Question: Prepare a multi-step Income Statement with proper form concluding with Earnings per Share. In computing earnings per share, assume that the average number of common

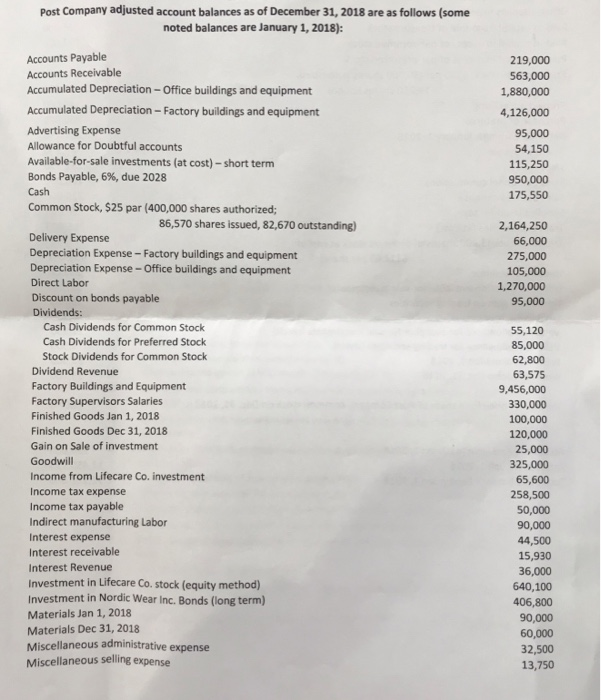

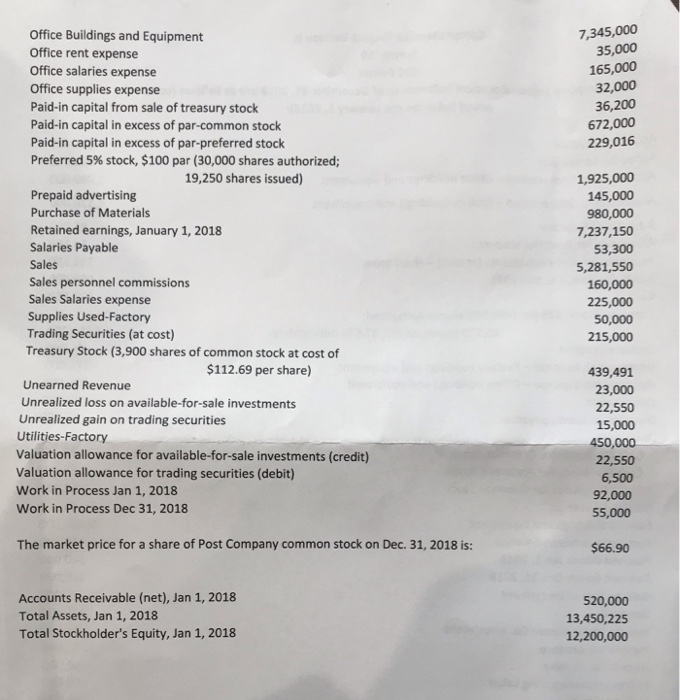

Post Company adjusted account balances as of December 31, 2018 are as follows (some noted balances are January 1, 2018): Accounts Payable Accounts Receivable Accumulated Depreciation-Office buildings and equipment Accumulated Depreciation- Factory buildings and equipment 219,000 563,000 1,880,000 4,126,000 95,000 54,150 115,250 950,000 175,550 Advertising Expense Allowance for Doubtful accounts Available-for-sale investments (at cost)-short term Bonds Payable, 6%, due 2028 Cash Common Stock, $25 par (400,000 shares authorized; 86,570 shares issued, 82,670 outstanding) 2,164,250 66,000 275,000 105,000 1,270,000 95,000 Delivery Expense Depreciation Expense- Factory buildings and equipment Depreciation Expense-Office buildings and equipment Direct Labor Discount on bonds payable Cash Dividends for Common Stock 55,120 85,000 62,800 Cash Dividends for Preferred Stock Stock Dividends for Common Stock Dividend Revenue Factory Buildings and Equipment Factory Supervisors Salaries Finished Goods Jan 1, 2018 Finished Goods Dec 31, 2018 Gain on Sale of investment Goodwill Income from Lifecare Co. investment Income tax expense Income tax payable Indirect manufacturing Labor Interest expense Interest receivable Interest Revenue Investment in Lifecare Co. stock (equity method) Investment in Nordic Wear Inc. Bonds (long term) Materials Jan 1, 2018 Materials Dec 31, 2018 Miscellaneous administrative expense Miscellaneous selling expense 63,575 9,456,000 330,000 100,000 120,000 25,000 325,000 65,600 258,500 50,000 90,000 44,500 15,930 36,000 640,100 406,800 90,000 60,000 32,500 13,750 7,345,000 35,000 165,000 32,000 36,200 672,000 229,016 Office Buildings and Equipment Office rent expense Office salaries expense Office supplies expense Paid-in capital from sale of treasury stock Paid-in capital in excess of par-common stock Paid-in capital in excess of par-preferred stock Preferred 5% stock, $100 par (30,000 shares authorized; 19,250 shares issued 1,925,000 145,000 980,000 7,237,150 53,300 5,281,550 160,000 225,000 50,000 215,000 Prepaid advertising Purchase of Materials Retained earnings, January 1, 2018 Salaries Payable Sales Sales personnel commissions Sales Salaries expense Supplies Used-Factory Trading Securities (at cost) Treasury Stock (3,900 shares of common stock at cost of $112.69 per share) 439,491 23,000 22,550 15,000 450,000 22,550 6,500 92,000 55,000 Unearned Revenue Unrealized loss on available-for-sale investments Unrealized gain on trading securities Utilities-Factory Valuation allowance for available-for-sale investments (credit) Valuation allowance for trading securities (debit) Work in Process Jan 1, 2018 Work in Process Dec 31, 2018 The market price for a share of Post Company common stock on Dec. 31, 2018 is: $66.90 Accounts Receivable (net), Jan 1, 2018 Total Assets, Jan 1, 2018 Total Stockholder's Equity, Jan 1, 2018 520,000 13,450,225 12,200,000 Post Company adjusted account balances as of December 31, 2018 are as follows (some noted balances are January 1, 2018): Accounts Payable Accounts Receivable Accumulated Depreciation-Office buildings and equipment Accumulated Depreciation- Factory buildings and equipment 219,000 563,000 1,880,000 4,126,000 95,000 54,150 115,250 950,000 175,550 Advertising Expense Allowance for Doubtful accounts Available-for-sale investments (at cost)-short term Bonds Payable, 6%, due 2028 Cash Common Stock, $25 par (400,000 shares authorized; 86,570 shares issued, 82,670 outstanding) 2,164,250 66,000 275,000 105,000 1,270,000 95,000 Delivery Expense Depreciation Expense- Factory buildings and equipment Depreciation Expense-Office buildings and equipment Direct Labor Discount on bonds payable Cash Dividends for Common Stock 55,120 85,000 62,800 Cash Dividends for Preferred Stock Stock Dividends for Common Stock Dividend Revenue Factory Buildings and Equipment Factory Supervisors Salaries Finished Goods Jan 1, 2018 Finished Goods Dec 31, 2018 Gain on Sale of investment Goodwill Income from Lifecare Co. investment Income tax expense Income tax payable Indirect manufacturing Labor Interest expense Interest receivable Interest Revenue Investment in Lifecare Co. stock (equity method) Investment in Nordic Wear Inc. Bonds (long term) Materials Jan 1, 2018 Materials Dec 31, 2018 Miscellaneous administrative expense Miscellaneous selling expense 63,575 9,456,000 330,000 100,000 120,000 25,000 325,000 65,600 258,500 50,000 90,000 44,500 15,930 36,000 640,100 406,800 90,000 60,000 32,500 13,750 7,345,000 35,000 165,000 32,000 36,200 672,000 229,016 Office Buildings and Equipment Office rent expense Office salaries expense Office supplies expense Paid-in capital from sale of treasury stock Paid-in capital in excess of par-common stock Paid-in capital in excess of par-preferred stock Preferred 5% stock, $100 par (30,000 shares authorized; 19,250 shares issued 1,925,000 145,000 980,000 7,237,150 53,300 5,281,550 160,000 225,000 50,000 215,000 Prepaid advertising Purchase of Materials Retained earnings, January 1, 2018 Salaries Payable Sales Sales personnel commissions Sales Salaries expense Supplies Used-Factory Trading Securities (at cost) Treasury Stock (3,900 shares of common stock at cost of $112.69 per share) 439,491 23,000 22,550 15,000 450,000 22,550 6,500 92,000 55,000 Unearned Revenue Unrealized loss on available-for-sale investments Unrealized gain on trading securities Utilities-Factory Valuation allowance for available-for-sale investments (credit) Valuation allowance for trading securities (debit) Work in Process Jan 1, 2018 Work in Process Dec 31, 2018 The market price for a share of Post Company common stock on Dec. 31, 2018 is: $66.90 Accounts Receivable (net), Jan 1, 2018 Total Assets, Jan 1, 2018 Total Stockholder's Equity, Jan 1, 2018 520,000 13,450,225 12,200,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts