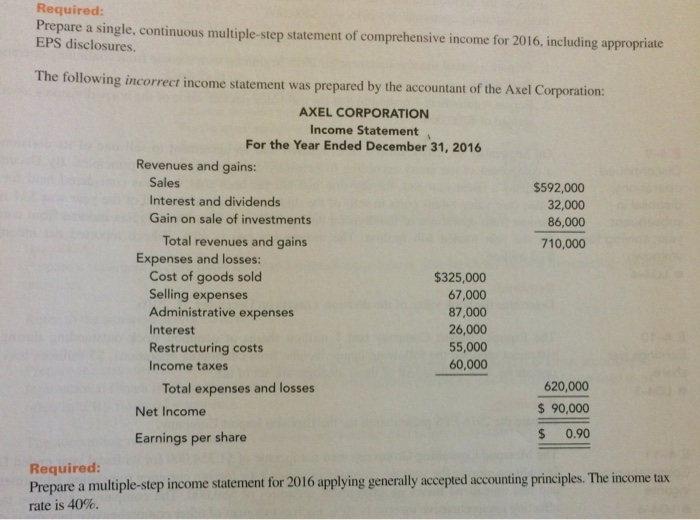

Question: prepare a multi step income statement for 2016 applying generally accepted accounting principles. the income tax rate is 40%. Required: Pesure a single. continuous multiple-step

Required: Pesure a single. continuous multiple-step statement of comprehensive income for 2016, ncluding approri The followving incorer income statement separedlby th accoun Prepare a single, continuous multiple-step statement of comprehensive income for 2016, including appropriate EPS disclosures. The following incorrect income statement was prepared by the accountant of the Axel Corporation: ng incorrect income statement was prepared by the accountant of the Axel Corporation: AXEL CORPORATION Income Statement For the Year Ended December 31, 2016 Revenues and gains: Sales Interest and dividends Gain on sale of investments $592,000 32,000 86,000 710,000 Total revenues and gains Expenses and losses: Cost of goods sold Selling expenses Administrative expenses Interest Restructuring costs Income taxes $325,000 67,000 87,000 26,000 55,000 60,000 Total expenses and losses Net Income Earnings per share 620,000 $90,000 $ 0.90 Required: Prepare a multiple-step income statement for 2016 applying generally accepted accounting principles. The income tax rate is 40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts