Question: prepare a multiple step income statement Required information Exercise 6-21 (Algo) Complete the accounting cycle using inventory transactions (LO6-2, 6-3, 6-5, 6-6, 67) On January

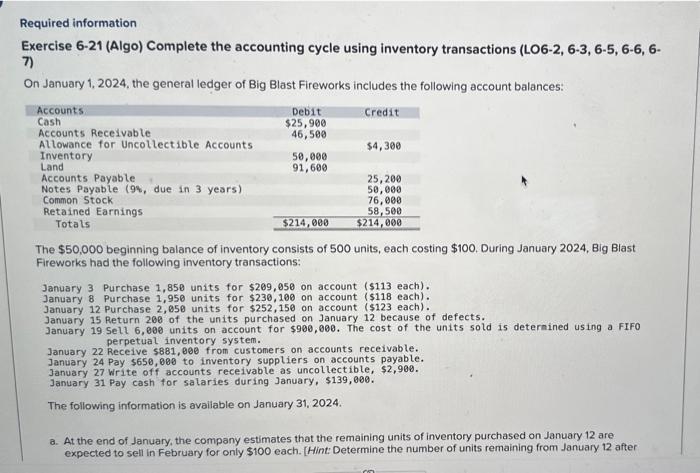

Required information Exercise 6-21 (Algo) Complete the accounting cycle using inventory transactions (LO6-2, 6-3, 6-5, 6-6, 67) On January 1, 2024, the general ledger of Big Blast Fireworks includes the following account balances: The $50,000 beginning balance of inventory consists of 500 units, each costing $100. During January 2024, Big Blast Fireworks had the following inventory transactions: January 3 Purchase 1,850 units for $209,850 on account (\$113 each). January 8 Purchase 1,950 units for $230,100 on account (\$118 each). January 12 Purchase 2,050 units for $252,150 on account ( $123 each). January 15 Return 260 of the units purchased on January 12 because of defects. January 19 Sell 6,000 units on account for $900,000. The cost of the units sold is deternined using a fifo perpetual inventory system. January 22 Receive 5881,080 from customers on accounts receivable. January 24 Pay $650,080 to inventory suppliers on accounts payable. January 27 Write off accounts receivable as uncollectible, $2,900. January 31 Pay cash for sataries during January, $139,000. The following information is avaliable on January 31,2024. a. At the end of January, the company estimates that the remaining units of inventory purchased on January 12 are expected to sell in February for only $100 each. [Hint: Determine the number of units remaining from January 12 after

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts