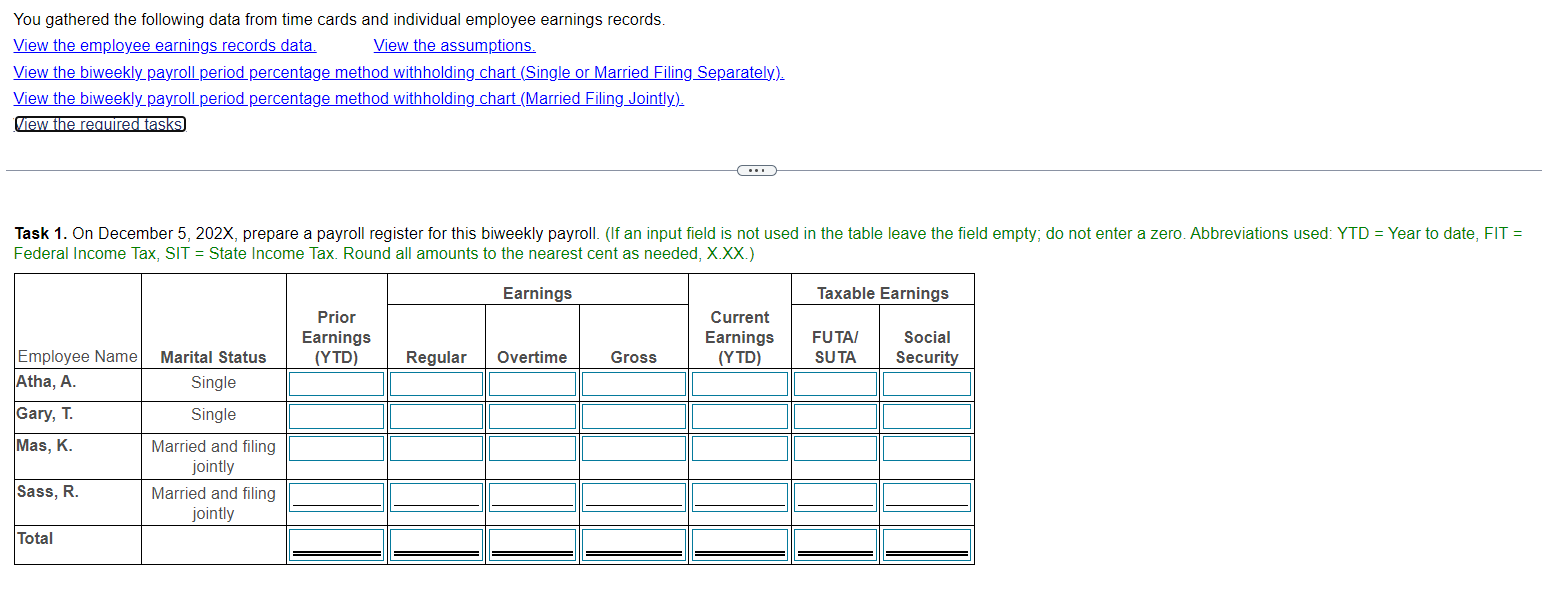

Question: , prepare a payroll register for this biweekly payroll. ( If an input field is not used in the table leave the field empty; do

prepare a payroll register for this biweekly payroll. If an input field is not used in the table leave the field empty; do not enter a zero. Abbreviations used: YTD Year to date, FIT Federal Income Tax, SIT State Income Tax. Round all amounts to the nearest cent as needed, XXXYou gathered the following data from time cards and individual employee earnings records.

View the employee earnings records data. View the assumptions.

View the biweekly payroll period percentage method withholding chart Single or Married Filing Separately.

View the biweeklypayroll period percentage method withholdingchart Married FilingJointly

lew the required tasks. Federal Income Tax, SIT State Income Tax. Round all amounts to the nearest cent as needed, XXX

tableEmployee Name,Marital Status,tablePriorEarningsYTDEarnings,tableCurrentEarningsYTDTaxable EarningsRegularOvertime,Gross,tableFUTASUTAtableSocialSecurityAtha ASingle,,,,,,,Gary TSingle,,,,,,,MastableMarried and filingjointlySass RtableMarried and filingjointlyTotal

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock