Question: prepare a multiple - step income statement for the year ended December 31. White Cloud Products, Inc. provided the following information from its current-year trial

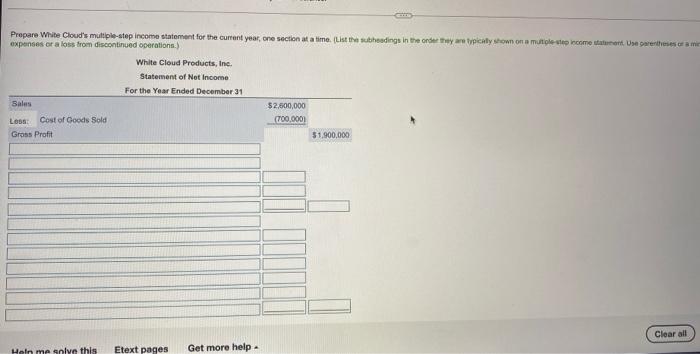

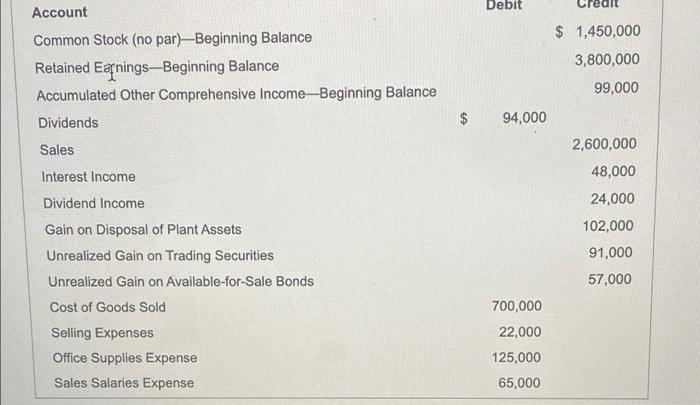

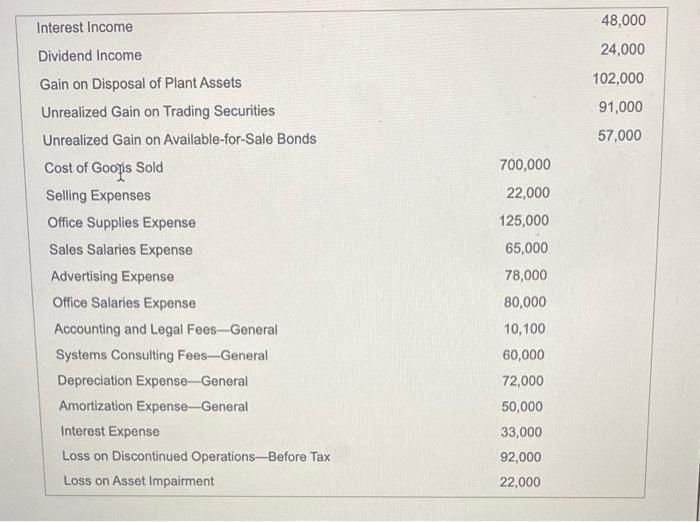

White Cloud Products, Inc. provided the following information from its current-year trial balance. (Click the icon to view the trial balance.) Requirements Prepare a single-step income statement for the year ended December 31. The tax rate is 30%. b. Prepare a multiple-step income statement for the year ended December 31. a. PS 6 Point 2.748 Sarve White Cloud Products, in provided the totown cematen trom tan cuore your traillance Prepare White Couture income strement to the currynar, onu section time the wings they are also content was en om de White Cloud Products Statement of Hut Income For the Year Ended December Prepare White Cloud's multiple-step income statement for the current year, one section at a time. (List the subheadings in the order they are typically shown on a muito come to Use grenses La expenses or a loss from discontinued operations.) White Cloud Products, Inc. Statement of Not Income For the Year Ended December 31 Sales $2,500,000 (700,0001 Los: Cost of Goods Sold Gross Profit 51.900.000 Clear all Holn me solve this Etext pages Get more help Debit Account Common Stock (no par)-Beginning Balance Retained Earnings-Beginning Balance Accumulated Other Comprehensive Income--Beginning Balance Dividends $ 1,450,000 3,800,000 99,000 $ 94,000 Sales Interest Income 2,600,000 48,000 24,000 Dividend Income 102,000 91,000 57,000 Gain on Disposal of Plant Assets Unrealized Gain on Trading Securities Unrealized Gain on Available-for-Sale Bonds Cost of Goods Sold Selling Expenses Office Supplies Expense Sales Salaries Expense 700,000 22,000 125,000 65,000 Interest Income 48,000 Dividend Income 24,000 102,000 91,000 57,000 Gain on Disposal of Plant Assets Unrealized Gain on Trading Securities Unrealized Gain on Available-for-Sale Bonds Cost of Goois Sold Selling Expenses Office Supplies Expense Sales Salaries Expense Advertising Expense Office Salaries Expense Accounting and Legal Fees--General Systems Consulting Fees--General Depreciation Expense General Amortization Expense-General Interest Expense Loss on Discontinued Operations-Before Tax Loss on Asset Impairment 700,000 22,000 125,000 65,000 78,000 80,000 10,100 60,000 72,000 50,000 33,000 92,000 22.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts