Question: prepare a personal cash flow statement and a net worth statement FNCE-1016 Case Details February 2021 After having reviewed his other monthly expenses since the

prepare a personal cash flow statement

and a net worth statement

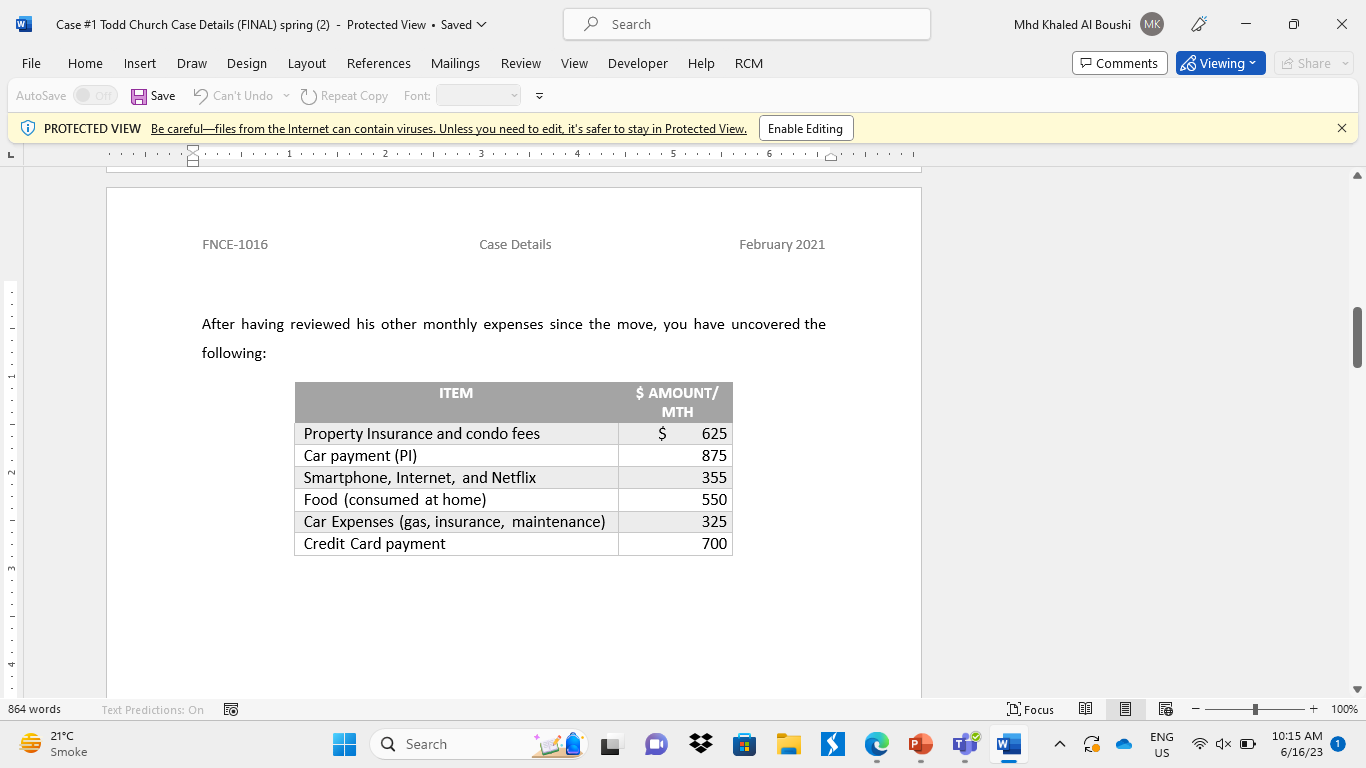

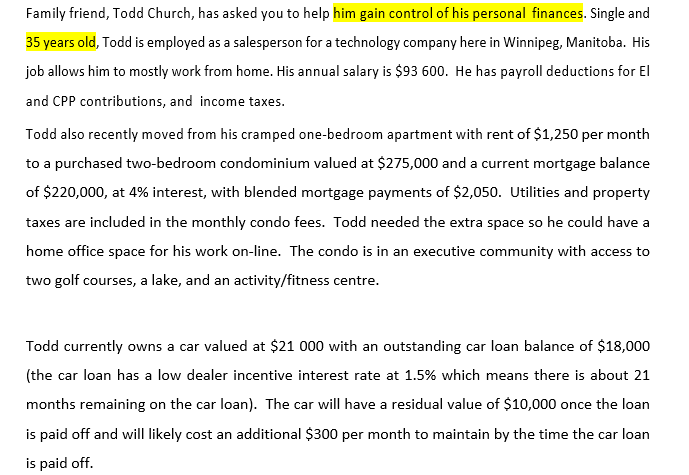

FNCE-1016 Case Details February 2021 After having reviewed his other monthly expenses since the move, you have uncovered the following: Family friend, Todd Church, has asked you to help him gain control of his personal finances. Single and 35 years old, Todd is employed as a salesperson for a technology company here in Winnipeg, Manitoba. His job allows him to mostly work from home. His annual salary is $93600. He has payroll deductions for El and CPP contributions, and income taxes. Todd also recently moved from his cramped one-bedroom apartment with rent of $1,250 per month to a purchased two-bedroom condominium valued at $275,000 and a current mortgage balance of $220,000, at 4% interest, with blended mortgage payments of $2,050. Utilities and property taxes are included in the monthly condo fees. Todd needed the extra space so he could have a home office space for his work on-line. The condo is in an executive community with access to two golf courses, a lake, and an activity/fitness centre. Todd currently owns a car valued at $21000 with an outstanding car loan balance of $18,000 (the car loan has a low dealer incentive interest rate at 1.5% which means there is about 21 months remaining on the car loan). The car will have a residual value of $10,000 once the loan is paid off and will likely cost an additional $300 per month to maintain by the time the car loan is paid off

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts