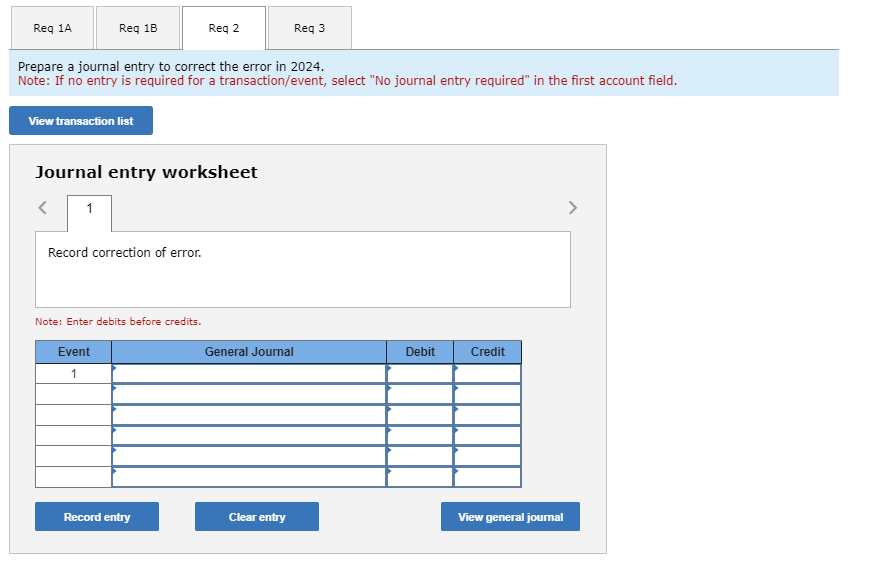

Question: Prepare a journal entry to correct the error in 2024 . Note: If no entry is required for a transaction/event, select No journal entry required

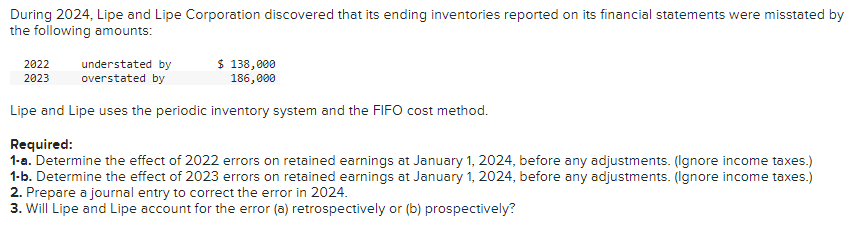

Prepare a journal entry to correct the error in 2024 . Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Will Lipe and Lipe account for the error (a) retrospectively or (b) prospectively? During 2024, Lipe and Lipe Corporation discovered that its ending inventories reported on its financial statements were misstated by the following amounts: Lipe and Lipe uses the periodic inventory system and the FIFO cost method. Required: 1-a. Determine the effect of 2022 errors on retained earnings at January 1, 2024, before any adjustments. (Ignore income taxes.) 1-b. Determine the effect of 2023 errors on retained earnings at January 1, 2024, before any adjustments. (Ignore income taxes.) 2. Prepare a journal entry to correct the error in 2024. 3. Will Lipe and Lipe account for the error (a) retrospectively or (b) prospectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts