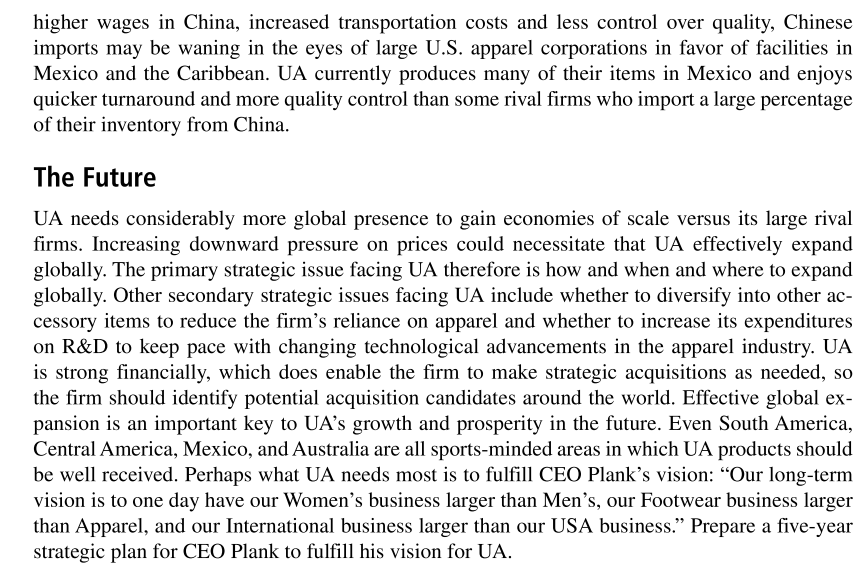

Under Armour, Inc., 2013 www.ua.com, UA Headquartered in Baltimore, Maryland, Under Armour (UA) was founded in 1996 by a former University of Maryland football player who desired a t-shirt that would whisk away perspiration rather than get soggy wet. The company has grown to be one of the most sought after brands among athletes around the world, being worn by some of the largest U.S. college football and European soccer teams. Colleges such as the Maryland Terrapins, Auburn Tigers, South Carolina Gamecocks, and many more have contracts with UA to outfit their teams. English soccer team Tottenham Hotspur, Greek team Aris F.C., and Mexican club Deportivo Toluca F.C. all are out- fitted by UA. Mega stars such as Tom Brady, Cam Newton, Bryce Harper, Michael Phelps, and many more, all sponsor and market UA products. UA designs, develops, markets, and distributes apparel, footwear, and accessories for men, women, and children worldwide. The company offers apparel in three styles: compression, fitted, and loose and designed to be worn in hot, cold, or normal weather. Footwear products include cleats for most all sports, running and basketball shoes, and even hunting boots. Accessories include gloves for football, baseball, golf, socks, and team uniforms. UAs moisture-wicking fabrications are engineered in many different designs and styles for wear in nearly every climate to provide a performance alternative to traditional products. Its products are sold worldwide and worn by athletes at all levels, from youth to professional, on playing fields around the globe. UA's European headquarters are in Amsterdam's Olympic Stadium, with additional offices in Denver, Hong Kong, Toronto, and Guangzhou, China. With about 1,800 employees, UA distrib- utes its products through specialty retailers, department stores, outlet stores, and institutional athletic departments. For the second quarter of 2013 that ended June 30, 2013, UA reported that revenues increased 23 percent to $455 million while the company's net income increased 163 percent to $18 million compared to the prior year's period. The company's apparel revenues increased 23 percent to $310 million, primarily driven by a new baselayer product and the expansion of the Storm and Charged Cotton products. The company's second quarter footwear revenues increased 21 percent to $82 million, spurred by the Highlight football cleat and the UA Spine platform. UAs Q2 2013 accessories revenues increased 30 percent to $51 million, primarily driven by headwear. For the quarter, UAs Direct-to-Consumer revenues represented 30 percent of total net revenues and grew 29 percent year-over-year. The company's Women's category is doing well with its new Studio and ArmourBra products, and the Spine running footwear is doing well. Copyright by Fred David Books LLC. (Written by Forest R. David) History At age 23, Kevin Plank developed a new t-shirt in his grandmother's basement in Washington D.C. after noticing that his compression shorts always stayed dry, but t-shirts had to be changed frequently because they became sweat soaked. This observation led Plank to create a new compression t-shirt that whisked away sweat. After graduating, Plank provided this t-shirt to his former teammates who were playing in the National Football League (NFL). After positive reviews, UA had t-shirt orders totaling $100,000 in 1997. UA's first big break came when USA Today pictured Oakland Raiders quarterback Jeff George wearing UA apparel. In late 1997, Georgia Tech asked for 10 shirts, ultimately leading to deals with Georgia Tech, Arizona State, and North Carolina State universities. In the 2000s, UA expanded rapidly after outfitting Warner Brothers with apparel for two films, and an advertisement placed in ESPN Magazine generated $750,000 in sales. In 2003, UA became the outfitter of the now defunct XFL football league and launched its first TV advertise- ment with the motto Protect this House." UA recently opened specialty stores, including a 6,000-square foot store in Illinois and has opened factory outlet stores in 34 states. In 2011, the company purchased 400,000 square feet of office space for $60.5 million. UA has new contracts with the NFL, National Basketball Association (NBA), and Major League Baseball (MLB) to produce footwear, apparel, and ac- cessories. Many European football teams such as Trottenham Hotspur and other rugby teams are outfitted with UA products. None of UA's 5,900 employees are members of a union, and 1,900 are full-time. Internal Issues UA owns no fabric or process patents. Thus, UA competitors can manufacture and sell products very similar to UA products. UA's success thus hinges a lot on their brand image, trademarks, and copyrights. Vision and Mission Regarding UA's vision, CEO Plank recently said: Our investments illustrate our commitment to realizing our long-term vision of one day having our Women's business larger than Men's, Footwear larger than Apparel, and our International business larger than our U.S. business. Organizational Structure UA reportedly operates under four geographic segments: (1) North America, (2) Europe, the Middle East, and Africa (EMEA), (3) Asia, and (4) Latin America. However, from its organiza- tion structure revealed in Exhibit 1, it appears the company is structured divisionally by product. Marketing UA's marketing expenses were $205.4 million in 2012, up from $167.9 million the prior year. But these marketing expenses were 11.2 percent of revenues, down from 11.4 percent the prior year. UA's advertising expenditures in 2012 and 2011 were $205.4 million and $167.9 mil- lion respectively. UA develops and markets products primarily for use in athletics, fitness, and any outdoor activities. UA attempts to drive demand through brand equity and increasing con- sumer awareness of its superior product. UA's growth is largely dependent on sales from Dick's Sporting Goods, The Sports Authority, and Foot Locker, which have store-within-a-store sales EXHIBIT 1 Under Armour's Organizational Structure Kevin Plank, CEO and Chairman of the Board Byron Adams Jr., Chief Performance Officer Brad Dickerson, Chief Financial Officer Kip Fulks, Chief Operations Officer Karl-Heinz Maurath, President International Matthew Mirchin, Senior Vice-president Global Brand and Sports Marketing John Rogers, Vice-president and General Manager of E-commerce Gene McCarthy, Senior Vice-president Footwear Adam Peake, Senior Vice-president U.S. Sales Henry Stafford, Senior Vice-president of Apparel channels. However, UA has been making great strides selling its products directly to consum- ers, with 29 percent of revenue in 2012 coming from direct sales. UA has the brand strength to attract many consumers to more profitable channels. However, 69 percent of 2012 revenue was from wholesale, and 2 percent from licenses. A key strategy for UA is securing endorsement of its products from high-performing ath- letes who have significant influence in the NFL, NBA, MLB, and even high school teams. Many sports stars such as Cam Newton and Tom Brady endorse and wear UA products. It is UA's belief that this strategy is the best possible way to advertise its products because many fans become familiar with UA products seeing them worn by high-performing athletes on a year round basis. In addition to focusing on the large-market leagues, UA also focuses on brand authenticity from a more grassroots level. By hosting camps, clinics, and other activities for young athletes, it is able to gain a firsthand appreciation for UA's product quality and brand equity. UA uses broadcast, print, and social media outlets to promote the firm's product. UA also engages in acquiring prime real estate in the 25,000 major retail stores worldwide in which their products are sold, as well as operating outlet stores in 34 different states. UA products are sold throughout the world. New UA products in 2012 included UA Studio line, the Armour Bra, cold- back technology, UA Spine footwear, and UA scent control technology. The biggest, baddest brand on the planet, bar none." That's how founder and CEO Plank likes to describe his vision for what UA can ultimately become. Plank and his team are excellent marketers; the company's blood-pumping ads resonate with athletes and those who aspire to be- come athletes. UAs bold logo and brash and edgy marketing campaigns inspire movement and physical fitness, positioning the company well within the healthier lifestyle megatrend. Plank and his team relish their underdog image versus big rival firms; they love to operate within and promote an us-versus-them philosophy. This competitive fire has served UA well and has en- capsulated many athletes and fans. UA has 102 factory house stores in North America, mostly located in the eastern USA. UA opened its first factory house store in Canada in 2012. Finance In late 2012, UA has an impressive annual growth rate of 34 percent since 2005, has a market cap of $4.32 billion, and a price-to-earnings (P/E) ratio of 49.4, above the S&P 500 P/E ratio of 17.7. UA shares were up 44.6 percent year-to-date as of December 20, 2012. Strong financially, UA has used zero of its $300 million revolving credit facility at the end of September 2012. UA's debt-to-equity ratio is low at 0.10. UA has a quick ratio of 1.84 and has improved its earnings per share by 22.7 percent in the most recent quarter compared to the same quarter a year ago. UA does not pay dividends, preferring to reinvest all earnings back into the firm. UA expects 2012 net revenues of approximately $1.82 billion, representing growth of 24 percent over 2011, and 2012 operating income of approximately $207 million, representing growth of 27 percent over 2011. Plank says: I am proud of what our team has accomplished so far this year and we are well positioned for growth in 2013 and beyond. I emphasize 'team', as we continue to make great strides with the additions of seasoned leadership in Supply Chain, Women's, and International." UA revenues increased 24 percent in the third quarter of 2012 to $575 million compared with net revenues of $466 million in the previous year's period. Net income increased 25 per- cent. UA's recent income statements and balance sheets are provided in Exhibits 2 and 3, respec- tively. Note that the company pays no dividends and is performing in an excellent manner. Segment Data By-Product Exhibit 4 provides a breakdown of UAs revenues by product. Note that apparel continues to be the strongest product offered based on net revenues, but footwear and accessories such as bags, hats, and gloves experienced higher percent increases over the most recent fiscal year. License revenues decreased as a result partly of less orders of hats and bags. Seventy-six percent of company revenues are derived from apparel in 2012. Followed by footwear at 13 percent and accessories at 9 percent. EXHIBIT 2 2 Under Armour Statements of Income (In thousands, except per share amounts) Year Ended December 31, 2012 2011 2010 Net revenues Cost of goods sold Gross profit Selling, general and administrative expenses Income from operations Interest expense, net Other expense, net Income before income taxes Provision for income taxes Net income Net income available per common share Basic Diluted Weighted average common shares outstanding Basic Diluted $1,834,921 955,624 879,297 670,602 208,695 (5.183) (73) 203,439 74,661 $128,778 $ $1,472,684 759,848 712,836 550,069 162,767 (3,841) (2,064) 156,862 59,943 $96,919 $1,063,927 533,420 530,507 418,152 112,355 (2,258) (1,178) 108,919 40,442 $68,477 $1.23 $1.21 $0.94 $0.92 $0.67 $0.67 104,343 106,380 103,140 105,052 101,595 102,563 Source: 2012 Form 10K, p. 49. EXHIBIT 3 Under Armour Balance Sheets Under Armour, Balance Sheets (In thousands, except share data) December 31, December 31, 2012 2011 Assets Current assets Cash and cash equivalents Accounts receivable, net Inventories Prepaid expenses and other current assets Deferred income taxes Total current assets Property and equipment, net Intangible assets, net Deferred income taxes Other long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Accounts payable Accrued expenses Current maturities of long-term debt Other current liabilities Total current liabilities Long-term debt, net of current maturities Other long-term liabilities Total liabilities $341,841 175,524 319.286 43,896 23.051 903.598 180.850 4.483 22,606 45,546 $1,157,083 $175,384 134,043 324.409 39.643 16,184 689,663 159,135 5,535 15,885 48,992 $919,210 $100,527 69.285 6,882 $143,689 85,077 9,132 14,330 252,228 52,757 35,176 340,161 6,913 183,607 70.842 28.329 282,778 (continued) EXHIBIT 3 Continued December 31, 2012 December 31, 2011 28 27 7 Commitments and contingencies Stockholders' equity Class A Common Stock, $0.0003 1/3 par value; 200,000,000 shares authorized as of December 31, 2012 and 2011; 83,461,106 shares issued and outstanding as of December 31, 2012 and 80,992,252 shares issued and outstanding as of December 31, 2011. Class B Convertible Common Stock, $0.0003 1/3 par value; 21,300,000 shares authorized, issued and outstanding as of December 31,2012 and 22,500,000 shares authorized, issued and outstanding as of December 31, 2011. Additional paid-in capital Retained earnings Accumulated other comprehensive income Total stockholders' equity Total liabilities and stockholders' equity 321,338 493,181 2.368 816,922 $1,157,083 268,206 366,164 2,028 636,432 $919,210 Source: 2012 Form 10K, p. 48 Apparel is offered in many styles and fits to cover most any environment condition. Apparel is specifically engineered to replace traditional nonperformance fabrics and replace them with the most cutting edge products available. UA currently has three gear lines that achieve the designed purpose of having a sophisticated apparel option for all weather conditions. The three products are marketed under HEATGEAR, designed for hot weather, COLDGEAR, designed for cold tem- peratures, and ALLSEASONGEAR, designed for between the extremes. In addition to the three temperature ratings, all products also come in three fit types: compression (tight fit), fitted (athletic fit), and loose (relaxed). All UA appeal products are designed to whisk water away from the wearer to keep them as dry and comfortable as possible in any temperature or type of activity. UA expanded into offering footwear in 2006 and today makes footwear for virtually all sports including running and even hunting boots. Like the traditional shirts, footwear offerings are designed to cushion and manage moisture. In 2011, UA began to sell hats and bags in house; these products were previously provided by a licensee. Other accessories developed and now marketed by UA in- clude gloves for football, baseball, golf, and running as well mouth guards, socks, and eye wear. Segment Data By Region Exhibit 5 reveals UA's recent revenues and operating profits for the North American and inter- national markets. UA reports revenues in four distinct geographic regions: (1) North America, (2) EMEA, (3) Asia, and (4) Latin America. Each geographic segment operates in the same EXHIBIT 4 UA Segment Data by Product Year Ended December 31 (in Thousands), Percent Change 2011 2010 2012 2011 2012 Apparel Footwear Accessories Total net sales License revenues Total revenues $1,385,350 238,955 165,835 1.790,140 44.781 1.834.921 S1, 122,031 181,684 132.400 1,436,115 36,569 $1,472,684 $853,493 127.175 43,882 1,024,550 39,377 $1.063.927 23.5% 31.5 25.3 24.7 22.5 24.6% 31.5% 42.9 201 40.2 (7.1) 38.4% Source: 2012 Form 10K, p. 29. manner, to design, develop, market, and distribute UA products. Note that only 6 percent of UA revenues were derived from international markets so the company combines all these countries into one segment for reporting reasons. UA acknowledges that the trend in performance prod- ucts is becoming increasingly global with a bright future, but 6 percent so far leaves tremendous upside for the company. UA's North American segment includes about 18,000 retail stores; UA also owns 80 outlet stores located in 34 different states. The company's two largest customers are Dick's Sporting Goods and The Sports Authority. In addition to selling to the public, UA earns income from the sale of uniforms and practice gear to high school, college, and professional teams. In EMEA, UA products are sold in approximately 4,000 retail outlet stores. European foot- ball teams that wear UA gear reside in many European nations including the United Kingdom, France, Germany, Greece, Italy, and Spain among others. First division rugby clubs in France, Ireland Italy, and the United Kingdom also wear UA products. Products in Europe are currently distributed out of The Netherlands. Since 2002, UA has enjoyed a licensing agreement with Dome Corp., which produces and sells UA products in Japan, which are all tailored for Japanese consumers' specific taste. Products are sold in more than 2,500 specialty stores in Japan, as well as to several profes- sional soccer and baseball games in Japan. Also in Asia, products are sold in both Australia and New Zealand, and in 2011, UA's first specialty store opened in Shanghai, China. Latin American customers are provided UA products through independent distributors but more commonly are served through distribution facilities in the USA. Only 6 percent of UA's 2012 revenues were generated from outside North America. The company does have two specialty stores in Shanghai, China. About 55 percent of the fabric used in UA products comes from suppliers in China, Malaysia, Mexico, Taiwan, and Vietnam. UA has 27 manufacturers in 14 countries. Competition UA has unique branding of a fabric to whisk away water from the body, but competitors such as Nike and Adidas have copied UA's designs and technology. The fabrics UA uses are not unique to them, and it does not control any patents on fabrics or processes. It is all about branding for UA. Because firms such as Nike and Adidas have much larger resources to draw on, competing long term may be difficult for UA, but so far the firm is doing well. In addition, competing for floor space at large retailers is difficult because many stores have their own store brands, in addi- tion to private label brands, all competing for floor space. Exhibit 6 provides some comparative information for UA and rival firms. Note that in terms of revenue UA is about the size of Columbia Sportswear, but Nike and Adidas are both more EXHIBIT 5 UA Segment Data by Geographic Region Year Ended December 31 (in Thousands), 2012 2011 2010 Percent Change $1,383,346 $1,726,733 108,188 1,834,921 89,338 $997,816 66,111 1,063.927 1,472,684 Net Revenues North America Other Foreign Countries Total Net Revenues Operating Profits North America Other Foreign Countries Total Operating Profit 38.6% 35.1% 38.4% 2012 31.0% (5.8) 28.2 $197,194 11,501 208,695 $150,559 12.208 162,767 $102,806 9.549 112,355 2011 46.4% 27.8 44.9 Source: 2012 Form 10K, p. 33. EXHIBIT 6 Comparative Information for Sports Apparel Firms Under Armour Adidas Columbia Sportswear Nike Number of Employees Net Income (S) Revenue (S) Revenue (SWEmployee EPS Ratio (S) Market Cap. 1.9K 98.9M 1.54B 855K 0.95 5.2B 39.9K 922M 17.1B 429K 2.20 15.3B 4.1K 94.6M 1.7B 414K 2.78 1.8B 40K 2.2B 24B 600K 4.73 42.6B EPS, earnings per share. Source: Based on company documents. than 10 times the size of UA. Note also that UA is exceptionally efficient as indicated by its high revenue per employee ratio. Nike Headquartered in Beaverton, Oregon, Nike is the largest apparel and footwear provider for men, women, and children worldwide. Nike outfits athletes globally in virtually every sport, including running, basketball, football, soccer, golf, and many more. In addition to apparel and footwear, Nike also produces golf clubs, athletic bags, gloves, footballs, bats, and much more. Nike owns brands such as Converse, Chuck Taylor, and All Star to name a few. Nike reported in 2011 that 42 percent of revenues derived from U.S. operations, where the company sells its products in a wide range of mediums from retail stores, its Internet site, 156 Nike factory stores, and tens of thousands of other stores, such as Foot Locker. Nike's interna- tional sales accounted for 58 percent of revenues in 2011 and products are sold in similar ways as in the USA. Nike currently operates 308 factory stores outside the USA. Approximately 67 percent of all Nike North American revenues are derived from footwear, 28 percent from appeal, and only 5 percent from equipment. Nike's operations in international markets have a similar revenue breakdown by product, making Nike's primary revenue generator footwear, as opposed to UA being primarily an apparel producer. Like UA, Nike outfits many professional and major U.S. college teams with their gear. Notable teams wearing Nike gear include the University of Oregon, Penn State University, and The University of Alabama. Nike has stars such as Michael Jordan, LeBron James, and Tiger Woods serving as spokespersons to help in promoting the brand. Late in 2012, Nike sold its Cole Haan handbag and shoe brand to private equity firm Apax Partners for $570 million and also sold its Umbro football brand to Iconix Brand Group for $225 million. Adidas AG Headquartered in Herzogenaurach, Germany, Adidas AG develops and produces a wide range of athletic appear, footwear, and accessories and operates in six business segments: wholesale, re- tail, TaylorMade-Adidas Golf, Rockport, Reebok-CCM Hockey, as well as other brands. Adidas sells its products through retail stores, the Internet, and through 2,401 company-owned stores worldwide. The company most closely competes with UA with its sport performance line of ap- parel that is modeled after UA fabrics to help keep athletes dry and comfortable for the duration of their activity. Adidas currently has a contract with the NBA to outfit all teams with apparel, and in addi- tion, Adidas outfits some or the largest European football clubs with apparel. Adidas employs many of soccer's biggest starts to market their products, such as Frank Lampard, Steven Gerrard, and Micheal Ballack. Tennis stars endorsing Adidas include Andy Murray, Justine Henin, Marcos Baghdatis, and many more. Andy Murray is Adidas's highest paid spokesman with a five-year contract worth $24.5 million. Adidas had sales of more than 13 billion euros in 2011, an 11-percent increase from the pre- vious year, with every reporting segment enjoying larger revenues than the previous fiscal year. The retail and TaylorMade-Adidas Golf segments enjoyed the largest percent increases at 20 and 16 percent, respectively. Columbia Sportswear Company Headquartered in Portland, Oregon, Columbia's trademark Bugaboo parka with weatherproof shell competes with some UA products, as does Columbia's performance apparel for a variety of activities and Columbia's sportswear accessories, boots, and rugged footwear, sold under brands Columbia, Mountain Hardwear, Sorel, and Montrail. Columbia brands are used globally during outdoor activities, such as skiing, snowboarding, hiking, climbing, camping, hunting, fishing, running, and the like. Columbia operates about 50 outlet retail stores and 10 branded retail stores in the USA, as well as 10 in Europe, 2 outlet stores in Canada, and about 300 stores in Japan and Korea. Thousands of other stores sell Columbia products globally, including even Dick's Sporting Goods and The Sports Authority that UA counts on most. External Issues Economic Factors The apparel industry has a mediocre outlook given weak economies in which consumers are faced with less discretionary income. Items expected to maintain strong sales are those that are well differentiated from competing products, where consumers value the extra features and are less price sensitive to products they deem necessary. More luxury items in both sport- ing activities are expected to have modest growth. In 2011, the apparel industry reported sales up 5.9 percent over 2010, however much of this gain was the result of inflation and the rising prices of commodities such as cotton, increased labor wages overseas, and increased freight fees. Nevertheless, the S&P Apparel Retail Index rose 22 percent versus a 12-percent increase for the S&P 1500 Index from March 2011 to March 2012. The S&P Footwear Index rose only 11.5 percent during this same time frame. Apparel sales totaling $77.7 billion was imported into the USA in 2011, up nearly 9 percent from 2010. Approximately 38 percent of all apparel imported came from China. The apparel industry is extremely fragmented with many firms competing for the same customers. For example, the top 10 national brands only account for 16 percent of wholesale apparel sales in the USA with 84 percent of apparel distributed coming from smaller brands and store brand goods. Women's segment has traditionally accounted for significantly more sales at 55 percent. Men only accounted for 28 percent and children 17 percent of apparel sales in 2011. The footwear industry grew at a slower rate than apparel in 2011. Fashion footwear accounted for 48 percent of total footwear sales, with performance footwear accounting for 27 percent, sports footwear 13 percent, outdoor footwear 8 percent, and work and safety foot- wear 4 percent. Fashion and sports footwear are expected to be the most significant areas of growth moving forward as people look to improve their fashion looks and the growing health- minded concerns of the public. Technological Changes Nike was one of the first companies to understand the importance of producing better sport- ing apparel and footwear for athletes, when Phillip Knight and his track coach Bill Bowerman developed a better shoe for members of the University of Oregon track team. Since the 1960s, there have been many developments and improvements in shoe and apparel design away from the traditional cotton sweat suit and basic tennis shoe. Today, apparel hugs the body and insu- lates the wearer from cold and keeps them cool from hot. Shoes can be synced to computers to determine performance and impact points for the runner and t-shirt fabrics can even help man- age odors. These types of technological offerings keep customers purchasing new items and can create intense competition and brand loyalty. Where to Produce China has historically been the low-cost alternative for apparel firms when selection a nation for the production of their products. In 2011 alone, 38 percent of all apparel imports and 74 percent of all footwear imports into the USA came from China. However, with rising production costs, higher wages in China, increased transportation costs and less control over quality, Chinese imports may be waning in the eyes of large U.S. apparel corporations in favor of facilities in Mexico and the Caribbean. UA currently produces many of their items in Mexico and enjoys quicker turnaround and more quality control than some rival firms who import a large percentage of their inventory from China. The Future UA needs considerably more global presence to gain economies of scale versus its large rival firms. Increasing downward pressure on prices could necessitate that UA effectively expand globally. The primary strategic issue facing UA therefore is how and when and where to expand globally. Other secondary strategic issues facing UA include whether to diversify into other ac- cessory items to reduce the firm's reliance on apparel and whether to increase its expenditures on R&D to keep pace with changing technological advancements in the apparel industry. UA is strong financially, which does enable the firm to make strategic acquisitions as needed, so the firm should identify potential acquisition candidates around the world. Effective global ex- pansion is an important key to UA's growth and prosperity in the future. Even South America, Central America, Mexico, and Australia are all sports-minded areas in which UA products should be well received. Perhaps what UA needs most is to fulfill CEO Plank's vision: Our long-term vision is to one day have our Women's business larger than Men's, our Footwear business larger than Apparel, and our International business larger than our USA business. Prepare a five-year strategic plan for CEO Plank to fulfill his vision for UA